E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Shales Have Built Big Hurdle For Canada’s Oil/NatGas Exports

Strong U.S. shale production will create stiff competition for Canadian exporters of oil as well as natural gas and liquid byproducts from Alberta and British Columbia, the Canadian petroleum capital of Calgary heard Monday.

A sobering outlook for an escalating international rivalry surfaced at an annual state of markets conference held by the Canadian Energy Research Institute (CERI), a semi-official industry voice supported by industry, government and academic agencies.

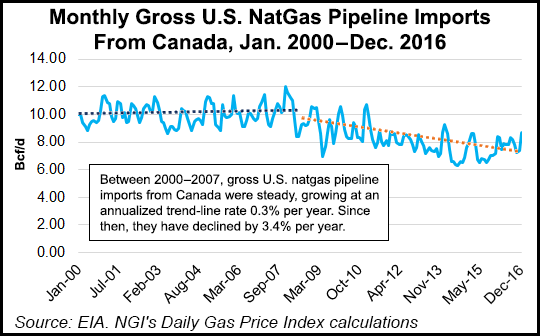

Canadian gas sales in the United States are sliding to 2 Bcf/d in five years as domestic U.S. production of low-cost shale supplies shrinks former reliance on imports, said CERI President Allan Fogwill.

Even that latest bleak CERI forecast — an 80% drop since pipeline deliveries to the U.S. peaked at 10 Bcf/d a decade ago — is more optimistic than the current National Energy Board (NEB) projection of a collapse to zero, added Fogwill.

No Canadian or U.S. energy economists predicted comparable erosion of Canadian oil exports after the NEB reported U.S. sales, chiefly from Alberta’s oilsands, rose to a record of 3.4 million b/d in second-half 2016.

But Canadian projections calling for yet more stellar growth of exports to the U.S. — by one million b/d, to the Gulf of Mexico refining region via new pipeline capacity — were rated as wishful thinking by still-growing northern bitumen projects.

U.S. demand for additional heavy oil is likely 300,000 to 400,000 b/d, said Sarah Emerson, president of Massachusetts-based Energy Security Analysis Inc. and managing principal of ESAI Energy Inc.

U.S. refineries had product surpluses of 700,000-750,000 b/d in 2014 and 2015, and their need for more crude will stay restrained because they are only draining part of the glut by pumping out 100,000-300,000 b/d less than they sell in 2016 and 2017, Emerson said.

U.S. shale production will revive briskly from the 2015-2016 international price lows as oil recovers into the US$55/bbl area, Emerson added. She described predictions of a one million b/d comeback as bullish but said a 600,000-650,000 b/d increase this year alone looks likely.

From a Canadian perspective the strength of U.S. shale production with horizontal drilling and hydraulic fracturing is especially powerful on export markets for liquefied natural gas (LNG), the well-attended CERI session heard.

“The Americans have very significant advantages in this game,” said Geoffrey Cann, an oil and gas partner in Deloitte Canada whose professional pedigree includes four years of work in the Australian LNG development boom.

Cann estimated that U.S. export programs, tapping readily accessible gas resources and using well-established infrastructure, cost about US$600-700 per ton of LNG capacity.

Australian projects, launched when oil was US$100/bbl and LNG was valued at matching highs by energy index contracts, run to US$3,500 per ton, Cann said. The new Australian export networks need gas prices of US$16-18 for 20 years to break even, he added.

The shaky Australian schemes “look exactly like Canada’s projects,” especially the dozen biggest proposals on BC’s Pacific coast in a 30-entry LNG export project lineup that on paper calls for investment of C$160 billion (US$120 billion), Cann said.

As in Australia the Canadian plans require starting from scratch by tapping undeveloped remote resources, building long new pipelines and constructing mammoth refrigeration, storage and tanker loading complexes on new industrial sites, Cann said.

“How are we going to deliver these [Canadian] projects at half the cost in Australia? I don’t have an answer for that,” he said.

Competition is also liable to be keen for international sales of natural gas liquid byproducts led by propane and butane, said Bill Rawlusyk, IHS Markit senior director of midstream oil and NGL.

U.S. shale producers are headed toward gas-liquids exports of one million b/d by 2020 and 1.3 million b/d as of 2025, Rawlusyk said. He added that although Asian demand is poised to grow, the burst of new supplies has cut prices to less than US$400 per ton from nearly US$1,000 since 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |