Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Onshore E&Ps Leading Charge in Global Spending

Global producers, led by U.S. operators, are opening their wallets again, but oil prices still may not be high enough to support sustainably stronger investments beyond 2017.

Raymond James & Associates Inc. on Monday issued results of a survey of global oil and gas producers large and small, which comprise about 75% of upstream investment. Recovery has begun, with capital expenditure (capex) levels skewed to the United States, where spending on average is set to rise about 58%.

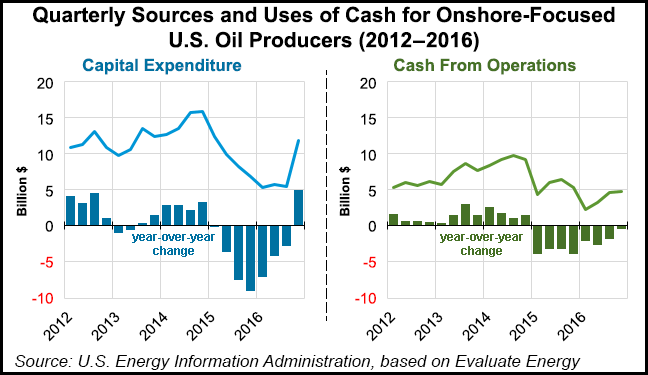

A survey by the U.S. Energy Information Administration (EIA), also issued Monday, indicated U.S. onshore-focused capex for 44 oil producers increased 72% to $4.9 billion between 4Q2015 and 4Q2016.

“This increase in investment spending was the largest year/year increase for any quarter by these 44 companies since at least the first quarter of 2012,” EIA principal contributor Jeff Barron said. The increase in the domestic rig count and company announcements suggest investment growth will continue.

Lower investment levels since late 2014 likely contributed to reduced cash from operations for the 44 exploration and production (E&P) companies, despite an increase in crude oil prices, according to EIA. The reduction in cash from operations totaled $475 million year/year in 4Q2016 for the 44 E&Ps.

Many operators use oil futures and options to hedge investments in production into the future. E&Ps bean using them more after crude oil prices rose above $50/bbl in the final three months of 2016. As of mid-February the number of short positions in U.S.-based futures and options reached 756,000 contracts, close to the 10-year high of 802,000 contracts, EIA noted.

Higher Oil Prices, Higher Capex

According to the Raymond James survey of global operators, 2016 spending fell by 33% year/year, the second year in a row with a decline of 20%-plus. Recovery has begun, led by U.S. E&Ps, said analysts led by Pavel Molchanov.

“U.S. spending (based on initial budgets) should increase by 58% (with room to flex up as the year progresses), but international spending is set for only a 9% increase,” Molchanov wrote. Based on current oil prices, the current level of investment “is simply not adequate” over the medium term to grow supply by operators that are not members of the Organization of the Petroleum Exporting Countries (OPEC).

The picture for 2017 is “looking somewhat better — but still far from great,” said Molchanov. “Even with the 2017 recovery, global oilfield capital spending is still down by nearly half from 2013 to 2017.”

In countries where industry is dominated by state enterprises, especially those without public listings, there always is less clarity, particularly true of most OPEC countries, which means that any analysis of global spending has limited precision. Raymond James used a sample of 50 mid-to-large cap E&Ps that disclose financials, including 18 U.S.-focused pure-plays that operate in all of the major basins. The companies represent about 70-80% of global upstream capex, with every kind of upstream activity– conventional, shale/horizontal, deepwater, oilsands, frontier and liquefied natural gas.

Aggregate capex for the surveyed companies peaked in 2013 at $590 billion and is set to decline to $309 billion in 2017, a cumulative drop of 48%, according to Raymond James.

Considering the magnitude of the cutbacks over the previous three years, “it is safe to say that the industry as a whole has still

not fully exited its period of austerity,” Molchanov said. The most noticeable trend is the sharp increase in U.S. capex.

“Based on our price deck ($70 West Texas Intermediate), our U.S. cash flow model calculates that ‘theoretical’ capital spending should approximately double in 2017,” he said. “So, is real life matching theory? Based on the initial 2017 budgets of our survey’s U.S. subset, there answer is: not quite.

“The budgets are averaging up 58%, which suggests that most operators are assuming oil prices in the mid-to-high $50s.”

Capex Shifting to U.S.

Of the 18 U.S. E&Ps in the survey, three have said they are upping spending by at least 100% this year —Diamondback Energy Inc., RSP Permian Inc., both Permian Basin-focused, and Range Resources Corp.All three have boosted their onshore portfolios over the past year.

Also included in the Raymond James survey are the largest explorers. ExxonMobil Corp. and Royal Dutch Shell plc are planning double-digit capex increases this year, as are Chevron Corp. and Total SA.

“Few of the multinationals provide much detail on the geographic allocation of their budgets, but at least anecdotally, it is possible to observe a shift to the U.S. in some cases,” Molchanov said. The initial E&P budgets in the survey are subject to revision, and analysts think the 2017 changes generally will be “in an upward direction, especially in the U.S.”

Initial U.S. capex plans appear to be based on oil prices in the mid-to-high $50s. If oil prices increase as 2017 progresses, the rig count also should rise along with spending.

“Furthermore, we think service cost escalation will exceed what’s currently being assumed in most E&P budgets,” Molchanov said. “There is also room to flex up spending outside the U.S., though not to the same extent.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |