Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Antero Positioning to Take Advantage of Improving NGL Price Outlook

Antero Resources Corp. is guiding for continued improvements in natural gas liquids (NGL) pricing in 2017, and its acreage holdings and infrastructure position mean the company is ready to take advantage, management told analysts.

Discussing 4Q2016 results on a conference call Wednesday, the Denver-based, Appalachian-focused producer said it has raised its expectations for 2017 Mont Belvieu, TX, NGL pricing to 50-55% of West Texas Intermediate (WTI), up from 45-50%.

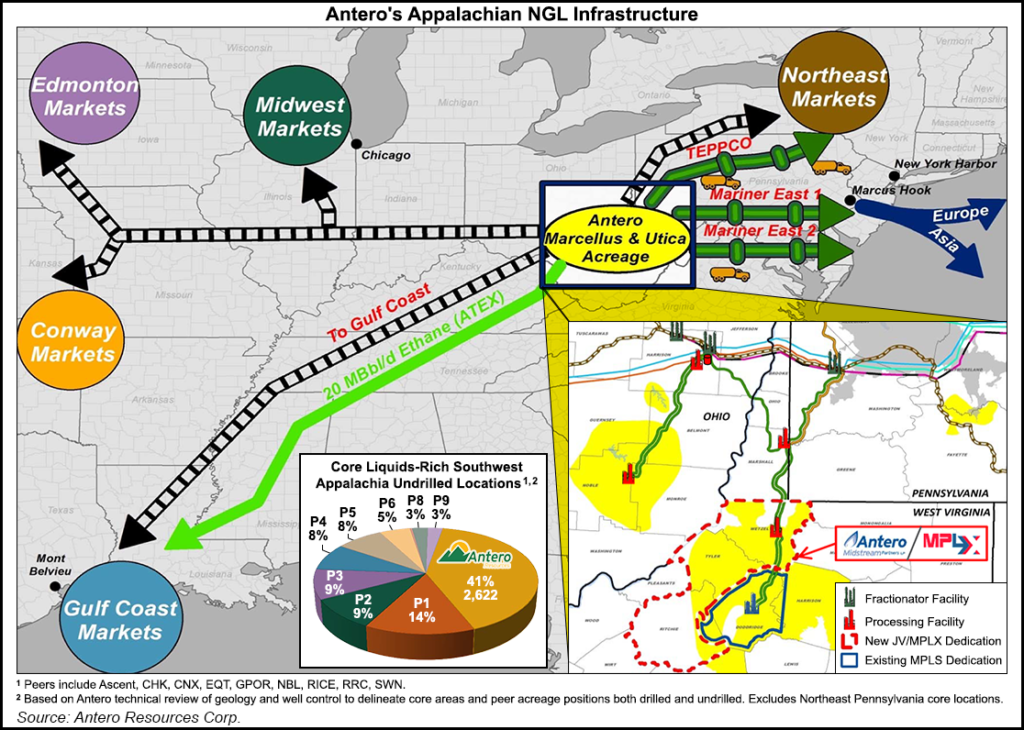

Antero’s 59%-owned affiliate Antero Midstream Partners LP recently announced plans to invest up to $800 million through 2020 in a joint venture (JV) with MPLX LP subsidiary MarkWest Energy Partners LP to develop NGL infrastructure in the Appalachian Basin.

The exploration and production company has also committed 61,500 b/d to Sunoco Logistics Partners LP’s Mariner East 2 pipeline. Sunoco recently secured approval from the Pennsylvania Department of Environmental Protection to begin construction on the NGL pipeline.

“Based on our detailed technical analysis, Antero hosts 41% of the undrilled core liquids-rich locations in Appalachia,” CFO Glen Warren said. “This provides us tremendous leverage and visibility when it comes to the NGL infrastructure buildout in the play…Our acreage position is well connected to significant NGL processing, fractionation and key long-haul transportation projects that move our product to market.”

The JV with MarkWest “provides us with tremendous clarity and certainty around the next 11 Antero-dedicated processing plants, or 2.2 Bcf/d of processing capacity in the Marcellus,” he said.

Warren said the 2017 guidance for Mont Belvieu pricing does not account for further improvements anticipated once Mariner East 2 comes online, currently scheduled for 3Q2017.

With Mariner East 2 in service, he said the E&P projects C3+ NGL price realizations of 55-60% of WTI in 2018. The projections are based on current strip pricing and do not assume “any incremental upside from an improvement in oil prices” affecting NGLs, he said.

On the natural gas side, Antero continues to pursue a strategy built around hedging and firm transportation commitments.

“We believe our firm transport and hedge book will continue to be competitive advantages for Antero, as uncertainty around both Northeast basis differentials and overall gas pricing is likely to continue,” Warren said. In 2017 and 2018, “we are 100% hedged on our expected gas production at very high levels, $3.63/Mcf for 2017 and $3.91/Mcf for 2018.”

With the Federal Energy Regulatory Commission approving the 3.25 Bcf/d Rover Pipeline last month, Antero now has more clarity on when its 800 MMcf/d capacity commitment to the project will become available.

CEO Paul Rady was asked about whether the E&P might be more active in the dry gas window of the Utica Shale in anticipation of Rover going into service later this year.

The expected date for service to Defiance, OH, “is July, and so we’re prepared to begin selling it as soon as it opens,” Rady said. “We might risk that a little bit, or at least we’re prepared if it opens later, but we expect it to be there in July.

“We have a pretty good split between the Utica dry gas and the Marcellus rich. At the current time, the Marcellus rich gas does have better economics than the Utica dry, but we’re making great progress on that Utica dry, really getting the well costs down there. We’ll be juggling back and forth, our capex [capital expenditure] budget, between the plays,” he added.

Antero moved toward higher proppant loads in 2016 as it reduced well costs by 30% year/year in the fourth quarter based on operational improvements and reduced service costs, Rady said.

“The key operational shift during 2016 was to increase proppant and water used per foot in each completion,” he said. “In the Marcellus, we increased proppant and water per foot from approximately 1,200 pounds and 33 barrels in 2015 to 1,500 pounds in early-to-mid 2016 and then to 2,000 pounds and 46 barrels in the fourth quarter.”

With the increase to 1,500 pounds/foot, Antero saw its estimated ultimate recovery (EUR) per 1,000 feet of lateral in the Marcellus increase 24% to 2.4 Bcfe, assuming ethane rejection, Rady said.

Management highlighted a recent 10-well Marcellus pad completed in the rich-gas area of West Virginia. The wells were drilled with average laterals of 10,500 and were completed with 1,750 pounds/foot. The combined 30-day production rate for the pad totaled 200 MMcfe/d, with 7,800 b/d of C3+ NGLs and 2,300 b/d of oil. The cost per well totaled $7.9 million for an all-in development cost of $0.36/Mcfe, the company said.

For the quarter, Antero produced a combined 1,990 MMcfe/d, up 33% from 1,497 MMcfe/d in the year-ago period. Antero’s 4Q2016 production totals included 135 Bcf of gas, 1,933,000 bbl of C2 ethane, 5,557,000 bbl of C3+ NGLs and 500,000 bbl of oil.

The producer completed and placed online 33 horizontal Marcellus wells during the fourth quarter with average laterals of 9,900 feet. In the Utica, the operator completed and placed online 10 wells with laterals averaging 8,600 feet.

Antero realized a combined price of $4.26/Mcfe for the fourth quarter after hedges, including $4.43/Mcf for gas, $9.36/bbl for C2 ethane, $25.60/bbl for C3+ NGLs and $39.18/bbl for oil.

Antero posted a net loss for the fourth quarter of $485.7 million (minus $1.55/share) including $829 million of unrealized hedge losses, versus year-ago net income of $158 million (57 cents/share).

For full-year 2016, Antero reported a net loss of $849 million (minus $2.88/share) including $1.5 billion of unrealized hedge losses, compared with a net income of $941 million ($3.43/share) in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |