NGI Data | Markets | NGI All News Access

NatGas Futures Bounce Back Following Release of Storage Data

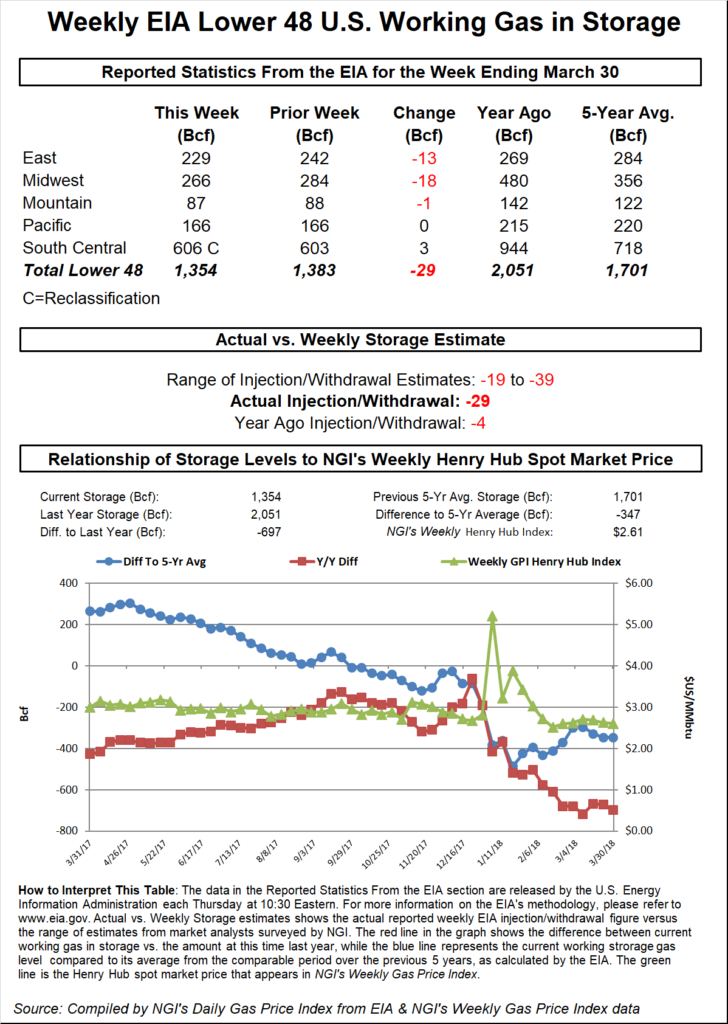

Natural gas futures initially plunged but made a sharp recovery Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was within a hair of what the market was expecting.

EIA reported a 43 Bcf storage withdrawal in its 10:30 a.m. EDT release, about in line with industry estimates. May futures were trading at $3.197 to $3.190 before the number came out and after its release made a quick foray lower to $3.141. Moments later, the market bounced back, and at 10:45 a.m. May was trading at $3.214, down 1.7 cents from Wednesday’s settlement.

Prior to the release of the data, Kyle Cooper of ION Energy was looking for a withdrawal of 46 Bcf, and industry consultant Bentek Energy, utilizing its flow model, figured on a pull of 43 Bcf. A Reuters survey of 20 industry cognoscenti revealed a 42 Bcf average with a range of -28 Bcf to -55 Bcf.

During the same week last year 19 Bcf was withdrawn, and the five-year pace stands at a 27 Bcf decline.

Traders were not optimistic Wednesday’s settlement would be exceeded. “If traders can hold the market at $3.18 to $3.19, they will probably close it against this [$3.21] level, but probably not taking out $3.23 to $3.24 area,” said a New York floor trader.

“The 43 Bcf net withdrawal was in line with consensus expectations for a 42-43 Bcf draw but supportive relative to the 27 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “The report was also supportive relative to our model’s 37 Bcf estimate and so does imply either a tighter balance between supply and demand or perhaps just some greater than anticipated carryover of demand from the prior week.”

Randy Ollenberger, an analyst with BMO Capital Markets said, “We believe the storage report will be viewed as neutral. Storage is trending below last year’s levels; however, rising associated gas production should keep U.S. storage levels at or above five-year averages assuming normal weather.”

Inventories now stand at 2,049 Bcf and are 423 Bcf less than last year and 250 Bcf greater than the five-year average. In the East Region 31 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 20 Bcf. Stocks in the Mountain Region were up 4 Bcf, and the Pacific Region was up 4 Bcf as well. The South Central Region was unchanged.

Salt Cavern storage was down 6 Bcf at 289 Bcf and non-salt storage was up 7 Bcf to 644 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |