Markets | NGI All News Access | NGI The Weekly Gas Market Report

No Luck For NatGas Forwards: Small Storage Draw, Mild Temps Pressure Prices Lower

Natural gas forwards markets slid an average of 11 cents at the front of the curve between March 10 and 16 as the luck of the Irish proved elusive, thanks to a smaller-than-expected storage withdrawal and weather forecasts calling for increasingly mild weather to close out March.

Forward prices were largely in the line with Nymex futures this week, where double-digit declines were seen through the summer, according to NGI’s Forward Look.

[ Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Nymex May futures dropped 11 cents during that time to $2.97, and the balance of summer (May-October) fell 10 cents to $3.08. The winter 2017-2018 strip was down 9 cents to $3.30, while smaller decreases of less than a nickel were seen further out the curve.

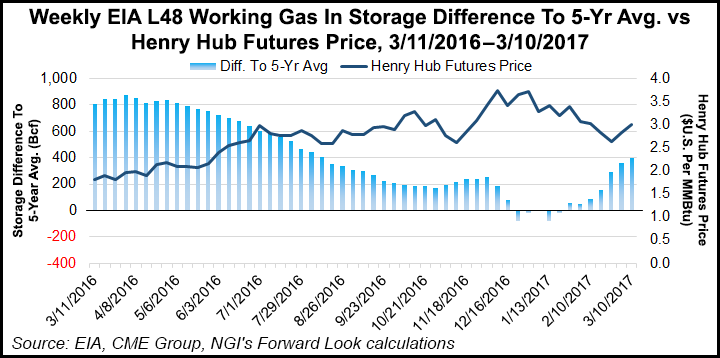

The market weakness occurred as the natural gas storage surplus over the five-year average swelled to nearly +400 Bcf following a smaller-than-expected storage report. The U.S. Energy Information Administration (EIA) on Thursday reported a 53 Bcf pull from inventories for the week ending March 10, slightly below industry expectations. At 2,242 Bcf, stocks are now 236 Bcf below year-ago levels but 395 Bcf above the five-year average.

“Following a slight bearish miss in EIA data yesterday, we are seeing prices struggle to rally much today despite expectations that a massive drawdown will be announced next Thursday,” forecasters with Bespoke Weather Services said Friday morning.

While Nymex April futures indeed traded nearly flat early Friday morning, the prompt-month had risen about five cents by midday to $2.95. The April contract ultimately settled 4.6 cents higher than Thursday’s regular session at $2.948.

Mother Nature threw the gas market a bone this week as a Nor’easter dumped several feet of snow across the Northeast and Mid-Atlantic. While the storm turned out to be smaller than expected, industry watchers still expect the storm to leave quite an impressive mark on storage.

Forecasters at NatGasWeather expect next week’s storage draw for the week ending March 17 to be greater than -140 Bcf, much larger than the five-year average of -21 Bcf, thereby dropping current surpluses of +395 Bcf to back under +270 Bcf. And Houston-based Mobius Risk Group said early indications for that report suggest a withdrawal near 150 Bcf could be reported.

“This would lead to a substantial reduction of the surplus to five-year average levels, and a material widening of the deficit versus last year,” Mobius said Thursday. The company added, however, that this bullish data point is being countered by moderating temperature expectations for the balance of the month, as well as steadily increasing dry gas production across multiple Lower 48 supply basins.

Indeed, while a cold weather system was once again expected to hit the Northeast Tuesday and Wednesday, it is latein the week and beyond where the pattern transitions to a more seasonal one as weather systems track across the country from west to east, but without much cold air associated with them. In fact, many areas are expected to see mild springlike conditions in between where highs will reach the 60s to 80s, locally 90s, NatGasWeather said.

“Timing wise, there’s likely to be a pronounced milder period over the eastern U.S. March 25-28, resulting in light national demand and where the weather data is milder compared to earlier in the week. However, cooler systems are favored the last few days of the month, arriving first of over the West,” the forecaster said.

Even with the milder weather on tap for much of the rest of the month, the forecaster expects the following couple storage draws after the next much larger pull will likely further reduce surpluses toward +200 Bcf.

How natural gas demand in April compares to the five-year average will be very important since if the background state remains tight, it should still decrease surpluses in supplies even though HDDs [heating degree days] would be near or slightly below normal, NatGasWeather said. “If true, this would be expected to decrease surpluses toward normal prior to the arrival of summer heat,” it said.

Bespoke, meanwhile, said that while weather conditions over the next couple of weeks are likely to keep March heating demand slightly below average, weather should not be seen so much as a bearish catalyst, but rather as limiting upside as the market tries to determine just how tight it is heading into the shoulder season.

To that end, it appears production is on the upswing after remaining rather dormant for several weeks. Production on Wednesday reached 71.7 Bcf/d, bringing the rolling 30-day average to 71.58 Bcf/d, about 0.91 Bcf/d below last year’s average for the same 30-day period, according to data and analytics company Genscape Inc.

The rolling 30-day average for production has shown a consistent year-on-year deficit since April 2016, averaging about 1.4 Bcf/d lower since then, including several days in excess of 3 Bcf/d back in mid-October, the Louisville, KY-based company said.

“As long as production doesn’t significantly increase in the weeks and months ahead, we expect [storage] surpluses to gradually decrease further throughout the spring shoulder season prior to the arrival of summer heat,” NatGasWeather said.

Looking more closely at the gas markets, natural gas forward prices at New England’s Algonquin Gas Transmission citygates moved against the pack as the pipeline on Tuesday released its summer maintenance schedule that included a major outage that is expected to run throughout the season.

In a notice on its website, Algonquin said it will be experiencing a planned outage between Southeast and Oxford compressor stations beginning in May and lasting through the first half of October. The planned maintenance is expected to reduce throughput at those stations to their lowest levels in June and July, but additional reductions will take place throughout the summer.

As such, AGT-CG April forwards fell 2.4 cents between March 10 and 16 to reach $3.03, compared to the 11-cent average decline seen in the rest of the country. AGT-CG May jumped 18 cents to $2.77, and the the balance of summer (May-October) shot up 23 cents to $2.94.

AGT-CG forward prices also appeared to reflect news that Algonquin was delaying its target in-service date for the Atlantic Bridge Project to sometime in 2018. The original in-service date was November 2017.

Work on the project will begin this year in Connecticut, which AGT says can provide up to 40 MMcf/d of incremental capacity: 34 MMcf/d from the AGT receipt point with Millennium at Ramapo and 6 MMcf/d from Iroquois at Brookfield. Genscape’s Infrastructure Intelligence Team has revised its estimate for the entirety of the 132 MMcf/d of new capacity from the project to become available in June 2018.

The AGT-CG winter 2017-2018 strip slid 1 cent to $6.565, compared to a 9-cent national average decline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |