E&P | NGI All News Access | NGI The Weekly Gas Market Report

ConocoPhillips Bidding Farewell to Gassy San Juan Basin in $3B Deal With Hilcorp

Houston-based ConocoPhillips, the largest operator in the natural gas-rich San Juan Basin, agreed Thursday to sell the portfolio for up to $3 billion to an affiliate of Hilcorp Energy Co.

The definitive transaction includes 1.3 million acres and output of 124,000 boe/d net, 78% weighted to natural gas, 20% to natural gas liquids (NGL) and 2% oil. Located in northwestern New Mexico and southwestern Colorado, ConocoPhillips’ conventional production today yields mainly coalbed methane and about 35% NGL. ConocoPhillips also owns and operates the San Juan Gas Plant in Bloomfield, NM, with processing capacity of 550 MMcf/d.

“This transaction significantly accelerates value from our San Juan Basin assets,” CEO Ryan Lance said. “Including our recently announced Canadian asset sales, we have line of sight to more than $16 billion of total considerations in 2017.”

Late last month Calgary-based Cenovus Energy Inc. agreed to pay $13.3 billion to buy ConocoPhillips’ Western Canadian oilsands and Deep Basin gas assets.

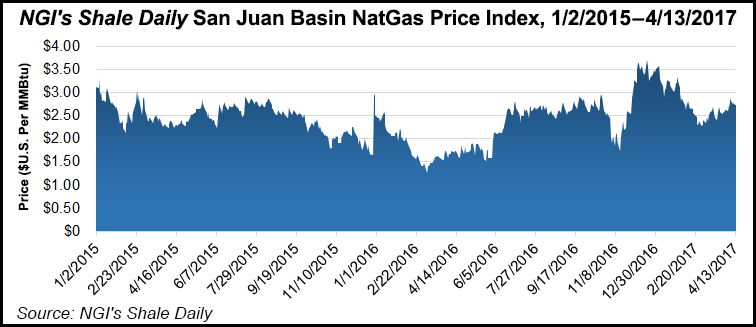

For the San Juan package, Hilcorp agreed to pay $2.7 billion in cash, as well as contingency payments beginning Jan. 1 based on an annual payment of $7 million/month if the average monthly Henry Hub price is at or above $3.20/MMBtu, capped at $300 million.

Together, the San Juan and Canadian transactions “will materially reduce our exposure to North American gas and achieve an immediate step change improvement in our balance sheet and cash margins, while accelerating our return of cash to shareholders,” Lance said. “Our company will be more focused, far stronger financially, and well positioned to execute our disciplined, returns-focused value proposition.”

At the end of 2016, the San Juan proved reserves were 0.6 billion boe, with operating cash last year estimated at $200 million. The net book value of the assets was about $5.9 billion, including $2.8 billion of step-up basis associated with the $35.6 billion takeover of Burlington Resources Corp., a former San Juan heavy hitter, in 2006.

The production mix including San Juan and Canadian assets now is split 30% oilsands/liquefied natural gas (LNG), 55% conventional oil and gas and 15% unconventional. After the two transactions, the split would be 30% oilsands/LNG, 50% conventional and 20% unconventional. Adjusted operating costs post the sales would decline to $5.3 billion from $6 billion. Reserves pro forma would fall to 4.5 billion boe from 6.4 billion boe at the end of 2016. The two transactions also are expected to reduce the average portfolio cost of supply to $35/bbl from $40/bbl.

During ananalyst presentation last November, Lance laid out plans for the super independent to market up to $8 billion of assets, primarily gas-weighted properties in North America, to make way for investments elsewhere, including in the Permian Basin, and the Eagle Ford and Bakken shales. During the4Q2016 conference call, management said it planned to have 11 rigs running at the end of March in the Permian, with four rigs each in the Eagle Ford and Bakken.

ConocoPhillips expects to record a noncash impairment for the San Juan and Canadian asset sales for 2Q2017. Updated cash flow sensitivities to reflect the transactions are expected when 1Q2017 results are issued on May 2.

At the end of 2016, ConocoPhillips, the largest independent in the world, had operations and activities in 17 countries, $90 billion of total assets and about 13,300 employees. Excluding Libya, production averaged 1.567 million boe/d in 2016, with proved reserves of 6.4 billion boe.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |