Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

API Says ‘Keep It in The Ground’ Policies Would Mean Millions of Jobs Lost by 2040

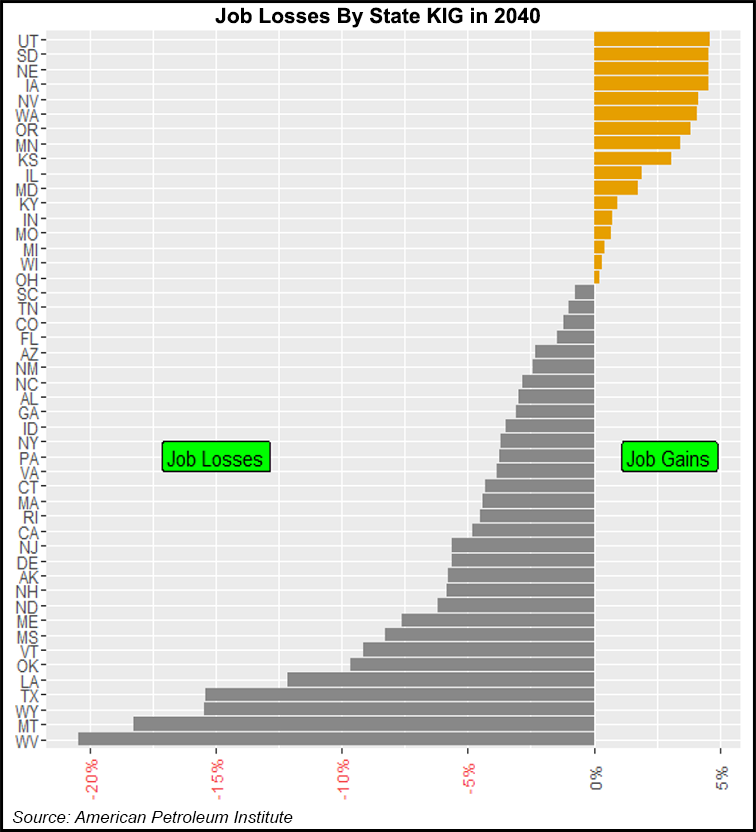

The U.S. would lose millions of jobs and trillions in cumulative gross domestic product (GDP) by the year 2040 if the nation’s energy policy adhered to actions championed by the “keep it in the ground” (KIG) movement, according to a study commissioned by the American Petroleum Institute (API).

In a 28-page report, “The Impacts of Restricting Fossil Fuel Energy Production,” API contends the United States would lose 5.9 million jobs by 2040 under a KIG scenario, when compared to a reference case similar to the U.S. Energy Information Administration’s (EIA) Annual Energy Outlook (AEO) 2016 Reference Case.

The KIG scenario assumes no new private, state or federal oil and gas leases; a complete ban on hydraulic fracturing (fracking); no new coal mines or expansion of existing mines; no new energy infrastructure, especially pipelines; restricting imports and exports to existing trade infrastructure, and no expansion of international gas pipelines into the U.S.

“U.S. energy leadership is generating major economic benefits for American families and businesses,” said Jack Gerard, CEO of API. “Increased energy production and infrastructure investment could create hundreds of thousands of additional jobs. [But] restrictive policies would take the United States back to an era of energy dependence — all based on the false idea that we must choose between energy self-sufficiency and environmental progress.”

API commissioned Vienna, VA-based OnLocation Inc. to perform the study, using the National Energy Modeling System (NEMS) that the EIA uses to compile its AEO reports.

In addition to the millions in lost jobs, cumulative GDP (from 2018) would be $11.8 trillion less by 2040 under the KIG scenario, compared to the NEMS model. Annual energy expenditures per household are also predicted to be $4,552 higher under KIG.

U.S. crude oil and natural gas liquids (NGL) production would be an estimated 11.7 million b/d lower, and natural gas production off by 81 Bcf/d, under the KIG scenario. To help offset the drop in domestic production, net liquid petroleum imports would be 11.1 million b/d higher under KIG. Prices for oil and gas would both be higher compared to the NEMS model — $40/bbl more for West Texas Intermediate (WTI) crude oil, and $21/MMBtu more at the Henry Hub.

The annual cost of oil and gas imports would rise to $129 billion in 2040 under the KIG scenario, compared to net revenue of $54 billion under the NEMS model. Meanwhile, net annual expenditures for crude and product imports would increase by $580 billion in 2040 under KIG, leading to a cumulative increase in outflows of $7.5 trillion by 2040.

Retail electricity prices would also be 56.4% higher under KIG, which would reduce the demand for electricity by 8% in 2040. The only bright spot appears to be a 13.1% reduction in carbon dioxide (CO2) emissions by 2040 across the nation’s economy.

“Cutting U.S. oil and natural gas production wouldn’t magically reduce world energy demand,” Gerard said. “But it could raise costs significantly for American families and manufacturers, profoundly damage the U.S. economy, diminish our geopolitical influence, and severely weaken our energy security.

“With forward-thinking energy policies, we can ensure the U.S. energy renaissance continues to provide benefits for American consumers, workers and the environment.”

According to API, the demand for liquid fuels remains relatively constant between the KIG scenario and the NEMS model, with transportation demand shrinking — by 0.7 quadrillion Btu (quads), or 2-3% by 2040 — due to higher prices, but industrial demand is predicted to increase (by 0.5 quads, or 4% by 2040) due to the substitution for natural gas.

Although natural gas demand is predicted to be lower across all sectors of the economy under the KIG scenario due to much higher prices, the falloff is especially pronounced in the power sector, where natural gas demand is reduced by more than 10 quads, or 80%, by 2040.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |