$3 Weekly Natural Gas Slightly Closer As Volatility Shrinks

It was a relatively quiet week of natural gas trading as most points fluctuated within a few pennies of unchanged. Widespread but modest losses in the Rockies, California and West Texas were offset by firm gains in South and East Texas and the Northeast.

The $3 threshold once again proved elusive as theNGI National Weekly Spot Gas Average rose a penny to $2.90. The point showing the week’s greatest gain was Transco Zone 6 New York with an advance of 27 cents to average $2.99 and the week’s biggest loser was Northwest Sumas with a slide of 14 cents to $2.55.

Regionally the week’s greatest gains were posted in the Northeast and East Texas with 8-cent advances to $3.00 and $3.01, respectively, and the largest set back was seen at Rocky Mountain points with an average loss of 4 cents to $2.68.

California and the Midcontinent were the only other regions to fall into the red with losses of 2 cents and 1 cent to $2.99 and $2.80, respectively.

The Midwest was unchanged at $2.99, and Appalachia and South Louisiana both added 2 cents to $2.71 and $3.01, respectively.

The Southeast rose 3 cents to $3.05 and South Texas gained 7 cents to average $2.99.

May futures lost 12.6 cents on the week to $3.101.

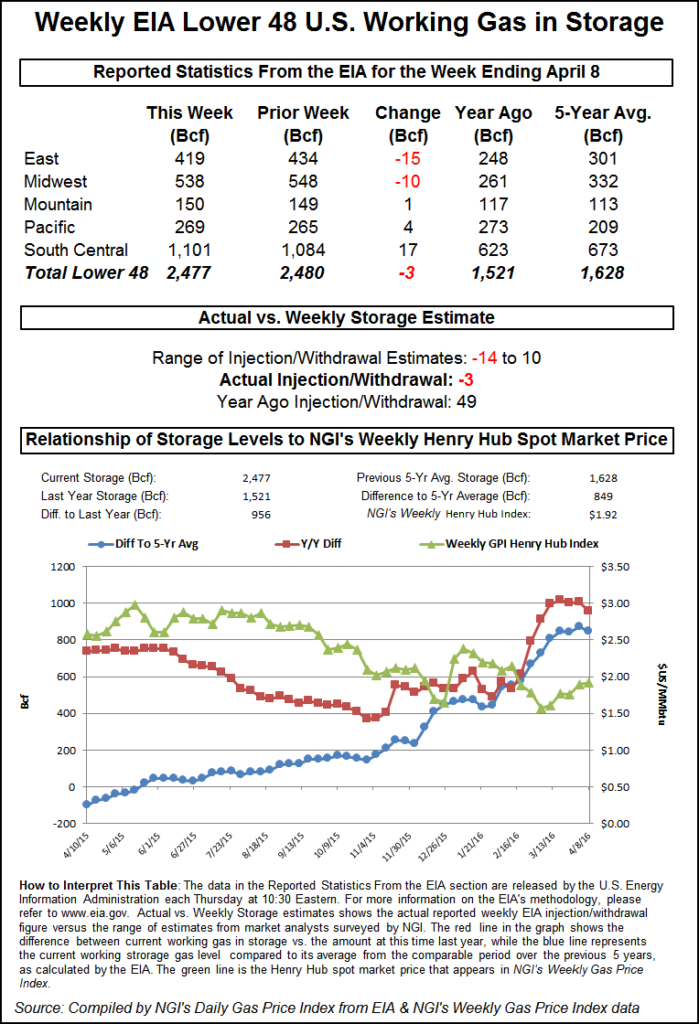

Thursday’s trading saw the EIA report a storage build of 54 Bcf for the week ending April 14, about 6 Bcf greater than expectations and futures fell to the low of the day following the release of the data. May futures retreated to $3.138, and at 10:45 a.m. on Thursday May was trading at $3.150, down 3.5 cents from Wednesday’s settlement. Those early losses remained embedded in the market, and at the close May had eased 2.6 cents to $3.159 and June had lost 2.6 cents also to $3.250.

Before the number was released, Ritterbusch and Associates predicted a build of 28 Bcf and Tradition Energy was expecting a 52 Bcf increase. A Reuters survey of 24 traders and analysts revealed an average 48 Bcf injection with a range of 28-55 Bcf.

In the same week last year, 6 Bcf was injected and the five-year pace was for a 35 Bcf build.

“We were hearing a number of 46 to 48 Bcf, so this is a little bearish,” said a New York floor trader.

“The 54 Bcf in net injections was more than the consensus expectation, above the 35 Bcf five-year average for the week and implies a somewhat weaker supply/demand balance than in recent weeks, a bearish combination,” said Tim Evans of Citi Futures Perspective.

Others also echoed the negative tonality. “We believe the storage report will be viewed as slightly negative. Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at, or above, five-year averages, assuming normal weather,” said Randy Ollenberger, an analyst with BMO Capital Markets.

Analysts noted that although the report fell into the bearish column, the market still remains undersupplied and the summer injection season is expected to fall about 345 Bcf short of normal.

“The 54 Bcf injection was 4 Bcf above consensus, 47 Bcf greater than last year’s mark and 19 Bcf greater than the five-year average of 35 Bcf. But the above-average storage figure was once again driven by warmer weather impacting demand,” said the energy team at Wells Fargo in a note to clients.

“Heating degree days for the U.S. [during the second week of April] came in at 73, 22% below the five-year average and 35% below the same period last year. And despite the relatively high injection figure, our storage model indicates that, on a weather adjusted basis, undersupply in the natural gas market is persisting… [W]e forecast an aggregate inventory build of 1.747 Tcf throughout injection season (five-year average of 2.092 Tcf), and view peak storage levels entering withdrawal season at 3.798 Tcf, 82 Bcf below the five-year average.”

Inventories now stand at 2,115 Bcf and are 368 Bcf less than last year and 282 Bcf greater than the five-year average. In the East Region 12 Bcf was injected, and the Midwest Region saw inventories rise by 11 Bcf. Stocks in the Mountain Region were greater by 3 Bcf and the Pacific Region was up 2 Bcf. The South Central Region increased 26 Bcf.

In Friday’s trading buyers for three-day deals were in short supply and physical natgas at nearly all points fell into the loss column. The losses were surprisingly uniform and most points were off a nickel to a dime, even the usually volatile Northeast.

The NGI National Spot Gas Average retreated 7 cents to $2.83. Buyers of futures contracts were in equally short supply, and at the close May had dropped 5.8 cents to $3.101 and June had lost a similar amount to $3.192.

East-to-west and north-to-south market points were awash in red ink as a cooling trend was forecast to march across the country over the weekend.

Gas at the Algonquin Citygate was quoted a dime lower at $2.76 and gas on Transco Zone 6 NY fell 7 cents to $2.92. Deliveries to Dominion South skidded a dime to $2.58.

In the nation’s midsection gas at the Chicago Citygate fell 8 cents to $2.87, packages at Northern Natural Demarcation also dropped 9 cents to $2.82, and gas at the Henry Hub changed hands 6 cents lower at $3.04.

Gas on El Paso Permian retreated a dime to $2.62, deliveries at the Kern Receipt point came in 9 cents lower at $2.69, and gas priced at the SoCal Border Average also shed 9 cents to $2.75.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

High temperatures during the week in portions of the Southeast reached as high as 90 degrees, and outside of the Pacific Northwest, most of the country has seen a lack of cooler-than-average air so far this month, but that is about to change, according to The Weather Channel.

“On the heels of the potential for severe weather late this week, relatively cooler air is expected to filter southward from the central Plains into the South over the weekend as a low-pressure system shoots across the mid-South. The cooler air will begin Friday along the Front Range of the Rockies from Montana southward into the central Plains and eastward to Missouri. Temperatures are expected to be 10 to 20 degrees below average, which translates to highs in the upper 40s or lower 50s near the Rockies to the upper 50s across the central Plains and Midwest.

“By Saturday, the cooler-than-average temperatures will slide south and eastward into the southern Plains and portions of the Ohio Valley. The most refreshing air will be seen from Missouri to Ohio, where high temperatures will be in the low to mid-50s. Temperatures will be in the 50s for a large part of the afternoon in Missouri, though some locations may stay in the 40s.

“Humidity levels will also drop Saturday across a large section of the Plains and Ohio Valley in a reminder that summer isn’t quite here. Sunday morning will feature temperatures in the 40s as far south as central Texas, with 30s in portions of the northern and central Plains.”

Summer may not quite be here but the National Hurricane Center had to issue a “Special Tropical Weather Outlook” when tropical storm Arlene surfaced in the mid-Atlantic. The hurricane season doesn’t officially start until June 1, but Arlene has ratcheted up the timetable. As of 11 a.m. EDT Post Tropical Storm Arlene was located 1,235 miles west of the Azores and was dissipating as it moved to the southwest at 23 mph. Maximum sustained winds had reached 50 mph. Forecasters are expecting less-than-normal Atlantic hurricane activity this season.

Observers see natural gas futures slipping lower until summer demand kicks in. “It’s not going down, down, but it’s going to fade,” said Jeff Richter, principal with EnergyGPS, a Portland, OR-based energy risk management firm. “You are in the sweet spot now with power burns being pretty weak, nuclear plants coming back on line, and load not high enough yet.

“You have another six weeks here of [prices] drifting, and we are in the lower third of the price range. Will it snap back up? Mother Nature will have a lot to say about that. We don’t see a lot of production but it’s going to be a little bit of time because power burns are weak all things considered. You are not making up the deficit, but you are not creating more of a deficit.

“There’s just going to be this lull period until Memorial Day, but I don’t think the [futures] market drops below $3.10 any time soon. Everybody is trying to find the next piece of information besides hot, hot weather and I don’t think there is any bullish news besides the stuff we have already seen, and the other components are pushing prices down.”

Natural gas bulls, however, may need an antidote to the enthusiasm of producers and drillers. According to Baker Hughes Inc. the United States saw a net gain of five oil and five natural gas rigs during the week just ended. More than twice as many oil rigs are operating as there were one year ago, and natural gas rigs are up by 90% from their year-ago tally.

The land-based rig tally climbed by 11 units to end at 834. One rig left the offshore, leaving 20, and there were three rigs running in the inland waters. Twelve horizontal and two vertical units came back as four directional rigs departed.

Analysts see risk to the downside. “[W]e still feel that a breakout of the past week’s trading range is more apt to develop on the downside rather than upside given ongoing expansion in the supply surplus that could potentially stretch toward 300 Bcf with next week’s EIA release,” said Ritterbusch in a Friday morning note to clients.

“While some recent additional downsizing in U.S. production and unexpectedly strong export activity is acting to deter aggressive selling interest, we still expect output to gradually increase during the late spring/early summer period in helping to accelerate seasonal supply injections.

“This will likely demand some strong CDD [cooling degree day] accumulation later next month if more price strength is to develop. Otherwise, we look for nearby futures to erode in erratic fashion down toward the $3.05 area where we will expect longer term support to set the stage for a summer price advance.”

Gas buyers for power generation across the PJM footprint this weekend look to have their hands full with highly variable weather conditions and not much in the way of wind and renewable generation to work with. “Changeable and variable conditions are expected as a frontal system and its associated cold front will continue to slide across the power pool [Friday] with a chance for additional showers and thunderstorms,” said WSI Corp. in a Friday morning report to clients.

“There will be a wide range and changeable temperatures. Much of the Mid Atlantic, except for northern New Jersey will be unseasonably warm and even a touch on the humid side, with readings in the 70s to mid 80s, but western PJM will cool into the upper 50s, 60s to near 70. A north-northeast wind will boost wind generation during the next two days with output 2-3 GW, and wind gen may increase early next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |