Markets | NGI All News Access | NGI Data

Bulls Welcome Supportive EIA Natural Gas Storage Stats; March Adds 6 Cents

Natural gas futures stayed within opening ranges Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what the market was expecting.

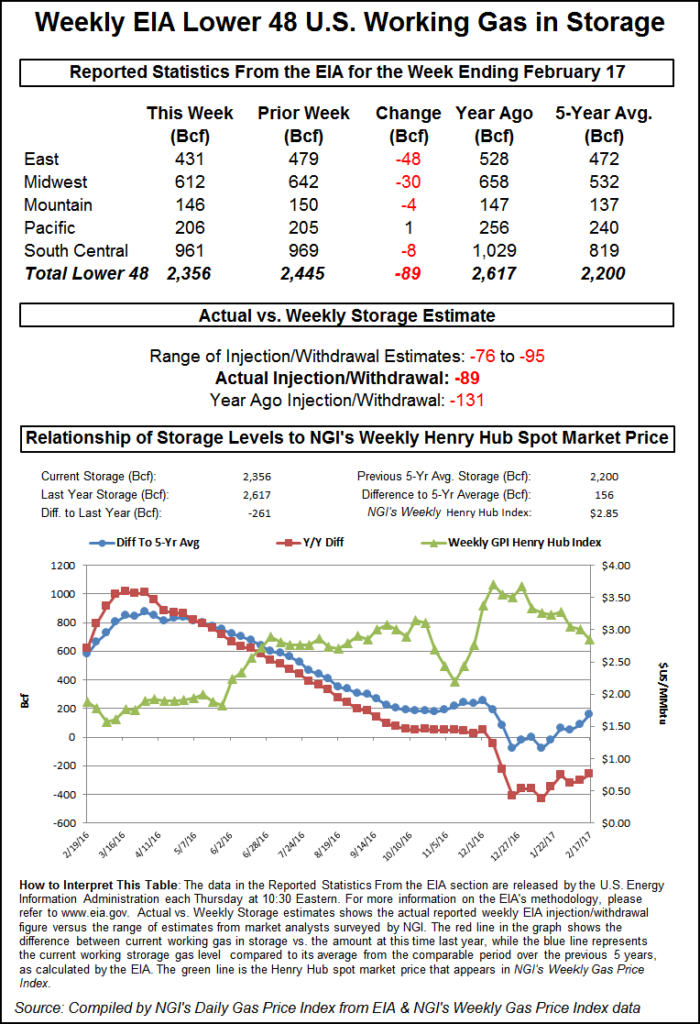

EIA reported an 89 Bcf storage withdrawal in its 10:30 a.m. EST release, about 4 Bcf greater than industry estimates. March futures rose to $2.662 and by 10:45 a.m. March was trading at $2.651, up 5.9 cents from Wednesday’s settlement. March opened floor trading at $2.680.

“We were hearing an 88 Bcf withdrawal, but the action after the number came out was pretty uneventful,” a New York floor trader told NGI. “Things are so depressed in this market. Last week we were talking $3 holding, then $2.75, and now $2.50, and in the midst of winter.”

“The 89 Bcf figure was more than the consensus expectation for 81-85 Bcf in net withdrawals, and so supportive for prices,” said Tim Evans of Citi Futures Perspective. “At the same time, the draw was still well below the 158 Bcf five-year average, and so bearish on a seasonally adjusted basis, limiting the potential for price recovery.”

Inventories now stand at 2,356 Bcf and are 261 Bcf less than last year and 156 Bcf greater than the five-year average. In the East Region 48 Bcf was withdrawn and the Midwest Region saw inventories decrease by 30 Bcf. Stocks in the Mountain Region fell 4 Bcf, and the Pacific Region was up 1 Bcf. The South Central Region dropped 8 Bcf.

Last year 131 Bcf was withdrawn and the five-year pace is for a 158 Bcf pull.

Salt Cavern storage was down 4 Bcf at 328 Bcf and non-salt storage was lower by 3 Bcf to 633 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |