Markets | NGI All News Access | NGI Data

NatGas Cash Post Solid Gains, But Futures Sag Ahead of Storage Data

Physical natural gas for Thursday delivery advanced in Wednesday trading, as forecasts of higher energy demand and supportive power pricing permeated the market. Most points were higher by double-digits, but a few eastern points slumped after an operational flow order (OFO) was lifted in the Northeast.

The NGI National Spot Gas Average rose 11 cents to $3.11. Futures prices eased ahead of a U.S. gas storage data expected to show the first build of the season and concerns of an overbought market.

At the close, May had given up 2.7 cents to $3.266, and June was off 2.1 cents to $3.344. May crude oil rose 12 cents to $51.15/bbl.

In physical market trading, the Northeast was the anomaly as an OFO by Algonquin Gas Transmission was lifted, easing some of the restrictions surrounding gas flow at its Stony Point, Cromwell, and Burrillville Compressor Stations.

Gas at the Algonquin Citygate fell 52 cents to $3.23, while deliveries to Iroquois, Waddington added a nickel to $3.48. Deliveries to Tenn Zone 6 200L retreated 13 cents to $3.96.

Elsewhere, strong energy demand and firm next-day power prices gave natural gas buyers a solid rationale for incremental purchases.

The PJM Interconnection forecast that peak load Wednesday of 30,410 MW would rise to 30,902 MW Thursday and to 31,304 MW by Friday. The New York ISO predicted peak load Wednesday of 17,753 MW would climb to 17,987 MW Thursday before slipping to 17,577 MW Friday.

Packages on Texas Eastern M-3, Delivery added 16 cents to $3.08, and gas bound for New York City on Transco Zone 6 gained 22 cents to $3.14.

Next-day on-peak power was also firm. Thursday on-peak power at the ISO New England’s Massachusetts Hub was 16 cents higher at $38.95/MWh, according to Intercontinental Exchange, while peak power at the New York ISO Zone G (eastern New York) delivery point advanced by $4.52 to $38.50/MWh. On-peak Thursday power at the PJM West terminal rose $2.52 to $34.94/MWh.

Other market centers posted solid gains as well. Gas on Dominion South added 18 cents to $3.00, and gas at the Chicago Citygate came in 9 cents higher at $3.24. Deliveries to the Henry Hub posted a 14 cent gain to $3.21.

In western markets, gas on El Paso Permian jumped 13 cents to $2.89, and gas at Opal was quoted 13 cents higher at $2.91. Gas priced at the SoCal Border Avg. Average changed hands 14 cents higher at $3.00.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

May futures opened 2 cents lower Wednesday at $3.27 as traders saw little in the way of supportive weather developments and digested the market’s current overbought condition.

“I’m thinking the market is kind of overbought,” said a California trader. He said that he wouldn’t be a seller until the Relative Strength Indicator, or RSI, currently at 64, reached 75 to 80. “If it gets to $3.50, I’m all over it.”

Forecasters see no significant near-term weather events.

“We continue to monitor a variable middle springtime pattern with mixed changes that frequently offset each other in this relatively low demand time of year,” said Commodity Weather Group President Matt Rogers in a Wednesday note to clients.

“One quick spike of warmth we are watching for the Middle Atlantic early next week looks to peak on Tuesday, day 7, with lower to middle 80s from Washington, DC, to Philadelphia, but humidity remains on the low side to restrict any early-season cooling demand concerns at this point. Otherwise, the West is also warmer in the six-10 day with the South a bit cooler.”

Forecaster Wunderground.com predicted that the high next Wednesday (April 12) in New York City would hit 73, nearly 20 degrees above normal. Chicago, on the other hand, is expected to see a high of 49, six degrees below normal.

Analysts had seen Tuesday’s advance as a function of technical and weather factors.

“The natural gas market turned a successful defense of uptrend support into a rally to new highs on Tuesday, supported by a somewhat cooler six-10 temperature outlook that added some late-season heating demand to the mix,” said Tim Evans of Citi Futures Perspective. Growing U.S. liquefied natural gas export capacity “may have also helped the market turn higher.”

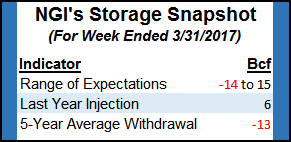

Early estimates of the week’s storage report by the U.S. Energy Information Administration have tightened somewhat from early readings of +11 Bcf to +7 Bcf. Last year, 6 Bcf was injected and the five-year pace stands at a 12 Bcf withdrawal.

JPMorgan Chase & Co. estimated a 4 Bcf increase and Wells Fargo Securities LLC is looking for an injection of 13 Bcf. A Reuters survey of 22 traders and analysts showed an average 7 Bcf increase with a range of -14 Bcf to +15 Bcf.

FCStone Latin America’s Tom Saal, vice president, in his work with Market Profile, expected the market to test Tuesday’s value area at $3.286 to 3.222 followed by a test of $3.157 to 3.139. Market Profile is a breakout trading system and once the week’s initial balance of $3.193 to 3.100 is exceeded or broken he looks for trading objectives at $3.389 or $3.037.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |