Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Soften On Heels Of Plump EIA Storage Figures

Physical natural gas traders weren’t taking any chances Thursday and got their deals done ahead of the release of the Energy Information Administration’s (EIA) weekly storage report. Most points outside the Northeast lost a few pennies up to a nickel, but Northeast points were down about a dime on average, and the NGI National Spot Gas Average fell 4 cents to $2.90.

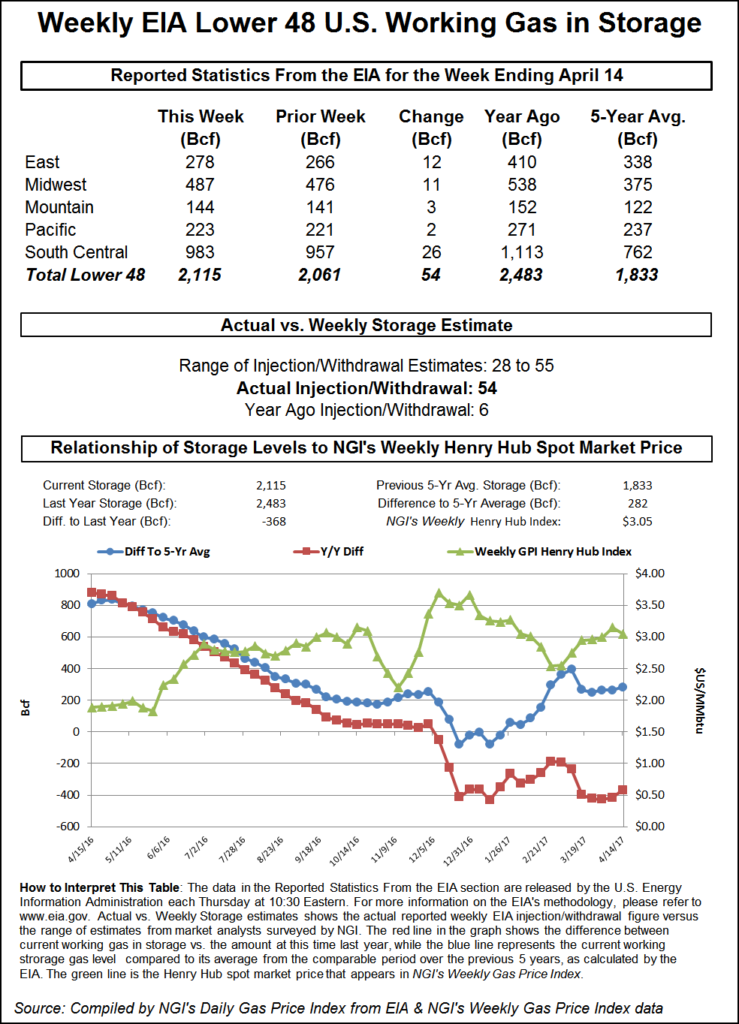

The EIA reported a storage build of 54 Bcf, about 6 Bcf greater than expectations and futures fell to the low of the day following the release of the data. May futures retreated to $3.138, and at 10:45 a.m. May was trading at $3.150, down 3.5 cents from Wednesday’s settlement. Those early losses remained embedded in the market, and at the close May had eased 2.6 cents to $3.159 and June had lost 2.6 cents also to $3.250. The expired May crude oil fell 17 cents to $50.27/bbl.

Before the number was released, Ritterbusch and Associates predicted a build of 28 Bcf and Tradition Energy was expecting a 52 Bcf increase. A Reuters survey of 24 traders and analysts revealed an average 48 Bcf injection with a range of 28-55 Bcf.

In the same week last year, 6 Bcf was injected and the five-year pace is for a 35 Bcf build.

“We were hearing a number of 46 to 48 Bcf, so this is a little bearish,” said a New York floor trader. Based on market responses to previous storage reports, however, he said he expected the market to work back toward unchanged if not higher on the day.

“The 54 Bcf in net injections was more than the consensus expectation, above the 35 Bcf five-year average for the week and implies a somewhat weaker supply/demand balance than in recent weeks, a bearish combination,” said Tim Evans of Citi Futures Perspective.

Others also echoed the negative tonality. “We believe the storage report will be viewed as slightly negative. Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at, or above, five-year averages, assuming normal weather,” said Randy Ollenberger, an analyst with BMO Capital Markets.

Analysts noted that although the report fell into the bearish column, the market still remains undersupplied and the summer injection season is expected to fall about 345 Bcf short of normal.

“The 54 Bcf injection was 4 Bcf above consensus, 47 Bcf greater than last year’s mark and 19 Bcf greater than the 5-year average of 35 Bcf. But the above average storage figure was once again driven by warmer weather impacting demand,” said the energy team at Wells Fargo in a note to clients.

“Heating degree days for the U.S. last week came in at 73, 22% below the 5-yr average and 35% below the same period last year. And despite the relatively high injection figure, our storage model indicates that, on a weather adjusted basis, undersupply in the natural gas market is persisting… [W]e forecast an aggregate inventory build of 1.747 Tcf throughout injection season (5-yr average of 2.092 Tcf), and view peak storage levels entering withdrawal season at 3.798 Tcf, 82 Bcf below the 5-yr average.”

Inventories now stand at 2,115 Bcf and are 368 Bcf less than last year and 282 Bcf greater than the five-year average. In the East Region 12 Bcf was injected, and the Midwest Region saw inventories rise by 11 Bcf. Stocks in the Mountain Region were greater by 3 Bcf and the Pacific Region was up 2 Bcf. The South Central Region increased 26 Bcf.

In the physical market, prices slumped as temperatures for the most part were forecast to hover around the mid-60s. AccuWeather.com forecast that Thursday’s high of 65 degrees in New York City would slide to 58 Friday and rebound to 66 Saturday, 3 degrees above normal. Chicago’s Thursday high of 71 was seen sliding to 52 Friday and Saturday, 9 degrees below normal.

Consistent with the mild temperature outlook the National Weather Service (NWS) predicted weak heating loads in major markets for the week. New England will see just 78 heating degree days (HDDs) or a whopping 50 below normal, and the Mid-Atlantic will experience 55 HDDs or 52 below normal. The greater Midwest from Ohio to Wisconsin is expected to endure 55 HDDs as well or 55 less than its seasonal tally.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

New England points were most impacted by the soft weather landscape. Gas at the Algonquin Citygate shed 8 cents to $2.86 and deliveries to Iroquois, Waddington dropped 17 cents to $2.94. Deliveries to Tennessee Zone 6 200 L shed 17 cents to $2.94.

Other major market centers were a few pennies lower. Gas at the Chicago Citygate eased a penny to $2.95 and parcels at the Henry Hub fell 2 cents to $3.10. Gas on El Paso Permian was quoted at $2.72, down a penny as well.

Deliveries to Panhandle Eastern bucked the trend and added 6 cents to $2.77 and gas at Opal was unchanged at $2.78. Parcels delivered to the SoCal Citygate shed 2 cents to $3.18.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |