NatGas Forwards Put Up Double-digit Gains as Cash Rallies, Storage Injection Falls Short

May futures and forwards markets were up 16 cents, on average, between March 31 and April 6 as benchmark Henry Hub cash prices rose steadily through the week and the final storage report for the traditional withdrawal season showed a 2 Bcf injection, according to NGI’s Forward Look.

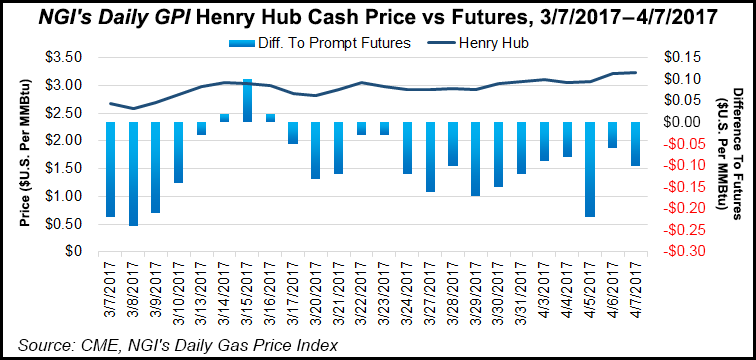

Nymex May futures led the charge as the prompt-month climbed 14 cents during that time to settle Thursday at $3.33. Cash prices at the Henry Hub, meanwhile, were up 13 cents over the same period to $3.23, NGI historical price data shows.

Interestingly, cash prices at this level are incentivizing injections into salt dome gas storage, and while this is not uncommon from a seasonal perspective, the pace will be an important factor affecting prices over the next two to three months, analysts at Mobius Risk Group said.

Thursday’s storage inventory report from the U.S. Energy Information Administration (EIA) said 6 Bcf was injected into salt dome storage during the week ending March 31, Mobius said. This caused the deficit versus last year to remain steady at 27 Bcf.

“Natural gas prices could remain supported as long as inventory in this asset class remains at a deficit to last year. For reference, 40 Bcf was injected last April and thus, weekly injections of 10 Bcf or less will be deemed neutral to bullish,” the Houston-based company said.

As for total underground storage, EIA reported a 2 Bcf injection into inventories for the week ending March 31, effectively elevating stocks to an end-of-season 2.051 Tcf. The 2 Bcf build was below market estimates of about 7 Bcf, and compared to a 6 Bcf injection for the same week last year and a 12 Bcf withdrawal for the five-year average.

“In isolation, today’s inventory report supported a path towards end-of-October inventory of 3.5-3.6 Tcf,” Mobius said late Thursday. “Bullish market sentiment is intimately linked to inadequate inventory ahead of next winter’s withdrawal season, and more specifically, a flat year-over-year injection profile.”

But while this week’s small storage build may have provided market bulls some fuel, the weeks ahead will likely prove quite bearish on the storage front. Early indications point to a double-digit injection for the reporting week ending April 7, which compares to a 1 Bcf withdrawal during the same week in 2016. “In addition, the subsequent week’s weather forecast points to another bearish data point, and an injection of more than 30 Bcf versus a comp of +6,” Mobius said.

Looking further ahead, the April 21 EIA reference week will have critical implications for market bulls, the analytics group said. During that same week last year, 64 Bcf was injected, and on similar weather during the week of May 5, 2016, 56 Bcf was injected. “It is not clear which benchmark will carry more weight, but it is certain that the inventory gain will need to be sub-56 Bcf for recent upward momentum to be sustained,” Mobius said.

On Friday, the Nymex May futures contract was in the red for much of the day, ultimately settling at $3.26, down 7 cents.

Weather forecasts are providing less and less support these days, with next week showing the only period of slightly cooler-than-normal temperatures as a spring storm traverses the country. The amount of cold air drawn out of Canada has diminished considerably since early in the week, however, and is now expected to play out barely colder than normal, forecasters at NatGasWeather said.

Additional heating degree days have also been lost as a warm ridge is favored over the southern and eastern United States April 17-19, and a near-normal weather pattern is favored to close out the month, it said.

“Bigger picture, even with relatively bearish weather patterns, surpluses in supplies won’t notably increase, highlighting just how tight the background S/D (supply/demand) environment is. But they also won’t be dropping much either, and that could lead to some choppy trade ahead,” NatGasWeather said.

Indeed, the tight S/D environment is what keeps investment bank Jefferies bullish on gas. With production levels remaining around 70-71 Bcf/d and exports continuing to climb — up a combined ~2.3 Bcf/d yoy at ~5.8 Bcf/d — the New York bank sees strong support for gas going forward.

Commissioning is now completed on Train 3 at Cheniere’s Sabine Pass LNG facility, and commissioning of Train 4 is now under way. Additionally, Dominion’s Cove Point export terminal remains on track to begin exporting LNG late in 2017, and Mexican exports continue to run higher year over year, having averaged ~4.0 Bcf/d year to date and recently reached highs of ~4.2 Bcf/d, Jefferies said.

Taking this into account, Jefferies sees rising exports counteracting the blow from declining power burn, which it sees falling around 3.5 Bcf/d this summer compared to 2016. Furthermore, the bank said the tight s/d balance will work down the current storage excess through the summer months, bringing storage back to the five-year average by November 2017.

The bank did note, however, that production gains will likely be seen in the second half of the year. Despite the natural gas rig count almost doubling from recent lows, natural gas production in 2017 has averaged ~70.6 Bcf/d year to date, down ~2.3 Bcf/d year over year. “We expect supply to respond in 2H17 driven by Appalachia and associated gas, and our exit to exit supply model shows growth of ~1.4 Bcf/d,” Jefferies said.

It appears the forwards markets are also reflecting tight market conditions as double-digit increases were seen through the winter 2017-2018 strip. Nymex May futures were up 14 cents from March 31 to April 6 to settle at $3.33, June futures were up 15 cents to $3.40, the balance of summer (June-October) was up 15 cents to $3.47 and the winter 2017-2018 was up 16 cents to $3.63.

On a national level, May forward prices averaged 16 cents higher, June forward prices averaged 17 cents higher, the balance of summer averaged 17 cents higher and the winter 2017-2018 averaged 17 cents higher during the same time period.

New England’s Algonquin Gas Transmission Citygates put up stronger increases at the front of the curve as the pipeline issued an operational flow order that went into effect April 7 after the pipeline began experiencing lower than normal pressures on its G system due to delivery point operators taking gas at sustained high hourly rates. In a notice to shippers, AGT said delivery point operators on the G system need to lower their takes to levels closer to nominated ratable levels to allow the system to return to normal operating pressures. The OFO is expected to remain in effect until further notice.

AGT Citygates May forward prices jumped 24.6 cents between March 31 and April to reach $3.25, while June was up 16 cents to $3.31, the balance of summer was up 19 cents to $3.45 and the winter 2017-2018 strip was up 18 cents to $7.12, according to Forward Look.

Meanwhile, the pipeline remains under a summerlong maintenance that is expected to last through October.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 |