Texas Oil/NatGas Industry Posts Fourth Straight Month of Recovery

The Lone Star State’s oil and natural gas industry is back in another growth cycle after a three-year downturn, according to the economist who compiles the Texas Petro Index (TPI), a barometer of industry activity.

The TPI climbed to 160.4 in March to post its fourth straight monthly increase, economist Karr Ingham said Wednesday. December was the first month that the TPI saw an increase.

“Economically speaking, the TPI data indicate that when the oil and gas industry gathers in Wichita Falls [TX] in late April for the annual meeting and exposition of the Texas Alliance of Energy Producers, they will be meeting during a time of industry expansion for the first time in three years,” he said. “This is the first time these guys have had the wind at their backs since 2014.”

Lifting the TPI during the first quarter were crude oil and natural gas prices, drilling activity, the number of drilling permits issued, and the value of statewide oil and gas production, which were all higher compared with year-ago levels.

However, the TPI is only at about half the value of the record level of 313.5 set in November 2014, and it still has not caught up in some other economic arenas, Ingham said.

Employment is increasing, but it still lags behind last year after the loss of more than 100,000 upstream jobs, Ingham said. An estimated 9,000 jobs have been added back since employment reached its low point last September.

“We still have a long way to go, but 2017 is going to be a year of recovery and expansion in the Texas statewide oil and gas exploration and production economy,” Ingham said. “Activity levels will continue to expand, jobs will continue to be added, and the industry will support the broader state economy again, rather than acting as a drag on growth as it has for the prior two years.”

A composite index based upon a group of upstream economic indicators, the March TPI of 160.4 was about 5.6% lower than a year ago. Before the recent economic downturn, the TPI peaked at a record 313.5 in November 2014, which marked the zenith of an economic expansion that began in December 2009, when the TPI stood at 187.4.

During March, estimated Texas crude oil production totaled more than 99.6 million bbl, 2.5% less than in March 2016. With oil prices in March averaging $46.15/bbl, the value of Texas-produced crude oil amounted to nearly $4.6 billion, slightly 30% more than in March 2016.

Texas natural gas output reached nearly 666.4 Bcf, a year-over-year decline of about 5.9%. With natural gas prices in March averaging $2.74/Mcf, the value of Texas-produced gas increased about 57.8% to more than $1.82 billion.

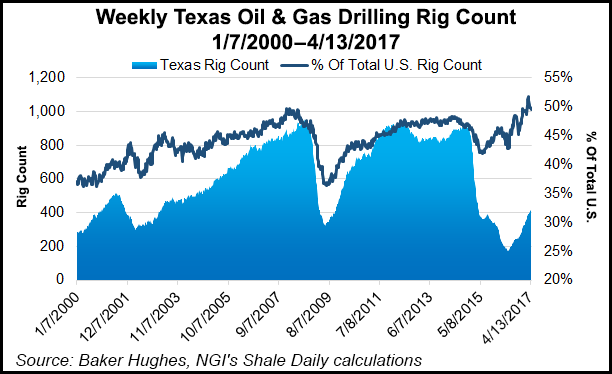

The Baker Hughes Inc. count of active drilling rigs in Texas averaged 399, which was 80.5% higher than in March 2016 when an average of 221 rigs were working.

The number of original drilling permits issued in March was 1,310, about 156.4% more than the 511 permits issued in March 2016.

And an estimated average of 201,300 Texans remained on upstream oil and gas industry payrolls during March, according to revised quarterly data from the Texas Workforce Commission. That was about 2.2% fewer than in March 2016 and about 34.2% fewer than the estimated high of 306,020 in December 2014.

According to Ingham, during the first quarter the statewide working rig count averaged 368, about 43.5% more than in first quarter 2016 when on average 257 rigs were drilling. The Railroad Commission of Texas issued 3,257 drilling permits, 104.3% more than in first quarter 2016 when 1,594 permits were granted.

Texas producers recovered an estimated 291.4 million bbl of crude oil during the first quarter, 3% less than in first quarter 2016. And they recovered about 1.93 Bcf of natural gas, 7.5% less year/year.

Crude oil wellhead prices averaged $48.47/bbl during the quarter, 60.8% higher than in first quarter 2016, boosting the estimated value of Texas-produced crude oil by 55.5% to about $14.1 billion.

Natural gas prices averaged $2.88/Mcf during the quarter, 51.7% more than in first quarter 2016, increasing the estimated value of Texas-produced natural gas by 40.2% to nearly $5.55 billion.

About 199,000 Texans, on average, were employed in the oil and gas production, drilling and service sectors during the first quarter, about 6.1% fewer than the average of 211,975 in first quarter 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |