Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Nexus Eager to Get FERC Order as Competition Advances

The Nexus Gas Transmission pipeline was a notable omission when FERC pushed out a series of last-minute certificate orders approving natural gas pipelines before losing its quorum last month.

Now the Marcellus/Utica-to-Midwest project will have to wait on a decision from the Federal Energy Regulatory Commission as the competition moves forward, including Energy Transfer’s Rover Pipeline — now cleared to start construction — and efforts by TransCanada Corp. to entice Western Canadian producers to ship gas eastward on its Mainline from Alberta to Ontario and Quebec.

That Nexus has to wait on a certificate order from the currently quorumless FERC creates additional risk of a delay from its target start-up in November.

But Nexus may also have more questions to answer as it pushes for FERC — once the Commission gets back to business — to make a determination of market need. Regulatory filings indicate Nexus, a demand-pull project backed by Detroit-based DTE Energy and Enbridge Inc., has signed precedent agreements for around 59% of its proposed 1.5 Bcf/d of capacity.

Gas-on-Gas Competition

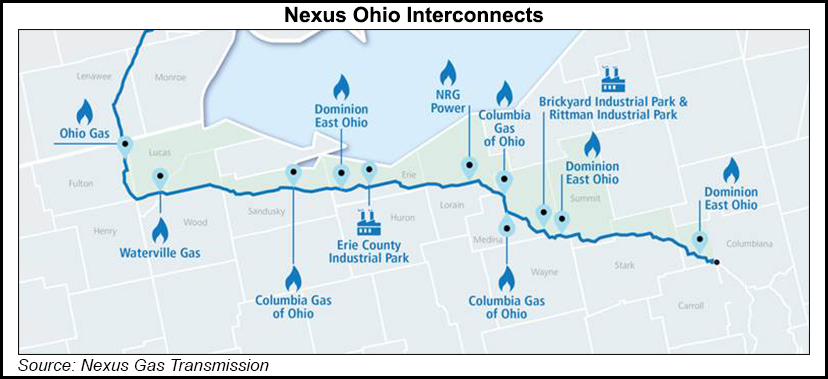

According to its certificate application, Nexus has secured agreements with Union Gas Limited, DTE Gas Co., DTE Electric Co., CNX Gas Co. LLC, Noble Energy Inc. and Chesapeake Energy Marketing Inc. Nexus later added a 50,000 Dth/d commitment from Columbia Gas of Ohio Inc.

In its certificate application, Nexus proposed a number of tee-tap connections that would serve projected demand for the project based on “discussions with a number of potential shippers and end-users in Ohio and Michigan.”

In its final environmental impact statement (FEIS) for the project, FERC wrote that “because Nexus has contractual commitments with customers, we disagree with the commenters who suggest that a market does not exist at the receipt and delivery points proposed by Nexus. However, for the purpose of our analysis we recognize the difference between definitive receipt and delivery points based on binding precedent agreements and speculative receipt and delivery points based on the potential for future customers.”

Nexus would follow a market path similar to that of the 3.25 Bcf/d Rover, which has signed commitments from producers for about 95% of its capacity.

Both projects aim to carry Marcellus and Utica shale gas produced in Ohio, Pennsylvania and West Virginia westward into Michigan, providing access to Midwest markets and to the Dawn Hub in Ontario, Canada.

Nexus, having received its FEIS in late November, was among several large natural gas infrastructure projects ripe for a certificate order from FERC in the lead-up to former Chairman Norman Bay’s Feb. 3 departure. While Rover, Transcontinental Gas Pipe Line Co.’s Atlantic Sunrise and National Fuel Gas Co.’s Northern Access expansion all received orders, Nexus got left behind.

“We really thought that we would” get an order before FERC lost its quorum, DTE CEO Gerard Anderson told analysts during a 4Q2016 conference call last month. “What we’ve learned is the FERC worked through the queue that they had sequentially by filing date, and they simply ran out of time on Friday at midnight before addressing Nexus.”

Despite the setback, he said the project has “a variety of construction scenarios” that would result in a 4Q2017 start-up for Nexus.

“The typical timeframe for confirming a new FERC Commissioner is about two to three months, but we’d like to think” the lack of a quorum “will result in the process moving along more quickly than that,” he said.

The Trump administration is reportedly poised to announce new FERC nominees, no doubt giving hope for projects like Nexus that the quorum will soon be restored.

The projected residential/commercial demand growth for the market areas targeted by projects such as Nexus and Rover doesn’t support all of the additional pipeline capacity planned for the region, according to BTU Analytics analyst Marissa Anderson.

Looking at all of the proposed takeaway capacity from Southwest Pennsylvania, West Virginia and Ohio “from a total U.S. demand standpoint, we don’t necessarily need all this production to fill all this pipe capacity,” she said. “We’re looking at essentially an overbuild and what could be open pipe in that region over the next few years as all these projects really come to fruition.”

BTU’s demand projections show “the U.S. being more demand-constrained and not necessarily needing to fill all these pipes,” she added.

Anderson noted that not all of Rover’s proposed capacity is destined for Michigan or the Dawn Hub and thus may not all be in direct competition with Nexus. But the “finite demand in that region” still points to a risk for “gas-on-gas type competition,” with Canadian producers also in the mix, she said.

Pushback From Michigan Regulators

Meanwhile, Nexus has encountered pushback in Michigan, where DTE has been working to secure support from utility regulators for its commitments to the project.

Last year, a Michigan administrative law judge (ALJ) characterized DTE’s commitments to the pipeline as “an affiliate transaction” and called for the arrangement to “be closely examined.”

“What does appear quite clear is that [DTE Energy affiliate] DTE Gas never seriously considered any other options for acquisition of the 75,000 Dth/d transportation capacity” it signed up for on Nexus, the ALJ wrote. “…it is clear that when DTE Gas was working out the details of” its agreement with Nexus, “other avenues for the transport of Appalachian gas, some quite possibly less expensive than Nexus, were available and today still more are available.

“Because of this, it is incumbent upon DTE Gas to establish that approval of this contractual arrangement is in its customers’ best interest.”

ANR Pipeline Co. has also argued against the DTE Gas contract on Nexus, telling the Michigan Public Service Commission (PSC) that the utility didn’t adequately consider alternatives, including Rover.

Counsel for ANR wrote that DTE Gas’s commitment to Nexus should be denied because the utility “did not seriously consider competing greenfield projects because it believed it was already committed to its parent’s sponsored project.” DTE did not “engage in meaningful negotiations for service on these alternatives,” according to ANR.

Representatives for DTE Gas have testified that a number of the alternatives raised by opponents were not available at the time it committed to Nexus.

In a cost-recovery case for DTE Electric, another DTE affiliate, the Michigan PSC concluded in January that “costs associated with Nexus should not be recoverable absent a transparent evidentiary presentation examining the full nature of the Nexus arrangements,” citing concerns raised by ANR and others.

Nexus Committed to 4Q2017 Start Date

Nexus spokesman Adam Parker told NGIvia email that “NEXUS continues to negotiate with other customers along the route and will provide access to new customers even after the project is placed into service.

“Our shippers are committed to the NEXUS project. The pipe is located in an area with some of the best reserves in North America and the path provides an opportunity to secure long-term capacity from LDCs [local distribution companies] and industrial load centers along this path,” he added.

“NEXUS believes the record supporting the FEIS and application are complete and ready for prompt FERC approval. Pending timely issuance of FERC’s certificate authority, we remain committed to placing the project in service in 4Q2017, and are working with our contractors to ensure a safe and responsible construction plan is in place to achieve it.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |