Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Fewer Rigs, Wells And Less Spending Show in Ohio’s 4Q Shale Production

The decline in rig counts, less spending and a smaller backlog of drilled but uncompleted (DUC) wells that persisted as 2016 came to an end are thought to be some of the culprits responsible for Ohio’s first sequential shale gas production decline since the state started reporting quarterly three years ago.

While year/year unconventional natural gas production increased 43% in 2016 to 1.4 Tcf from 955.6 Bcf in 2015, the Ohio Department of Natural Resources (ODNR) reported the first quarter/quarter decline since it began collecting that data in 1Q2014, when volumes were just 67.3 Bcf. Unconventional production was 345.2 Bcf in 4Q2016, down from a record of 360.7 Bcf in 3Q2016.

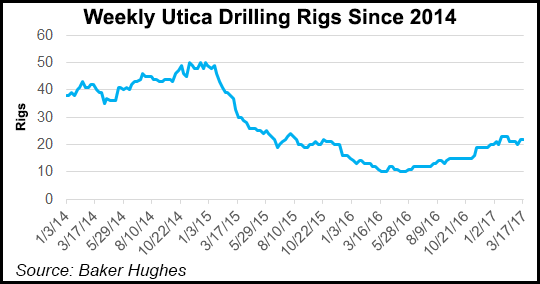

“The big reason is an overall relative lack of drilling in 2015 and 2016,” said NGIDirector of Strategy and Research Pat Rau, who added that it’s “starting to catch up.” Operators have been busy working off their DUC inventories, while takeaway constraints remain a concern as the basin awaits more pipeline infrastructure. Since January 2014, rigs running in the Utica peaked at 50 and bottomed out around 10 in mid-2016, according to calculations by NGIusing Baker Hughes data. The count has climbed since, however, reaching 21 rigs in Ohio at the end of last week.

“It’s the combination of a lot of things; less wells brought online from a declining DUC inventory and less wells were drilled,” said Shawn Bennett, executive vice president of the Ohio Oil and Gas Association. “When you combine those two things, it goes a long way, and it was always going to come. It just took a while. It’s lower capital spending, fewer rigs, fewer permits. It’s the natural ebb and flow of things.

“You’re always a bit lower heading into the fourth quarter too with everything in storage and the winter just starting,” he told NGI’s Shale Daily. “So, hopefully, we’ll see a bump, albeit a small one, but a bump early this year.”

Rau added that low basis differentials and the depressed crude oil prices that weighed on natural gas liquids (NGL) didn’t help either, but he called those “temporary issues.” Some larger Utica operators that have historically played a significant role in the play, such as Chesapeake Energy Corp., have turned their focus to different basins, Rau said. Others such as Hess Corp. are no longer drilling in the Utica, and some, like Antero Resources Corp., are focused on the Marcellus Shale as they wait for projects like the 3.25 Bcf/d Rover pipeline to come online.

Permits have been on the increase this year compared to where they were at the same time in 2016. And fourth quarter natural gas production was up from the year-ago period when ODNR reported 302.4 Bcf.

Unconventional oil production, meanwhile, saw its fourth straight quarterly decline in Ohio, going from about 4 million bbl in 3Q2016 to 3.6 million bbl in 4Q2016. Oil production also fell year/year, going from 23 million bbl in 2015 to 17.9 million bbl last year as low crude prices forced Appalachian operators to focus more intently on their dry gas acreage. Ohio law does not require the separate reporting of NGLs and condensate. Those volumes are included in oil and gas reporting totals.

ODNR’s fourth quarter report lists 1,561 shale wells, of which 1,511 reported production. The average amount of oil produced was 2,392 bbl, while the average amount of natural gas produced was 228.7 MMcf. To date, the state has permitted 2,427 Utica wells and 1,931 have been drilled.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |