NGI Weekly Gas Price Index | NGI Data

Northeast Losses Offset Broad Gains In Weekly NatGas Trading

Bulls and Bears traded to a draw for the four-day trading week ended March 30 as the NGI Weekly National Spot Gas Average was unchanged at $2.85. Most points made gains of a few pennies, but losses in the Northeast brought the average down to unchanged.

The market point showing the week’s greatest gain was gas at Nicor behind the Chicago Citygate with a rise of 13 cents to $3.11. The week’s biggest losers proved to be Algonquin Citygate with a drop of 81 cents to $3.10, followed closely by its neighbor Tennessee Zone 6 200 L with a decline of 51 cents to $3.51.

All regions outside the Northeast were either unchanged or in the black by a few pennies. California was flat at $2.85 and both Appalachia and the Midcontinent added a penny to $2.73 and $2.70, respectively.

The Rocky Mountains were up by 2 cents to $2.57, the Southeast rose 3 cents to $3.00, and the Midwest came in 4 cents higher at $2.95.

South Louisiana changed hands 5 cents higher at $2.95, East Texas added 6 cents to $2.97, and South Texas rose 7 cents to $2.95.

The Northeast proved to be the laggard dropping 21 cents to an average $3.09.

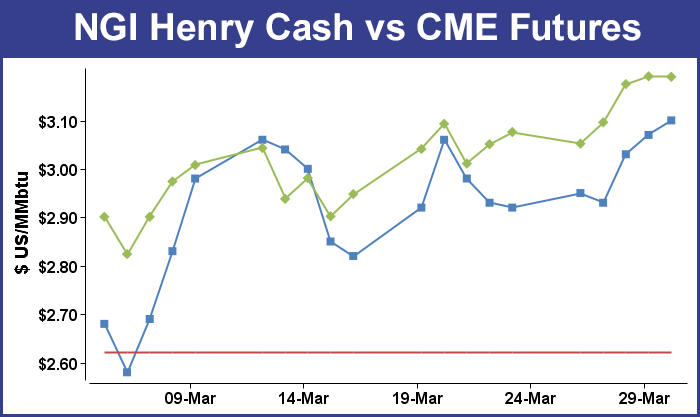

April futures settled Wednesday at $3.175, up a stout 54.8 cents from the March contract settlement.

The now spot May contract settled Thursday at $3.191, up 3.8 cents on the four-day trading week.

As trading for the week drew to a close Thursday physical natural gas for Friday delivery moved little as traders got their deals done ahead of the release of Energy Information Administration (EIA) storage data. Trading was lackluster and only a handful of points moved more than a few pennies either side of unchanged. TheNGI National Spot Gas Average was unchanged at $2.89. Over in the futures arena things momentarily got a little crazy when the EIA released storage data at 10:30 a.m and May futures took an immediate plunge to the low of the day at $3.141. Within a minute, however, trading stabilized and prices had returned to pre-report levels. At the close May had given up 4.0 cents to $3.191 and June was lower by 4.2 cents to $3.257. May crude oil continued its recovery and added 84 cents to $50.35/bbl., the first settlement of spot crude oil above $50 in three weeks.

EIA reported a 43 Bcf storage withdrawal in its 10:30 a.m. EDT release, about in line with industry estimates, but that was little consolation to traders who interpreted the number as bearish and sold only to have the market come bouncing back.

May futures were trading at $3.197 to $3.190 before the number came out and after its release made a quick foray lower to $3.141. Moments later, the market bounced back, and at 10:45 a.m. May was trading at $3.214, down 1.7 cents from Wednesday’s settlement.

Prior to the release of the data, Kyle Cooper of ION Energy was looking for a withdrawal of 46 Bcf, and industry consultant Bentek Energy, utilizing its flow model, figured on a pull of 43 Bcf. A Reuters survey of 20 industry cognoscenti revealed a 42 Bcf average with a range of -28 Bcf to -55 Bcf.

During the same week last year 19 Bcf was withdrawn, and the five-year pace stands at a 27 Bcf decline.

Traders were not optimistic Wednesday’s settlement would be exceeded. “If traders can hold the market at $3.18 to $3.19, they will probably close it against this [$3.21] level, but probably not taking out $3.23 to $3.24 area,” said a New York floor trader.

“The 43 Bcf net withdrawal was in line with consensus expectations for a 42-43 Bcf draw but supportive relative to the 27 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “The report was also supportive relative to our model’s 37 Bcf estimate and so does imply either a tighter balance between supply and demand or perhaps just some greater than anticipated carryover of demand from the prior week.”

Randy Ollenberger, an analyst with BMO Capital Markets said, “We believe the storage report will be viewed as neutral. Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at or above five-year averages assuming normal weather.”

Harrison NY-based Bespoke Weather Services said that “The number indicates that the market is a bit more balanced at these levels, and does not appear to provide a direct catalyst either higher or lower. It does seem to confirm the minor loosening of the last two weeks but that trend has not as clearly continued.”

Inventories now stand at 2,049 Bcf and are 423 Bcf less than last year and 250 Bcf greater than the five-year average. In the East Region 31 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 20 Bcf. Stocks in the Mountain Region were up 4 Bcf, and the Pacific Region was up 4 Bcf as well. The South Central Region was unchanged.

In Friday’s trading physical gas for April delivery over the weekend and Monday, for the most part, managed to hold its own, despite forecasts for lower energy usage.

Most market points outside the Northeast traded within a few pennies of unchanged, and in New England double-digit gains were noted as temperatures over the weekend were forecast to start the weekend well below normal.

The NGI National Spot Gas Average rose 3 cents to $2.93. May futures opened strong and made a valiant attempt to reach new high territory, but at the end of the day had to settle for a nominal setback. At the close May had eased one-tenth of a cent to $3.190 and June had given up three-tenths of a cent to $3.254. May crude oil tacked on 25 cents to $50.60/bbl.

Points in New England posted gains for weekend and Monday delivery, and in the Mid-Atlantic quotes held firm although energy usage was forecast to decline. ISO New York forecast that peak load Friday of 18,362 MW would recede Monday to 18,007 MW and peak load across the PJM grid was expected to fall from 33,701 MW Friday to 30,662 MW Monday according to figures from PJM Interconnection.

Gas at the Algonquin Citygate rose a dime to $3.72, and deliveries to Iroquois Waddington rose 3 cents to $3.39. Parcels on Tenn Zone 6 200L gained 40 cents to $4.33.

Gas on Texas Eastern M-3, Delivery added a penny, but gas bound for New York City on Transco Zone 6 shed 3 cents to $2.90.

Temperatures in the East were forecast well below normal but were seen rising close to seasonal norms by Monday. Midwest temperatures were seen at normal levels for most of the weekend. Forecaster Wunderground.com predicted that Boston’s Friday high of 39 degrees would fall to 36 by Saturday before reaching 49 by Monday, 1 degree below normal. Chicago’s Friday high of 41 was expected to jump to 57 Saturday before sliding to 53 Monday, right at the seasonal norm.

Most major trading centers posted gains. Gas on Dominion South added a couple of pennies to $2.81, but deliveries to the Chicago Citygate fell 6 cents to $2.94. Gas at the Henry Hub gained 3 cents to $3.10.

Out west, gas on Panhandle Eastern rose 6 cents to $2.70 and gas received on Kern River was quoted 3 cents higher at $2.65. Gas priced at the SoCal Citygate gained 9 cents to $3.09.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

The market opened trading 4 cents higher as overnight weather models turned cooler. “[Friday’s] six-10 day period forecast is colder than previous forecasts over the eastern two-thirds of the CONUS, especially the Southeast,” said WSI Corp. in its Friday morning outlook. “The western U.S. is a little warmer. As a result, CONUS GWHDDs are up 5.7 to 64.2, which are 9.4 below average.

“Even with today’s colder changes, an amplified upper level pattern and deep eastern U.S. trough offers a cooler risk over the eastern half of the U.S.”

Technical analysts are scratching their heads trying to figure out if Thursday’s 4-cent setback in the May contract may signal a market top.

“As anticipated the May contract ran into trouble at $3.232-3.245-3.258, the 200 week MA and 0.618 of ‘a’=’c’ up from the $2.522 low,” said Brian LaRose, a market analyst with United ICAP, in closing comments Thursday. “The question now, is a top brewing? Given Thursday’s candlesticks and the divergence on the intraday technicals that is a scenario we must now entertain. However, bears need to crack $3.131-3.068 to confirm that is the case. Otherwise, the trend is still up.”

Analysts focused on supply-side dynamics had plenty of additions to add to their drilling rig rosters. Five U.S. natural gas rigs returned to service during the week ending March 31, and 10 oil-directed rigs came back, according to Baker Hughes Inc. (BHI).

Gas buyers responsible for purchases for power generation across the MISO footprint may not have much in the way of wind generation available over the weekend.

“High pressure will nose into the power pool during the next two days,” WSI said. “This will promote partly cloudy skies and variable temperatures. In general, max temps will range in the 50s to mid 80s. The next storm system will traverse the lower Midwest and Miss Valley during Sunday and Monday with a round of heavy rain and severe thunderstorms. Temps will retreat into the 50s-70s. Wind generation will decrease and become light during the next two days with some minor improvement by Sunday.”

Tom Saal, vice president at FCStone Latin America LLC in Miami, in his work with Market Profile said to look for the market to test Thursday’s value area at $3.221 to $3.185. “Maybe” the market will test the week’s 100% breakout target at $3.286, he said in a morning report.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 |