NGI Data | Markets | NGI All News Access

Physical NatGas, Futures Join In 8-Cent Advance As Optimism On The Rise

Physical gas for Thursday delivery closed higher in Wednesday’s trading in a burst of exuberance aided and abetted by a strong performance from the expiring April contract. All points followed by NGI were in the black by about a nickel to a dime, and NGI’s National Spot Gas Average gained 8 cents to $2.89.

The expiring April futures gained ground as traders noted both fundamental and technical factors pointed higher, a primary ingredient for a market to trend higher. At the close April had added 7.9 cents to $3.175 and May was up by 5.4 cents to $3.231. May crude oil jumped $1.14 to $49.51/bbl.

Traders got a boost of confidence as Wells Fargo Securities LLC raised its natural gas price forecast for 2017, citing increased exports to Mexico and overseas, as well as improving demand, which should outpace “moderate” supply gains.

The revised price forecast for 2017 is set at $3.38/MMBtu from $3.26. However, the price outlook was cut beyond this year to $3.25/MMBtu from a previous forecast of $3.41 in 2018, $3.31 in 2019 and $3.50 long-term.

In the near-term, exports to Mexico, liquefied natural gas (LNG) exports and improving industrial and residential/commercial demand should trump “moderate supply growth and declining power demand growth,” said analyst David Tameron and his team.

The bullish forecast follows one by BofA Merrill Lynch Global Research earlier this month, which kept unchanged its 2017 average from April through December at $3.50/MMBtu, 37 cents above NGI’s Forward Look’s calculated forward curve as of March 20.

In addition the Federal Reserve Bank of Dallas reported that during the first three months of this year energy activity was stronger for the second consecutive quarter.

The business activity index, the broadest measure of conditions facing Eleventh District energy firms, “remained robust at 41.8, similar to last quarter’s 40.1 reading,” according to the quarterly Dallas Fed Energy Survey. “For a second consecutive quarter, nearly all survey measures — including input costs and selling prices — reflected expansion on a quarterly basis. Responses from oilfield services firms were particularly strong.”

Some in the Oil Field Services (OFS) sector see too much too fast.”Too many rigs have gone back to work,” an OFS respondent said. “Capital investment is driving drilling decisions rather than profitability. Price recovery is too fragile and the rig count increase is an illogical response to slightly improved prices. The market has not signaled that such a return to high activity levels is justified; therefore I can easily envision a price slump headed our way and the bottom of that cycle looks increasingly low.”

April futures traded as high as $3.140 in evening trading, a new high from the late-March low of $2.522. Market technicians are focusing on the May contract and see the potential for an advance of as much as another 18 cents.

“With April rolling off the board, our focus shifts to May,” said Brian LaRose, a market technician with United ICAP, in closing comments Tuesday. “Not a whole lot changes. To indicate a short-term top has formed, bears need to take out $3.097-3.081-3.071. At this time the only visible warning sign is bearish RSI divergence on the intraday chart. So as long as May can hold above this band of support, the door remains open for a push to $3.232-3.245-3.258, even $3.315-3.355 from here.”

Fundamental analysts hypothesize a tight market going forward, with lagging production leading to weak storage injections. “With every passing day of production trending under 71 Bcf/d our base case [approximately] 72 Bcf/d summer production expectation looks increasingly risky,” said Breanne Dougherty, an analyst with Societe Generale in New York.

“It would take material demand underperformance to offset any underperformance in production given the near-term structural impact of the latter. We see potential for slight price softening this spring as the market absorbs what we think will be underwhelming power generation data, but remain constructive on the near-term outlook for gas and warn of potential upside price volatility sessions in core demand months.”

Overnight weather data came in slightly more mild. “[Wednesday’s] forecast experiences a small national [heating] gain thanks to some slightly cooler eastern adjustments in the one- to five-day as well as some cooler shifts (essentially weaker warming) for the six- to 10-day in the Midwest to East,” said Matt Rogers, president of Commodity Weather Group in a morning report to clients.

“The West is also slightly cooler overall for the six- to 10-day. Some western cooler changes are also noted in the 11- to 15-day range, while the East edges slightly warmer overall. The main forecast problem appears to be navigating various storm systems through this unsettled pattern. The big picture still features enough Pacific flow to keep the warm prevailing narrative going, but individual storm details occasionally offer some transient cooling risks.”

Several physical market points posted new 30-day highs. Gas delivered to Katy, TX came in at $3.06, above its 30-day high of $3.05, and Transco Zone 1 posted a $3.06, a 2 cents higher than its 30-day high.

Gas at the Nicor delivery point behind the Chicago Citygate changed hands at $3.13 also up a penny from its 30-day high. Columbia Gulf onshore was quoted at $2.99, up from its previous 30-day high of $2.98.

Gas on El Paso Permian rose 8 cents to $2.61, deliveries at Opal were quoted at $2.63, up 6 and gas priced at the SoCal Border Avg. Average gained 9 cents to $2.74.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

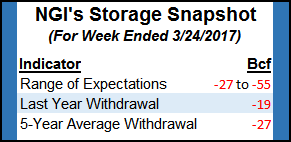

Thursday’s storage figures look to show continued tightening of the market relative to historical norms. Last year 19 Bcf was withdrawn and the five-year average is for a 27 Bcf pull. This week’s numbers are all up around the 40 Bcf mark.

Citi Futures Perspective calculates a 37 Bcf decline and Raymond James is looking for a 32 Bcf withdrawal. A Reuters survey of 20 traders and analysts showed an average 42 Bcf decline with a range of -28 Bcf to -55 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |