New England NatGas Price Weakness Unable to Offset Broader Gains; May, June Add 4 Cents

Physical natural gas for delivery Thursday managed to creep higher in Wednesday trading despite forecasts of weak energy demand and mixed next-day power pricing. Slumping quotes in Appalachia and the Northeast were offset by modest but broad gains in Texas, Louisiana, the Midwest and Midcontinent.

The NGI National Spot Gas Average rose 2 cents to $2.94. Futures gains were somewhat counterintuitive as traders prepared for the release of government inventory data expected to show above-normal additions to inventories.

At the close, May had added 4.0 cents to $3.185, and June also improved 4.0 cents to $3.276. May crude oil tumbled $1.97 to $50.44/bbl.

In the physical market, the biggest moves were seen at New England points as traders focused on steady to lower forecast energy demand and weak next-day power quotes at the expense of expected delivery shortfalls on Algonquin Gas Transmission.

Deliveries to the Algonquin Citygate slumped 50 cents to $2.94, and gas on Iroquois, Waddington fell 15 cents to $3.11. Deliveries to Tenn Zone 6 200L gave up 35 cents to $3.11.

ISO New England forecast that peak power loads Wednesday of 14,240 MW would ease to 13,870 MW Thursday and 13,530 MW Friday. PJM Interconnection calculated that peak load Wednesday of 30,530 MW would reach 30,578 MW on Thursday before slipping to 30,340 MW on Friday.

Intercontinental Exchange reported on-peak power for Thursday at the ISO New England’s Massachusetts Hub fell $4.90 to $28.68/MWh, but power at the PJM West terminal rose $4.86 to $37.20/MWh.

The slumping next-day quotes at the Algonquin Citygate come as somewhat of a surprise as restrictions are to be in place Thursday at the Algonquin Southeast Compressor Station.

According to industry consultant Genscape Inc., flows will be reduced by 225 MMcf/d as Algonquin performs single day maintenance at the Southeast Compressor Station, dropping capacity to 1,536 MMcf/d. “Timely volumes through Southeast for Wednesday are nearly at capacity, with 1,761 MMcf scheduled,” Genscape said.

May futures opened 4 cents higher Wednesday morning at $3.19 as traders elected to discount not only mild weather patterns but also expected plump storage figures.

“Springtime variability looks to continue to limit temperature extremes over the next couple of weeks,” said Commodity Weather Group President Matt Rogers. “In the near term we are still watching some modest, transient warmth course through the Midwest and East to end the week with some 80s from the Ohio Valley to the Mid-Atlantic.

“After a pullback over the weekend and early next week, there is another burst of warmth across these areas late next week and into the early 11-15. We are a little warmer with that next round of warmth (around 80 across the southern Midwest to the Mid-Atlantic), but risks still lean a few degrees higher.”

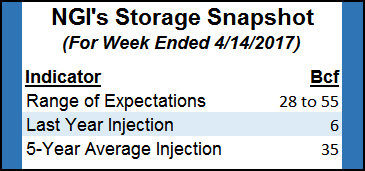

Analysts’ calculations show a somewhat greater than average storage build for Thursday’s Energy Information Administration storage inventory report.

“The early consensus for Thursday’s…storage report is running at 45-46 Bcf in net injections from what we’ve seen, a seasonal step up from the prior week’s 10 Bcf gain, and more than the 35 Bcf five-year average refill for the week ended April 14,” said Tim Evans of Citi Futures Perspective in closing comments Tuesday.This is not exactly good news for the bulls. “While only a modest excess over the five-year average rate, we also note that the storage data fails to confirm the implied bullish view of money managers who held the largest net long position since May 2014 in the CFTC Commitments of Traders report from April 11,” Evans said.

Last year 6 Bcf were injected and the five-year average build stands at 35 Bcf. Ritterbusch and Associates calculates an increase of 28 Bcf and Tradition Energy is looking for an injection of 53 Bcf. A Reuters survey of 24 industry cognoscenti revealed an average 48 Bcf addition with a range of 28 Bcf to 55 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |