Natural Gas Futures Slide Following Thin Storage Withdrawal Stats

Natural gas futures retreated Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was significantly less than what traders were expecting.

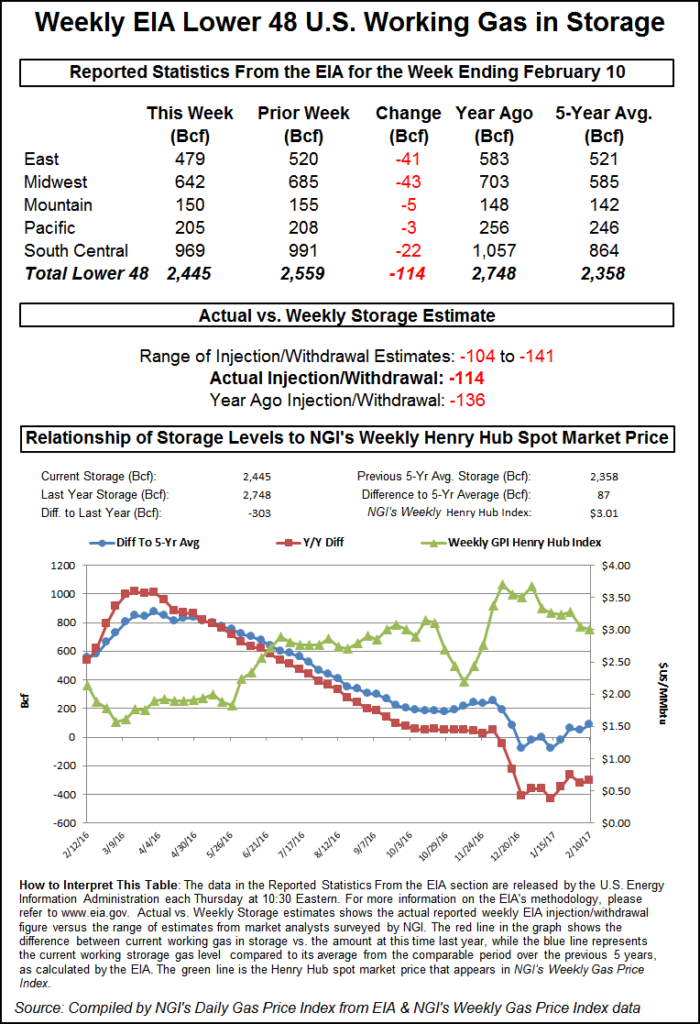

The EIA reported a 114 Bcf storage withdrawal for the week ending Feb. 10 in its 10:30 a.m. EST release, about 10 Bcf less than industry estimates. March futures traded down to $2.865, and by 10:45 a.m. the contract was trading at $2.886, down 3.9 cents from Wednesday’s settlement.

Traders were somewhat surprised that the market didn’t fall further. “It looks like it wants to hold here,” said a New York floor trader. “I’m thinking that since it didn’t break under $2.86 it is a sign it wants to work better.

“The net withdrawal of 114 Bcf was a clear bearish miss compared with the 124 Bcf consensus expectation, implying a weakening of the background supply-demand balance,” said Tim Evans of Citi Futures Perspective. “The draw was also bearish compared with the 156 Bcf five-year average decline.”

Harrison, NY-based Bespoke Weather Services said, “There may be enough bullish weather risk for prices to hold on, but this number certainly tilts risk back to the downside as the market loosens.”

Inventories now stand at 2,445 Bcf and are 303 Bcf less than last year and 87 Bcf greater than the five-year average. In the East Region 41 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 43 Bcf. Stocks in the Mountain Region fell 5 Bcf, and the Pacific Region was down 3 Bcf. The South Central Region dropped 22 Bcf.

Last year 136 Bcf was withdrawn for the week, and the five-year pace was a 156 Bcf pull.

Salt Cavern storage was down 6 Bcf at 332 Bcf, and non-salt storage was lower by 18 Bcf at 636 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |