Regulatory | Infrastructure | Mexico | NGI All News Access | NGI The Weekly Gas Market Report

Mexico’s CENAGAS First Open Season Is Mixed Bag

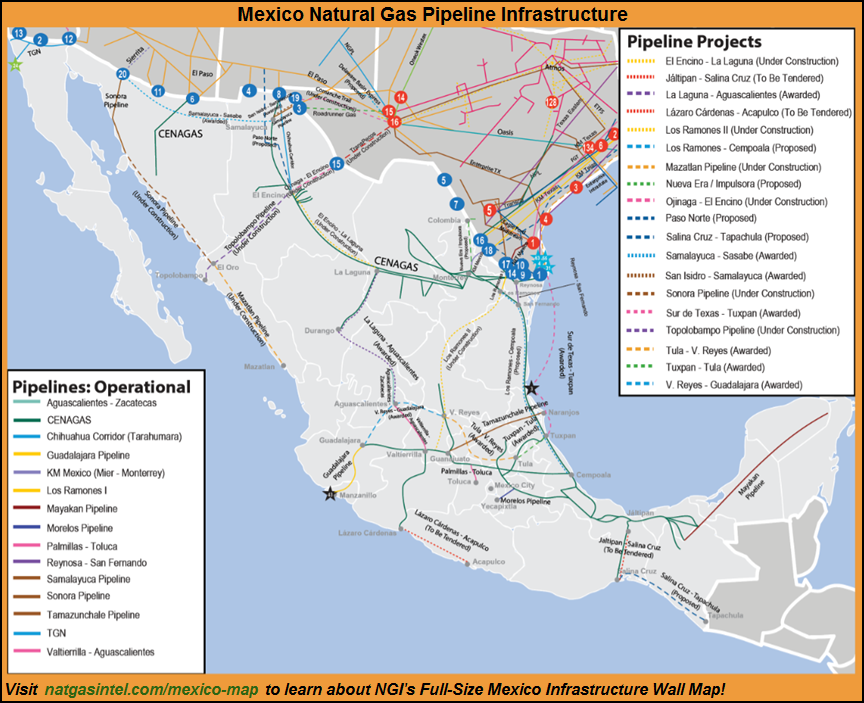

On March 27, four days after Cenagas announced the results of its first open season for one-year contracts on Mexico’s National Integrated Natural Gas Transportation System (Sistrangas), it called for a second round of bidding to make adjustments for three oversubscribed routes.

Through April 7 participating companies will be allowed to make new offerings for capacity on oversubscribed routes, updating the monetary additional per unit offers, but not quantities, injection and extraction points or route priorities. Only companies that submitted bids for these routes in the first phase will be allowed to participate in the second round. Companies’ bids are offers to pay a premium over the base tariff across SISTRANGAS’ injection points.

The twenty-three companies’ bids for 18 injection points resulted in oversubscribing the Ramones and Kinder Morgan Monterrey importation ducts (pipelines) and the Cactus gas processing center in the south. The results will be announced April 8, after which companies will be allowed to engage in swaps. One-year contracts will begin on July 1, Cenagas said. Seven of the 18 points received no bids.

On March 23, CENAGAS published the first phase average and median bids and subscription percentages for the Sistrangas open season. The second round of bidding, focused on assigning priorities for contracts on oversubscribed routes, was taking place from March 27 to April 7.

The Ramones injection point, interconnected to the Net Mexico Pipeline at Camargo, received requests of 2.2 MMcf/d for 1.1 MMcf/d capacity, or 206% saturation. The interconnection point for the Kinder Morgan Texas Pipeline at Pesquería had requests of 379 MMcf/d for 223 MMcf/d capacity, or 170%. Finally, the Cactus Nuevo Pemex injection point in the southern state of Chiapas had requests of 195 MMcf/d for 175 MMcf/d capacity, or 112%.

Eight other injection points had subscription levels ranging from 79% to 1%, while seven others received no bids.

Sistrangas’ four other importation points had modest bids. The interconnection point to the Kinder Morgan Border Pipeline at Argüelles had requests for 50.7 MMcf/d for 76.8 MMcf/d capacity (66% saturation); Gloriadios, interconnected to Gasoductos de Chihuahua at Juárez, saw requests of 42.4 MMcf/d for 121.2 MMcf/d capacity (35% saturation); the interconnection point to the Kinder Morgan Border Pipeline at Reynosa had requests for 25.6 MMcf/d for 94.8 MMcf/d capacity (27% saturation); and the interconnection to the Tennessee Gas Pipeline, also at Reynosa, saw requests of 13.8 MMcf/d for 59.8 MMcf/d capacity (23% saturation).

Among the domestic injection points, the one servicing state oil company Pemex’s Mendoza field in Veracruz state had the highest bids, 165.7 MMcf/d for 209.8 MMcf/d capacity or 79%. It was followed from afar by the Poza Rica injection point, also in Veracruz, at 14% (10.4 MMcf/d for 74.6 MMcf/d capacity) and the Campo Nejo injection point, in Tamaulipas state, at 2% (3.3 MMcf/d for 165.1 MMcf/d capacity). The six remaining, and smaller, domestic injection points received no bids.

Finally, Sistrangas’ injection points connected to LNG terminals saw minimal interest. The Manzanillo injection point saw requests of 1.1 MMcf/d for 109.3 MMcf/d capacity, while the Altamira injection point received no bids.

Twenty-three companies are participating in Sistrangas’ first open season. Ten of them are marketers or distributors, such as BP Energia de Mexico, CFE Energia, Compañia Mexicana de Gas, Ecogas Mexico, Engie Mexico, Gas del Litoral, Macquarie Energy Mexico, Pemex Transformación Industrial, Shell Trading Mexico and White Eagle Gas Mexico.

The other ones are large consumers, including industrial conglomerate Alfa, ArcelorMittal Mexico, Energéticos Gangmen, Energía Infra, Fábrica de Envases de Vidrio de Potosí, GCC Cemento, Industrias Peñoles, Igasamex Bajío, Indorama Ventures Polymers, glass-making giant Vitro, Industrias de Hule Galgo, Industrias Derivadas de Etileno and Virtual Pipelines de Mexico. Several of these companies are located in Monterrey, Nuevo León, which explains why the Ramones and Kinder Morgan Monterrey injection points were heavily oversubscribed.

The results of the open season will be announced May 8, but companies will be allowed to swap capacity from May 15 to May 19. Contracts will be signed from May 22 to June 2, and companies will receive training from June 5 to June 30. Contracts will be valid for one year, starting on July 1.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |