Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Transco Files Application For Northeast Supply Enhancement

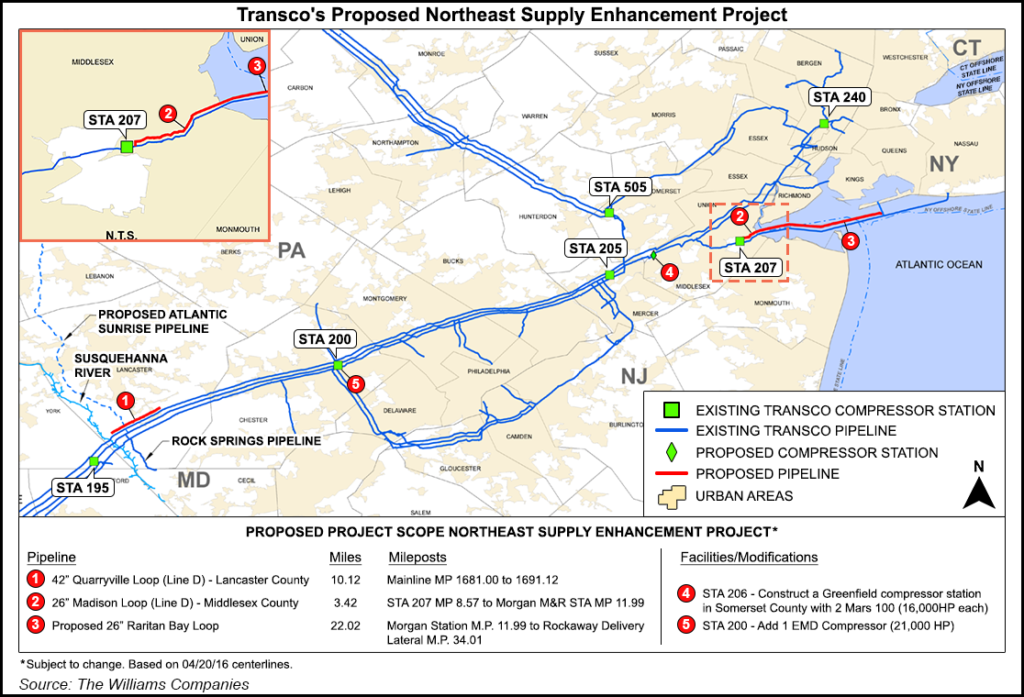

Williams Partners LP said Monday its Transcontinental Gas Pipe Line Co. (Transco) filed an application at FERC for its Northeast Supply Enhancement project.

The project would create 400,000 Dth/d of incremental firm capacity to markets in the northeastern United States for the 2019-2020 winter heating season.

Transco has executed precedent agreements with subsidiaries of National Grid — the largest distributor of natural gas in the northeastern U.S. — for firm service under the project. Once complete, the project will help meet demand in the Northeast, including the 1.8 million customers served by National Grid in Brooklyn, Queens, Staten Island and Long Island.

“This project complements the existing Brooklyn Queens Interconnect/Rockaway Lateral Project, which was completed last spring, and was the first new gas supply delivery point in decades for National Grid customers in this region,” said Ken Daly, president of National Grid New York.

New York’s appetite for natural gas is increasing as consumers continue to phase out the use of heavy fuel oils, Williams Partners adi. In April 2015, New York City Mayor Bill de Blasio announced goals to curb city emissions 80% by 2050, which includes phasing out the use of No. 4 fuel oil by 2030.

“As demand for natural gas increases, the importance of the associated energy infrastructure becomes even more critical,” said Rory Miller, senior vice president of Williams Partners’ Atlantic-Gulf operating area. “The Northeast Supply Enhancement project will add critical infrastructure necessary to meet the region’s growing demand for natural gas while helping reduce air emissions.”

Northeast Supply Enhancement project is expected to consist of about 10 miles of 42-inch diameter pipeline looping facilities, three miles of onshore 26-inch diameter looping facilities, 23 miles of offshore 26-inch diameter looping facilities, the addition of 21,902 hp at an existing compressor station; a new 32,000 hp compressor station; and related appurtenant facilities.

The certificate application reflects an expected capital cost of $926.5 million and a target in-service date of Dec. 1, 2019.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |