Markets | NGI All News Access | NGI Data

NatGas Cash Higher on Cooler Temps, Hardly A Turnaround; April Adds 8 Cents

Physical natural gas traders for Thursday deliveries had to look no further than their local weather forecasts Wednesday to ascertain the necessity of incremental purchases. Forecasts from New England to the Midwest called for blustery, windy, and cool conditions heading toward the weekend and not a single point followed by NGI traded lower.

The NGI National Spot Gas Average rose a stout 15 cents to $2.66, and although gains were most pronounced in the East, major market centers also put in healthy advances. Futures managed to trade higher as traders looked to weather models calling for cooler conditions.

At the close, March had added 7.7 cents to $2.901, and May was up 6.0 cents to $2.981. April crude oil took a nosedive, down $2.86 to $50.28/bbl.

Weather forecasts at major trading hubs called for a trend of cooling temperatures along with near-term windy conditions. AccuWeather.com forecast that Boston’s high of 57 degrees on Wednesday would drop to 49 Thursday and hit 39 by Friday, 4 degrees below normal.

Gas at the Algonquin Citygate jumped 63 cents to $2.98, and gas at Iroquois, Waddington rose 16 cents to $3.06. Deliveries to Tennessee Zone 6 200 L added 63 cents to $3.07 as well.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

The National Weather Service (NWS) said Boston Thursday would be mostly sunny but cooler with highs in the mid 40s. West winds 15 to 20 mph with gusts up to 40 mph could be expected. Thursday evening was seen partly cloudy in the evening…”then mostly cloudy with a chance of snow after midnight. Lows around 30. West winds 10-15 mph with gusts up to 30 mph…becoming northwest around 5 mph after midnight. The chance of snow was put at 40%.”

In the Midwest, Chicago’s high of 52 Wednesday was forecast to fall to 42 Thursday and then to 34 by Friday, 10 degrees below normal.

Gas at the Chicago Citygate rose a dime to $2.80, and gas at the Henry Hub changed hands at $2.69, up 11 cents. Deliveries to Panhandle Eastern were quoted 12 cents higher at $2.54, and gas on Kern Receipt gained 13 cents to $2.53. Packages at the PG&E Citygate added 9 cents to $3.15.

NWS said Chicago on Thursday should be mostly cloudy, with highs in the lower 40s inland and in the upper 30s near the lake. Northeast winds were predicted to be 10-15 mph. By evening, it was still expected to be mostly cloudy then clearing, with lows in the lower 20s and north winds 5-10 mph. After midnight, winds were expected to switch to the northwest and increase to 10-20 mph after midnight. Near the lake, gusts of up to 30 mph were expected after midnight.

Traders seem circumspect with a slight bias higher.

“$2.81 seems like solid support and we seem to be holding,” said a trader with Rafferty Technical Services. “If we can take out $2.952, then we could be off to the races. It looks like an uptrend began in late February with a low of $2.641 and now we just have to take out $2.952.

“It looks like it could run a little bit. My next resistance is $3.09 to $3.10,” the trader said.

“We got a little pop, but it is still within our weekly range,” said a trader with FCStone Latin America in Miami. “We are still within the weekly initial balance and the market could go either way. We do have targets both to the upside and downside which adds to the volatility.

“Word on the street is that we will have colder temperatures in the Northeast and Midwest, and if that happens funds could come in and extract some value out of this perhaps buying a little bit and then selling.”

Tuesday overnight, longer term weather models flipped to a colder pattern for next week in key eastern markets. Weather models introduced a significant cold system for next week.

“A potential weekend winter system for the southern Midwest to Middle Atlantic has essentially gone away, but a new storm that takes aim more toward the Northeast early to middle next week seems to get much stronger on the latest models, which helps to amplify a bigger cold upper level trough over the Eastern U.S. for a longer period of time next week,” said Commodity Weather Group President Matt Rogers in a Wednesday morning forecast to clients.

“This leads to bigger colder changes in the six- to 10-day (Monday-Friday) for the Midwest and East as well as some colder changes into the Deep South as the West ticks a bit warmer.”

Followers of Elliott Wave and Retracement see bears on the defensive.

“Seasonally, this is the time of year where are actively searching for evidence of bottoming action,” said United ICAP market technician Brian LaRose in closing comments Tuesday. “At present, there is not enough evidence to suggest $2.641 marked the end of an ABC pattern down from the $3.994 high. So fresh lows are still possible from here. However, I would emphasize that the current wave count suggests any fresh lows are likely to be marginal. Bears take note.”

The Energy Information Administration (EIA) acknowledged what every market bear has known for some time in its latest Short Term Energy Outlook issued Tuesday. The Henry Hub 2017 spot price was cut to $3.03/MMBtu from $3.43 a month ago, and 2018 was revised down to $3.45 from $3.70. EIA said, however, that new natural gas export capabilities and growing domestic natural gas consumption were expected to drive the higher prices in 2018.

Weather dominates everything, even lower production and supply.

“U.S. dry gas production was 2.73 Bcf/d lower than a year earlier, net pipeline imports were 1.30 Bcf per day lower than last year, and net LNG exports were 1.74 Bcf per day more than a year ago,” said Tim Evans of Citi Futures Perspective in a note to clients.

“On a combined basis that was 5.81 Bcf/d less supply. However, demand of 83.95 Bcf/d was 7.72 Bcf/d lower than last year, outpacing the decline in supply and allowing the storage surplus to rebuild.”

Thursday’s EIA storage report should give traders more insight into the declines in both supply and demand.

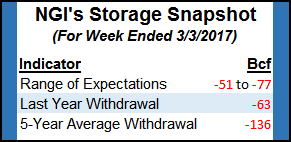

Early estimates of the week’s storage withdrawal came in about 56 Bcf but since then have risen. The Desk Early View composed of a survey of 9 traders saw an average of 56 Bcf with a range of -50 Bcf to – 69 Bcf. Last year 63 Bcf were pulled and the five-year pace stands at -136 Bcf.

A Reuters survey of 18 traders and analysts Wednesday showed an average 61 Bcf withdrawal with a range of -51 Bcf to -77 Bcf. Ritterbusch and Associates calculates a pull of 54 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |