Markets | NGI All News Access | NGI Data

Eastern NatGas Cash Jumps; Futures Weather Historic February Storage Build as April Adds A Penny

The physical natural gas market Thursday was a tale of the East and everyone else, as forecasts for steep dives in temperatures at the end of the week along the Eastern Seaboard prompted robust advances.

At the same time, Midwest market centers, along with producing zones, saw quotes slip by a few pennies. Most physical traders scurried to get their deals done before the Energy Information Administration (EIA) storage report. When the smoke had cleared, the NGI National Spot Gas Average had risen 4 cents to $2.56.

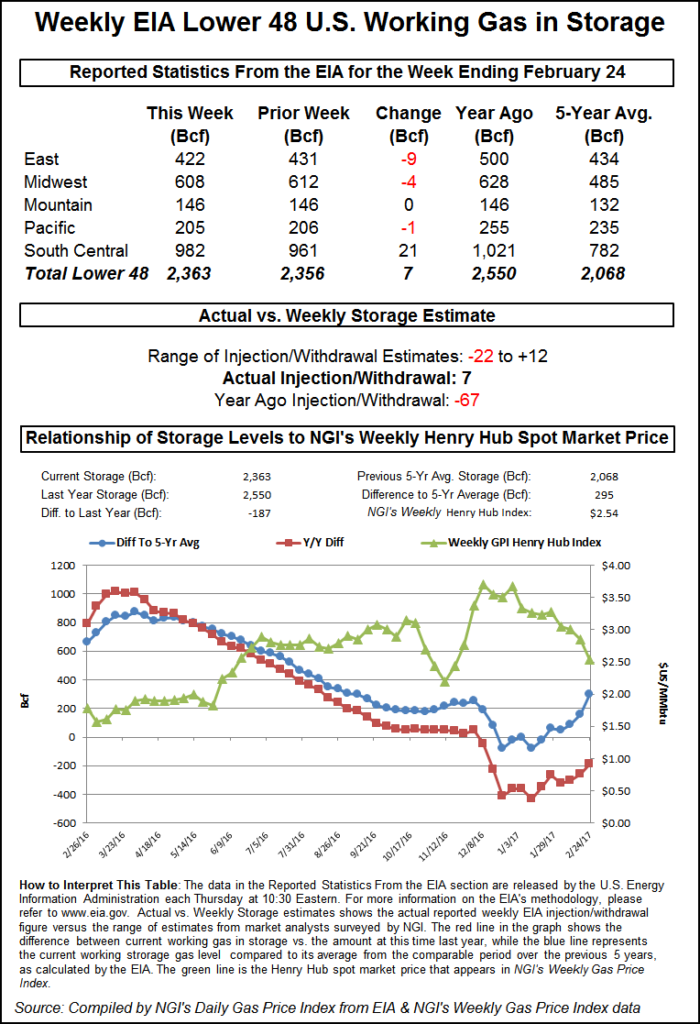

EIA reported a historic February storage build of 7 Bcf for the week ending Feb. 24, about 11 Bcf greater than the consensus, and although prices dropped initially, futures managed to creep into positive territory. At the close April had risen five-tenths of a cent to $2.804, and May had followed suit with a similar gain to $2.914. April crude oil plunged $1.22 to $52.61/bbl.

Immediately following the 10:30 a.m. EST release of fresh storage data, April futures fell to $2.730, and by 10:45 a.m. April was trading at $2.763, down 3.6 cents from Wednesday’s settlement.

According to EIA data, the only other time there was an injection in the months of December, January or February since 2010 was for the week ending Dec. 7, 2012, which saw an injection of 2 Bcf.

“Everybody was thinking -4 Bcf to -6 Bcf, and traders took it down and brought it right back,” a New York floor trader told NGI. “That seems to be the case most of the time. We see whether the number is off the mark, and then after 15 to 20 minutes it comes right back to where it was.”

“The 7 Bcf build in storage for last week was at the bearish end of the range of expectations and reportedly a first for February,” said Tim Evans of Citi Futures Perspective. “This was a bearish surprise that also points to some weakening in the overall supply-demand balance that may have implications for the reports to follow.”

Others see more bullish implications. “We believe the storage report will be viewed as slightly negative,” said Randy Ollenberger of BMO Capital Markets. “However, storage is trending close to five-year average levels, and we believe that U.S. working gas in storage could trend toward five-year lows by the end of the 2017 summer injection season, assuming normal weather.”

Heading into the report, Kyle Cooper of IAF Advisors estimated a 2 Bcf build, and ICAP Energy was expecting a withdrawal of 4 Bcf. A Reuters survey of 24 industry traders and analysts revealed an average 4 Bcf withdrawal with a range of +12 Bcf to -22 Bcf.

Inventories now stand at 2,363 Bcf and are 187 Bcf less than last year and 295 Bcf greater than the five-year average. In the East Region 9 Bcf was withdrawn and the Midwest Region saw inventories decrease by just 4 Bcf. Stocks in the Mountain Region were unchanged, and the Pacific Region down by 1 Bcf. The South Central Region grew by 21 Bcf.

Last year 67 Bcf was withdrawn and the five-year pace is for a 132 Bcf pull.

In physical market trading, Northeast gains squared off against losses of a few pennies at nearly every other market point in the country as two-day temperature drops of 40 degrees or more brought buyers off the bench. Wunderground.com forecast that Boston’s Thursday high of 62 would plunge to 33 by Friday and hit 19 on Saturday, 23 degrees below normal. New York City’s Thursday high of 64 was expected to drop to 38 Friday before landing at 27 Saturday, 18 degrees below normal. Philadelphia’s 62 max Thursday was forecast to drop to 41 Friday and 34 on Saturday, 14 degrees less than its seasonal norm.

Gas at the Algonquin Citygate surged $1.04 to $4.28, and deliveries to Iroquois, Waddington gained 41 cents to $3.40. Packages priced on Tenn Zone 6 200L also added $1.02 to $4.21.

Texas Eastern M-3, Delivery added 14 cents to $2.47, and gas headed to New York City on Transco Zone 6 gained 29 cents to $2.65.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

The National Weather Service in suburban Philadelphia said “deep low pressure over the Canadian Maritimes will continue to move away to the Northeast while cold high pressure builds over the area from the northwest through this weekend. Meanwhile, however, a weak disturbance will bring a chance for light rain or snow on Friday. The high pressure will move off the East Coast by Monday resulting in mild southwest winds but also a chance for rain. A cold front is expected to cross the area around midweek, followed by a return to cooler but dry weather.”

Other market centers couldn’t make it to the positive side of the trading ledger. Gas at the Chicago Citygate shed 3 cents to $2.65 and deliveries to the Henry Hub fell a penny to $2.59. Gas at the NGPL Midcontinent Pool gave up 3 cents to $2.39, and packages on Kern Delivery were quoted 4 cents lower at $2.49. Gas priced at the PG&E Citygate changed hands 4 cents lower at $3.03.

Overnight weather models trended slightly cooler. “Two things added together this morning to contribute to a slight heating degree day demand increase this morning,” said Matt Rogers, president of Commodity Weather Group, in a Thursday morning report to clients. “The one- to five-day has trended colder for the Midwest, East, and South with this cool to cold push into the weekend and lingering longer for the East Coast (slower warming) toward the end of the range. Also, the European has slid back some on the 11- to 15-day with less impressive warming overall, even though it does favor a general warm-dominated pattern look still for the Midwest, East and South.”

Tim Evans of Citi Futures Perspective saw Wednesday’s modest gain as reflecting a slightly cooler 11- to 15-day outlook and “There may have also been some book squaring ahead of [the] DOE storage report, although consensus expectations for a minimal 2-4 Bcf in net withdrawals are so far below the 132 Bcf five-year average that even a somewhat larger-than-expected draw for last week would still rate as clearly bearish on a seasonally adjusted basis.”

Further weak storage draws are likely next week as well. The National Weather Service (NWS) continues to forecast well below normal heating load. For the week ending March 4, NWS predicts that New England will have 177 heating degree days (HDD), or 56 fewer than normal, and the Mid-Atlantic states of New York, New Jersey and Pennsylvania are expected to have 169 HDDs, or 50 fewer than average. The greater Midwest from Ohio to Wisconsin is expected to see 180 HDDs, or 53 short of its normal seasonal tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |