Markets | NGI All News Access | NGI Data

Futures In Positive Territory Following ‘Neutral’ NatGas Storage Report

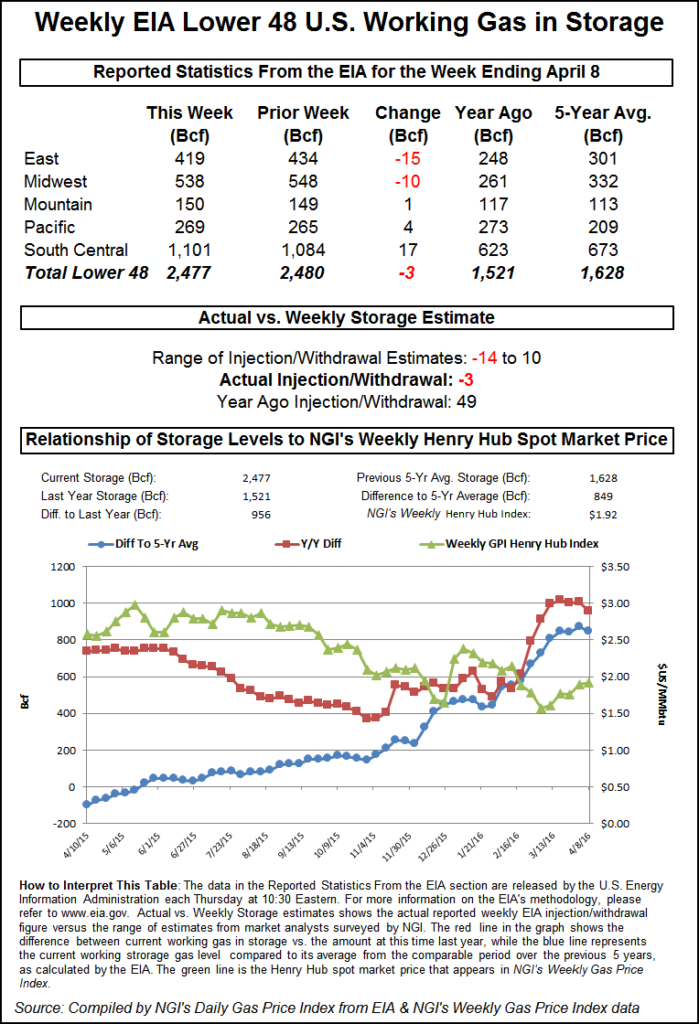

Natural gas futures moved nominally higher Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was about what traders were expecting.

EIA reported a 10 Bcf storage build in its 10:30 a.m. EDT release, only 1 Bcf greater than industry estimates. May futures managed to climb after the number came out, trading as high as $3.243. At 10:45 a.m. May was trading at $3.200, up 1.3 cents from Wednesday’s settlement.

Before the number was released, ICAP Energy predicted a build of 7 Bcf and Kyle Cooper of IAF Advisors was looking for a 6 Bcf increase. A Reuters survey of 21 traders and analysts revealed an average 9 Bcf injection with a range of +1 Bcf to +17 Bcf.

Last year 1 Bcf was withdrawn, and the five-year pace is for a 12 Bcf build.

“We’ve got almost a 10-cent range on the day, but the market bounced higher off the number,” said a New York floor trader. “We were hearing about a 6 Bcf figure.”

“The 10 Bcf net injection into U.S. natural gas storage for last week was in line with market expectations and close to the 12 Bcf five-year average level, a neutral outcome all the way around,” said Tim Evans of Citi Futures Perspective.

“We believe the storage report will be viewed as neutral,” said Randy Ollenberger of BMO Capital Markets. “Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at, or above, five-year averages, assuming normal weather.”

Inventories now stand at 2,061 Bcf and are 416 Bcf less than last year and 263 Bcf greater than the five-year average. In the East Region 2 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 3 Bcf. Stocks in the Mountain Region were down 1 Bcf, and the Pacific Region was up 5 Bcf. The South Central Region increased 11 Bcf.

Salt Cavern storage was up 6 Bcf at 301 Bcf, and non-salt storage was up 5 Bcf to 656 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |