Markets | NGI All News Access | NGI Data

Bulls All Runs, Hits And No Errors In Weekly NatGas Trading

There was no question who was on top of weekly natural gas trading for the week ended April 7. Bulls and bears drew to a standoff the week before, but this time around the NGI Weekly National Spot Gas Average put in a solid advance of 18 cents to $3.03.

The market point showing the greatest gain was Tennessee Zone 6 200 L with a rise of 55 cents to $4.06 followed closely by its neighbor Algonquin Citygates showing an advance of 37 cents to $3.47. Only one point followed by NGI showed a loss, Chicago Nicor Gas fell a penny to $3.10.

Regionally, the Northeast proved to be the week’s greatest gainer with a rise of 27 cents to $3.36 and East Texas brought up the rear with a gain of a dime to $3.07.

South Texas and the Southeast both rose 13 cents to $3.08 and $3.13, respectively and South Louisiana added 14 cents to $3.09.

The Midwest tacked on 17 cents to $3.12 and both the Rocky Mountains and California advanced 19 cents to $2.76 and $3.04, respectively.

Weekly Appalachian quotes rose 20 cents to $2.93, and the Midcontinent was up 21 cents to $2.91.

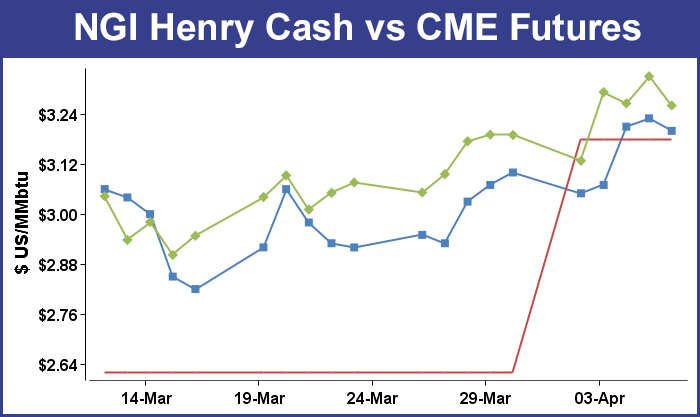

May futures survived a round of selling Friday and closed up 7.1 cents on the week to $3.261.

Futures jumped Thursday morning after the EIA reported a storage injection that was less than what traders were expecting.

EIA reported a 2-Bcf storage build in its 10:30 a.m. EDT release, about 5 Bcf shy of industry estimates. May futures bounded higher and lower after the number came out and traded as high as $3.334 and as low as $3.270 immediately after its release. At 10:45 a.m. May was trading at $3.311, up 4.5 cents from Wednesday’s settlement. At the close May had gained 6.5 cents to $3.331 and June was higher by 5.7 cents to $3.401.

Prior to the release of the data, Wells Fargo Securities LLC was looking for an injection of 13 Bcf. A Reuters survey of 22 traders and analysts showed an average 7-Bcf increase with a range of -14 Bcf to +15 Bcf.

Last year 6 Bcf was injected, and the five-year pace stands at a 12 Bcf decline.

“If the market stays above $3.31, I think they will take out $3.35. Right now the market feels supportive,” said a New York floor trader following the release of the number.

Others didn’t see the number as that helpful. “We believe the storage report will be viewed as neutral,” said Randy Ollenberger, an analyst with BMO Capital Markets. “Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at or above five-year averages, assuming normal weather.”

“The 2-Bcf net injection into U.S. natural gas storage for the week ended March 31 was smaller than expected and so supportive in the near term, even as the build was still bearish relative to the 13-Bcf five-year average draw,” said Tim Evans of Citi Futures Perspective. “The surprise implies a somewhat tighter supply/demand balance, which may carry over into future periods.”

Inventories now stand at 2,051 Bcf and are 427 Bcf less than last year and 265 Bcf greater than the five-year average.

In the East Region 10 Bcf was withdrawn and the Midwest Region saw inventories decrease by 7 Bcf. Stocks in the Mountain Region were up 1 Bcf and the Pacific Region was up 4 Bcf. The South Central Region increased 14 Bcf.

In Friday’s trading takers for weekend and Monday physical gas deliveries were few and far between as weather forecasts proved moderate and Monday energy usage was expected to be less than Friday’s.

All but one point followed by NGI lost ground, and outside of the Northeast declines were just under a dime. Northeast locations posted heftier double-digit losses, and the NGI National Spot Gas Average lost 8 cents to $3.01.

Futures had difficulty as well. Traders concentrated on long-term storage surpluses going into light shoulder-season demand. At the close May had fallen 7.0 cents to $3.261 and June was lower by 7.0 cents as well to $3.331.

Futures traders are looking lower. “I’m bearish on the market,” said John Woods, president of JJ Woods and Associates. “We traded up to $3.34 [Friday], but I look at the fund buying earlier, as the funds getting out. If you had a rash of buying coming in, you would see a continuation, and that did not happen.

“Our contract high is $3.50, and the reason it didn’t run like crazy was the existing longs decided it was a good place to sell. You can’t make contract highs on a shoulder season. Temperatures in the East are going to be in the 60s and 70s, and just a couple of weeks ago we were under $3 and everyone was talking lower. In the winter we got below $2.60, and I said, ‘No Way’.

“A fund got out of their short position, and the smart money sold it. If you and I are sitting around knocking down a couple of margaritas, we are not going to sell $3.28s during the course of the day when you know it’s going to get up to $3.325 to $3.34 because that is where it is supposed to be technically. That’s where the selling comes in. Just sell the technical points.”

For the past three trading sessions the high on May futures has been within a cent of $3.34.

At the day’s open traders were questioning just how much more upside the market has left in it given current ample storage.

If not outright bears, other traders are generally reluctant to follow the market higher but concede that the current surplus against five-year averages may not be enough to prevent a price response to early-season cooling load.

“[Thursday] saw the usual volatility spike post EIA storage release that lifted May futures back to the midweek highs of $3.35,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients. “We remain reluctant to follow this price advance given lack of weather related support within consensus of one- to two-week temperature views that still favor mild trends. Furthermore, we look for the storage surplus against five-year averages to stabilize in the 265-270 area for a couple of weeks with this supply cushion of almost 15% providing some offset against several non-weather supportive items.

“However, the recent price strength is sending off strong overtures that non-weather-related items have been increasing withdrawals while downsizing last week’s first injection of the season. Year-over-year production comparisons are not yet showing a strong response to the major upswing in the oil rig counts that should be translating to stronger associated gas output. Additionally, power demand has been stepped up with some help from coal to gas switching and larger than expected nuke downtime. Export activity also remains brisk.

“Nonetheless, we still question the sustainability of this recent price advance given unusually mild temperature forecasts that will be seen across the upper continent this weekend with extension out some two weeks. In view of the expected limited HDD and CDD accumulation, we feel that the surplus could see a further stretch through the rest of this month but with next week’s EIA release likely to indicate only a minor increase in the supply surplus. But while an approximate 15% supply overhang may be able to limit additional upside follow-through, it may not prove to be a match against an early start to a hot summer.”

Current natural gas production levels don’t yet reflect the influx of gas drilling that has taken place over the last several months, but rig counts continue to grow and it’s just a matter of time before additional volumes come calling.

One-dozen rigs returned to the Permian Basin during the week just ended, according to Baker Hughes Inc. (BHI) in its weekly tabulation of rig activity, and that propelled Texas to an overall gain of seven units during the week. But the good news for the energy patch isn’t confined to the Permian or to Texas. (see related story).

“Growth in the Permian has been well documented, but natural gas-heavy basins like the Marcellus, Utica, Haynesville and Eagle Ford have been ramping as well,” East Daley Capital said in a recent note. “The southwestern Marcellus and Utica have seen rig counts nearly triple as producers ramp production into the startup of Energy Transfer’s Rover Pipeline.”

In Friday physical trading, forecasts of lower energy demand in key eastern markets held little encouragement for buyers of incremental supply. The New York ISO and PJM Interconnection both predicted lower energy demand Monday than Friday. The New York ISO forecast peak load Friday of 17,705 MW would fall to 17,633 MW Monday and PJM calculated peak load Friday of 31,973 MW would fall to 30,375 MW Monday.

Gas for weekend and Monday delivery on Tetco M3 shed 19 cents to $2.95 and deliveries to New York City on Transco Zone 6 skidded 27 cents to $2.93.

Marcellus points were also weak. Gas on Dominion South fell 12 cents to $2.92 and packages priced on Tennessee Zn 4 Marcellus retreated 21 cents to $2.78. Gas on Transco-Leidy Line was down 19 cents to $2.83.

Other market centers were lower across the board as well. Gas at the Algonquin Citygate shed 11 cents to $3.30 and deliveries to the Chicago Citygate were quoted a nickel lower at $3.07. Gas at the Henry Hub came in 3 cents lower at $3.20.

Packages at the NGPL Midcontinent Pool changed hands 3 cents lower at $2.90, and gas at the Kern River receipt point shed 4 cents to $2.79. Gas priced at the SoCal Border Average was quoted 6 cents lower at $2.86.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

Gas buyers for weekend power generation across ERCOT will have not only warm temperatures to deal with but also a healthy collection of renewable generation to offset gas purchases. “Seasonable conditions will give way to spring warmth this weekend, and fair weather and a developing southerly wind with gusts in excess of 30 mph will support a quick warming trend [Friday] into the weekend,” said WSI Corp. in a Friday morning note to clients.

“Humidity levels will gradually creep up as well. Max temps will rebound into the 80s to near 90. This warm air mass and a cold front will support the increasing chance for heavy rain and strong thunderstorms Sunday evening into early next week. Wet weather will knock temperatures down into the 70s to low 80s.

“A warm southerly wind will cause wind gen ramp-up and become strong today into the weekend. Output is forecast to peak 11-14+ GW. Mostly sunny skies will support solar gen the next two days, but clouds will increase and impede solar gen by early next week.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |