E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Onshore Permitting Still Strong for ‘Usual Suspects,’ with California, Colorado Coming On

U.S. land oil and natural gas permitting the first week of April once again got off to a hot start in Texas, Oklahoma, Wyoming and Louisiana, and while it’s been a bit sluggish elsewhere, commodity price stability should result in robust drilling activity as the year proceeds, Evercore ISI said Tuesday.

Through April 7, U.S. land permitting stood at 672, and the four-week rolling average of 725 is “within striking distance” of the last 12 months’ high of 849 from mid-March, said Evercore’s James C. West, senior managing director.

“The usual suspects (Texas, Oklahoma, Wyoming, and Louisiana) again were off to extremely hot starts, with Texas poised to break the 1,000 permit for the third month in a row,” he said.

West and his team’s April report is a compilation of monthly permitting numbers for the United States, onshore and offshore. All major states and the Bureau of Ocean Energy Management require permits to be filed and approved before an exploration and production (E&P) company may begin drilling a new well or bypass/sidetrack an existing well. Most onshore permits are issued several months before drilling begins, while offshore permits often are secured much further in advance.

U.S. land permits outstanding totaled 3,945 in March, 23% higher month/month (m/m) than in February and 116% higher year/year (y/y), and last month saw the highest permit total since October 2015. It was the first March-to-March increase since 2013, West said.

Relatively strong permit numbers m/m also were up in California by 41%, in North Dakota at 110%, and Oklahoma, which saw a 37% increase. Declines from February to March were in Ohio, down 17%, and and Utah, minus 67%).

Texas is Trend-Setter

Fueled by a two-times increase m/m in the Permian Basin, Texas permitting jumped 8% in March and rose a whopping 116% y/y. The continuing Texas surge “served as a strong tailwind for improvement elsewhere,” West said. “With nearly half of the working U.S. oil rigs, Texas continues to be the single-most important state in terms of evaluating the magnitude and direction of U.S. permitting trends…”

States in the “peripheral” unconventional basins — the Niobrara formation, Woodford and Bakken shales — should “continue their positive trajectory as oil prices improve and ‘fringe’ acreage becomes economical.”

West noted that April traditionally has been a weak one permit-wise, down m/m every year since 2012, with the exception of 2016 when permits rose 15% from March. However, as commodity prices have stabilized and E&Ps have provided better visibility for capital expenditures, permitting momentum should continue, allowing operators to lock in incremental production at better economics.

California, Colorado ”in-the-money’

“A broader base of ‘in-the-money’ drilling prospects, particularly beyond ‘sweet spot’ acreage, could serve to boost permitting levels outside of the major petro-states,” he said.

By far, California has exhibited the “greatest sequential and y/y improvement” in states beyond the Permian. West called California’s newfound growth “an ode to revamped drilling programs” by companies based in the Golden State, including California Resources Corp., Chevron Corp. and San Joaquin Basin operators.

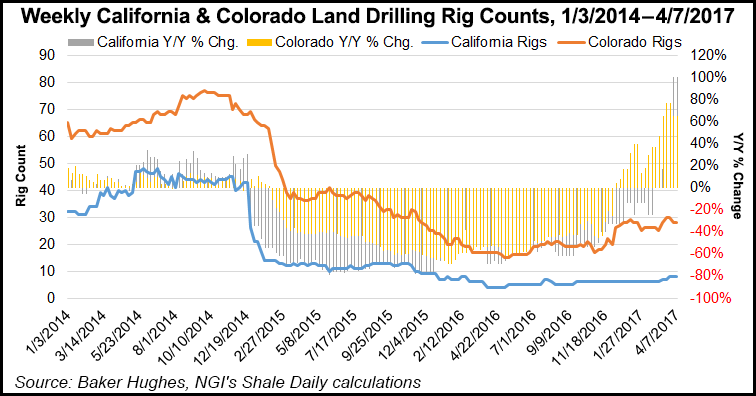

California and Colorado both look promising for robust rig growth from here, West said.

“Absolute permit totals do not tell the complete story for projected activity growth, as basin-specific momentum is a better indicator of the rig count directionality,” he said.

Texas still garners more than half of the oil rig count, but permitting in the state exhibited only slightly higher quarter/quarter and y/y improvement in 1Q2017 compared to the rest of the United States.

“This is indicative not only of the resilience of Texas basins through the downturn (specifically in the Delaware and Midland cores), but also that activity growth will likely moderate in this basin before auxiliary basins hit their stride,” West said.

Meanwhile, Colorado permitting grew 49% from 4Q2016 to 1Q2017, and 1Q2017 was 134% above 1Q2016.

“While more permits are generally observed per incremental rig added on an absolute basis, Colorado’s recent momentum should yield steep activity increases as crude grinds higher and extended reach drilling improves in the Wattenberg.”

The Energy Information Administration’s Drilling Productivity Report in March reported new-well production/rig in the Denver-Julesburg Basin/Niobrara formation “is among the tops in U.S. land, just slightly below the 1,442 b/d observed in the Eagle Ford Shale (and much higher than the 662 b/d in the Permian),” West said. “In addition, California has shown unmatched (and unprecedented) permit growth.”

Meanwhile, in the Gulf of Mexico, 17 new permits were issued in March, up 113% from February’s eight and 13% higher y/y.

Shallow water permitting held flat at four m/m, with three sidetracks and one bypass approved. Seven new midwater permits were filed versus two in February, while deepwater permitting improved to five, with two new wells and three sidetracks approved. Ultra-deepwater permitting notched a single new well permit in March, flat m/m.

The sharpest decline from the 2014 peak (ex-ultra-deepwater) is in shallow water permitting, down 82% in 2017 from year-to-date 2014.

“We believe that offshore drilling (and jackup utilization) will continue to languish as long as shallow water permits remain at historically low levels,” West said. “Offshore planning from last month points to modest offshore improvement in the 2Q2017-3Q2017 timeframe, with four drilling plans filed for possible tieback work…

“Overall, we remain cautious in allocating optimism to the offshore space, but permitting trends have certainly shown upward momentum over the first quarter of 2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |