Markets | NGI All News Access | NGI Data

Weekly NatGas Slips Below $3, Futures Endure Small Loss

The $3 threshold proved just a little bit much for weekly natural gas prices and the NGI Weekly Spot Gas Average retreated from last week’s $3.03, dropping 14 cents to $2.89 over the shortened 4-day trading week.

Losses were widespread and the only point to show a gain was found in Canada at NOVA/AECO C rising 15 cents to $C 2.73/Gj. Gas at PG&E Citygate did manage to eke out an unchanged reading at $3.33, but all other points were in the red, typically by a dime or more. The point showing the greatest setback was Tennessee Zone 6 200 L with a 94-cent loss to $3.12. Regionally, California showed the greatest resilience easing just 3 cents to $3.01, and the Northeast endured the largest setback falling 44 cents to $2.92.

Appalachia skidded 24 cents to $2.69, South Texas fell 16 cents to $2.92, and East Texas shed 14 cents to $2.93.

The Midwest came in lower by 13 cents to $2.99, the Southeast gave up 11 cents to $3.02, and both the Midcontinent and South Louisiana fell a dime to $2.81 and $2.99, respectively.

The Rocky Mountains were quoted a modest 4 cents lower at $2.72.

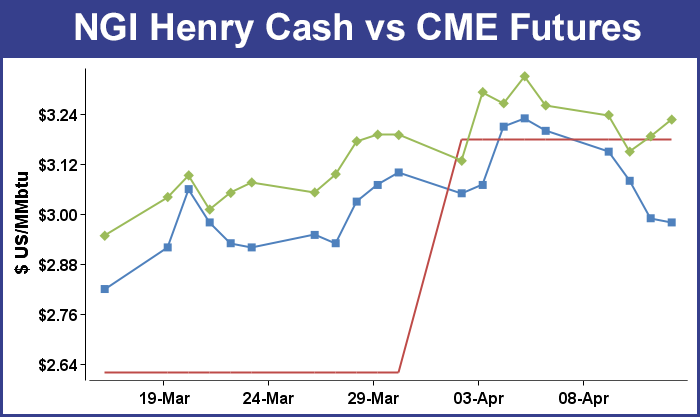

May natural gas futures retreated 3.4 cents on the week to $3.227.

In Thursday trading, physical natural gas for Friday through Monday delivery softened as energy demand was forecast to be steady to lower over the extended weekend, peak power prices fell, and energy demand was forecast steady to lower.

Modest strength in Louisiana and the Southeast was unable to offset double-digit declines in Appalachia and the Northeast, and the NGI National Spot Gas Average skidded 7 cents to $2.81.

The Energy Information Administration (EIA) reported a storage increase of 10 Bcf, about what the market was expecting, but bulls nevertheless managed to seize the reins and at the end of the day May futures had increased 4.0 cents to $3.227 and June had added 4.5 cents to $3.307. May crude oil rose 7 cents to $53.18/bbl.

EIA reported a 10 Bcf storage build in its 10:30 a.m. EDT release, only 1 Bcf greater than industry estimates. May futures managed to climb after the number came out, trading as high as $3.243. At 10:45 a.m. May was trading at $3.200, up 1.3 cents from Wednesday’s settlement.

Bulls were undeterred as before the number was released, ICAP Energy predicted a build of 7 Bcf and Kyle Cooper of IAF Advisors was looking for a 6 Bcf increase. A Reuters survey of 21 traders and analysts revealed an average 9 Bcf injection with a range of +1 Bcf to +17 Bcf.

Last year 1 Bcf was withdrawn during the same week, and the five-year pace is for a 12 Bcf build.

“We’ve got almost a 10-cent range on the day, but the market bounced higher off the number,” said a New York floor trader. “We were hearing about a 6 Bcf figure.”

“The 10 Bcf net injection into U.S. natural gas storage for last week was in line with market expectations and close to the 12 Bcf five-year average level, a neutral outcome all the way around,” said Tim Evans of Citi Futures Perspective.

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger of BMO Capital Markets. “Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at, or above, five-year averages, assuming normal weather.”

Inventories now stand at 2,061 Bcf and are 416 Bcf less than last year and 263 Bcf greater than the five-year average. In the East Region 2 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 3 Bcf. Stocks in the Mountain Region were down 1 Bcf, and the Pacific Region was up 5 Bcf. The South Central Region increased 11 Bcf.

In the physical market prices slumped as on-peak power prices eased, leaving less wiggle room for gas buyers of power generation looking for incremental purchases. Intercontinental Exchange reported that Friday on-peak power at the ISO New England’s Massachusetts Hub dropped $2.76 to $28.16/MWh and deliveries to the PJM West terminal fell $3.80 to $28.32/MWh.

Algonquin Gas Transmission notified customers Wednesday of an unplanned outage at its Cromwell Compressor Station in Middlesex, CT, which temporarily restricted flows before the station was back to full capability by the afternoon.

In a morning note to clients, natural gas analytics firm Genscape said the outage was expected to reduce capacity by around 130 MMcf/d to 1,107 MMcf/d. Nominated flows through Cromwell were 1,033 MMcf/d Thursday compared with a 14-day peak of 1,220 MMcf/d, the firm said.

“Part of the reason Cromwell flows have not been fully at capacity is because of planned maintenance upstream at Stony Point, NY,” Genscape wrote. “Work there has reduced capacity to as low as 1,186 MMcf/d in the past two weeks (normal is 1,811 MMcf/d), with flows through that point mostly filling the available maintenance-restricted capacity.”

While the restriction created the potential for upward pressure on Algonquin Citygate basis Thursday, Genscape said mild temperatures and near-full inventories at the Everett LNG terminal in Boston could weigh on demand.

These bearish factors appeared to set the tone in the Northeast Thursday, as points across the region plunged to 30-day lows.

Weekend and Monday deliveries to the Algonquin Citygate dropped 41 cents to $2.62 and gas at Iroquois, Waddington skidded 43 cents as well to $2.77. Gas on Tenn Zone 6 200L dropped 54 cents to $2.80.

Marcellus points also weakened. Gas on Dominion South shed 18 cents to $2.49 and parcels priced on Tennessee Zn 4 Marcellus fell 31 cents to $2.34. Gas on Transco-Leidy Line changed hands at $2.40, down 25 cents.

Most major market centers followed the lead of the Northeast. Gas at the Chicago Citygate was quoted 9 cents lower at $2.87, and deliveries to the Henry Hub came down a cent to $2.98. Gas on Panhandle Eastern gave up 3 cents to $2.72. Deliveries to Opal shed 2 cents to $2.74 and gas at the SoCal Citygate fell 9 cents to $3.16.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

Forecast energy demand at eastern points as measured by power loads was steady to lower. The New York ISO predicted that Monday peak power load would reach 17,220 MW slightly below Thursday’s peak of 17,273 MW. The PJM Interconnection forecast Thursday’s peak load of 30,190 MW would rise to 31,450 MW by Monday.

Forecasters called for little change in their outlooks and saw little in the way of significant shifts from current mild conditions. Changes were mixed [Thursday] as the 6-10 day continues to be quite the battleground between warmth from the South and cooling in Canada with the war zone continuing to extend from the Midwest to the East Coast cities,” said Matt Rogers, president of Commodity Weather Group in its morning report to clients.

“Today’s trends are in the slightly warmer direction for this battleground area, but confidence has slipped a bit lower as a slight north or south shift next week can make a decent difference for temperatures. The West edges a bit cooler in the 6-10 day, but then back a bit warmer again in the 11-15 day. The 11-15 day is also a challenge for the Mid-west, East, and South with mostly cooler changes today from the Midwest to the Deep South and nearly flat/unchanged for the East Coast.”

In Wednesday trading physical natural gas for delivery Thursday inched lower as very modest gains in the Northeast and Rockies were unable to counter broad declines of a few pennies at most major market centers.

The NGI National Spot Gas Average shed 2 cents to $2.88, and those that did trade in positive territory mostly managed to do so by just a penny or two.

Futures trading was equally lackadaisical ahead of a storage report that was expected to show a modest build. At the close, May had advanced 3.7 cents to $3.187, and June was up 3.8 cents to $3.262.

Current weather conditions may not be encouraging to market bulls, but Tuesday, the Energy Information Administration’s estimated 2017 average Henry Hub spot price, which had tumbled 12% in the agency’s March Short-Term Energy Outlook (STEO), would increase. The April report forecast that Henry Hub spot prices would rise to $3.10/MMBtu, a 2.2% increase compared with the previous forecast.

The 2018 Henry Hub spot price is expected to average $3.45/MMBtu, EIA said, unchanged from March’s forecast. The price increase next year is expected to come primarily from new natural gas export capabilities and growing domestic gas consumption, EIA said.

Not everyone is buying into the forecast for higher prices. Analysts with Raymond James & Associates Inc. have predicted the reverse of EIA’s forecast, with 2017 prices higher and 2018 prices lower. The group bases its downward trend on faster-than-anticipated growth in supply, along with surprising gains in renewable power generation capacity. This is expected to displace more demand than forecast only four months ago. In early January analysts had said U.S. gas prices were poised for the best prices in 2017 since 2014. Now, however, while they are maintaining their 2017 forecast of $3.25/Bcf, the 2018 estimate has been slashed to $2.75 from $3.50 and the long-term forecast reduced to $2.75 from $3.00.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |