NGI Data | Markets | NGI All News Access

NatGas Cash Holds Steady, But Futures Lose Their Grip; May Drops 4 Cents

Physical natural gas for Friday delivery moved little on Thursday as traders got their deals done before the release of Energy Information Administration (EIA) storage data.

Trading was lackluster and only a handful of points moved more than a few pennies either side of unchanged. TheNGI National Spot Gas Average was up a penny to $2.90.

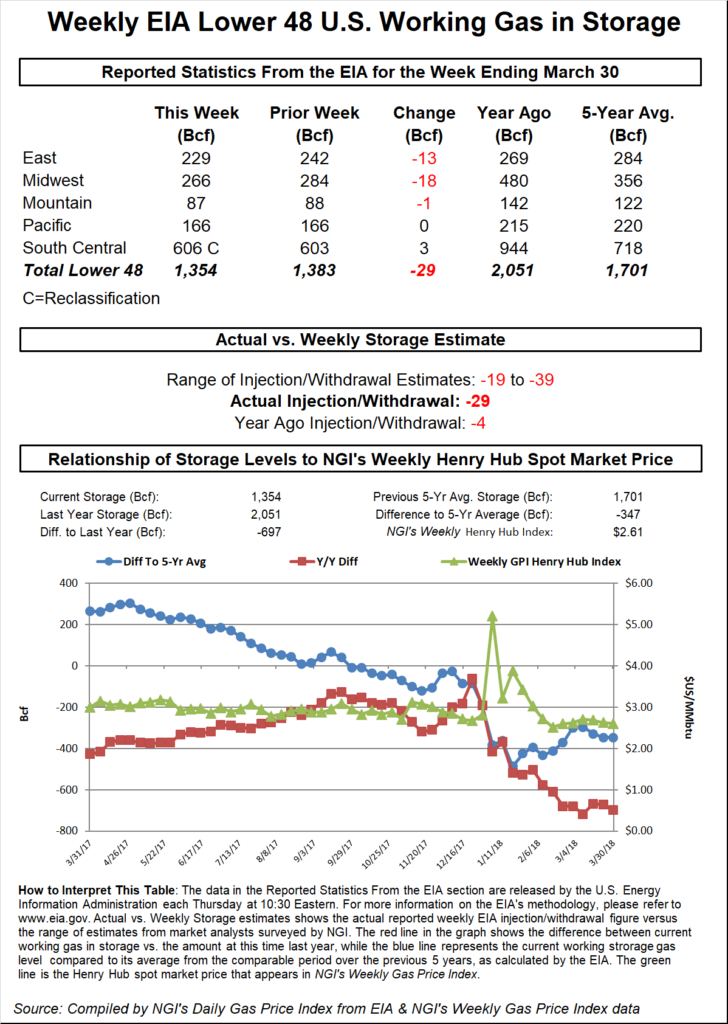

EIA reported a 43 Bcf storage withdrawal for the week ending March 24, about in line with industry estimates, but that was little consolation to traders who interpreted the number as bearish and sold only to have the market come bouncing back.

Over in the futures arena things momentarily got a little crazy when EIA released storage data at 10:30 a.m EDT and May futures took an immediate plunge to the low of the day at $3.141. Within a minute, however, trading stabilized and prices had returned to pre-report levels. At the close May had given up 4.0 cents to $3.191 and June was lower by 4.2 cents to $3.257. May crude oil continued its recovery and added 84 cents to $50.35/bbl, the first settlement of spot crude oil above $50 in three weeks.

Prior to the release of the storage data, Kyle Cooper of ION Energy was looking for a withdrawal of 46 Bcf, and industry consultant Bentek Energy, utilizing its flow model, figured on a pull of 43 Bcf. A Reuters survey of 20 industry cognoscenti revealed a 42 Bcf withdrawal average with a range of 28 Bcf to 55 Bcf.

During the same week last year 19 Bcf was withdrawn, and the five-year pace stands at a 27 Bcf decline.

Traders were not optimistic Wednesday’s settlement would be exceeded. “If traders can hold the market at $3.18 to $3.19, they will probably close it against this [$3.21] level, but probably not taking out $3.23 to $3.24 area,” said a New York floor trader.

“The 43 Bcf net withdrawal was in line with consensus expectations for a 42-43 Bcf draw but supportive relative to the 27 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “The report was also supportive relative to our model’s 37 Bcf estimate and so does imply either a tighter balance between supply and demand or perhaps just some greater than anticipated carryover of demand from the prior week.”

Randy Ollenberger, an analyst with BMO Capital Markets said, “We believe the storage report will be viewed as neutral. Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at or above five-year averages assuming normal weather.”

Harrison NY-based Bespoke Weather Services said, “The number indicates that the market is a bit more balanced at these levels, and does not appear to provide a direct catalyst either higher or lower. It does seem to confirm the minor loosening of the last two weeks but that trend has not as clearly continued.”

Inventories now stand at 2,049 Bcf and are 423 Bcf less than last year and 250 Bcf greater than the five-year average. In the East Region 31 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 20 Bcf. Stocks in the Mountain Region were up 4 Bcf, and the Pacific Region was up 4 Bcf as well. The South Central Region was unchanged.

Longer term, overnight weather models were mixed. The 11- to 15-day period “offers a mix of changes that include a cooler West to Central and a warmer East Coast,” said MDA Weather Services in its Thursday morning report to clients. “This comes in a lower than usual confidence period as models struggle to find agreement in what is expected to remain an active pattern out of the Pacific and into the U.S. In the wake of low pressure coming out of the Rockies late in the six-10 day period, above to much above normal temperatures are featured in the Midcontinent early and pressing southeastward as the period progresses.

“However, upstream ridging over Alaska has the forecast fading the warm anomalies late along the Northern tier. Model disagreements exist, with GFS being warmer in the Plains and cooler in Eastern Half versus forecast. The European model, preferred in the forecast, is cooler in the West.

In physical market trading next-day New England prices got a boost from firming prompt power pricing. Intercontinental Exchange reported that on-peak Friday power at ISO New England’s Massachusetts Hub rose $4.63 to $36.77/MWh. Next-day power at the PJM West terminal gained $2.39 to $34.54/MWh.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

At the Algonquin Citygate Friday deliveries were quoted at $3.62, up 56 cents, and at Iroquois, Waddington gas changed hands 3 cents higher at $3.36. Packages on Tenn Zone 6 200L rose 46 cents to $3.93.

Elsewhere trading was more subdued. Gas on Dominion South rose 3 cents to $2.79, deliveries to the Chicago Citygate shed 3 cents to $3.00, and gas at the Henry Hub fetched $3.07, up 4 cents.

On El Paso Permian Friday deliveries changed hands at $2.61, unchanged, and deliveries to Opal were quoted at $2.63, also unchanged. Gas at the PG&E Citygate added a penny to $3.21.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |