Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North Dakota Production Plummets; Prices, Rig Count Steady

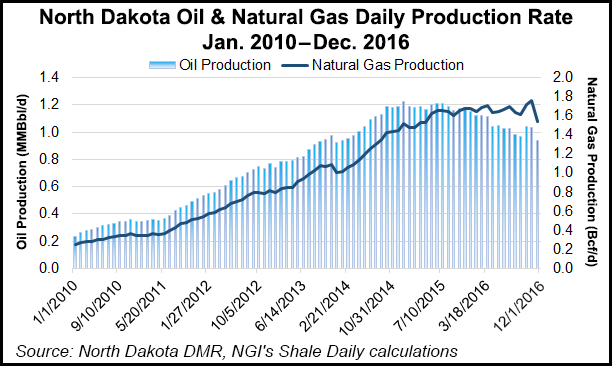

North Dakota oil and natural gas production plunged in December with oil again dropping below the 1 million b/d average, but prices and rig counts have held through January, state energy officials said Wednesday. The decline month/month was the biggest reduction ever since the Bakken Shale boom began a decade ago.

In December, the most recent month of complete statistics, oil production dropped 9% from November to 29.2 million bbl (942,455 b/d) from 31 million bbl (1.03 million b/d). Natural gas in December declined 13% to 47.6 Bcf (1.54 Bcf/d), compared to 52.7 Bcf (1.76 Bcf/d) in November.

Department of Mineral Resources (DMR) Director Lynn Helms said in a media webinar he expects oil production to bottom out at mid-year and begin to increase toward the end of the year; natural gas production will most likely turn more quickly.

“With natural gas, the infrastructure is in place; it was a matter of mechanical and freezing problems” in December, he said, “so as soon as we see warm weather, gas production should turn around.”

The state’s chief oil and gas regulator said the big production declines were mostly caused by severe winter weather that included three major snowstorms and several days in December of severe wind.

“We had half the days when winds were above 35 mph, and above that wind speed you can’t move rigs or do hydraulic fracturing,” Helms said, adding that the state had nine days with temperatures below minus 10 degrees.

When the thaw does come, a combination of road restrictions on running heavy duty trucks and flooding will keep oil production down, Helms said.

“This production loss will linger into the second quarter of the year, and we won’t see it turn around for quite some time,” he said.

On the positive side, Helms said there were 81 well completions despite the bad weather, and the number of drilled-but-uncompleted (DUC) wells statewide declined during the month as the West Texas Intermediate (WTI) price increased.

“It is another indicator that the $50/bbl WTI oil price is creating a very strong drive for companies to complete wells,” he said. “Some of those companies are saying they will add as many frack crews this summer as they can to reduce the 800-well inventory of DUCs.”

He cited the Bakken’s largest operator, Continental Resources Inc., as committing to running six fracking crews this summer to get its DUC inventory down by about two-thirds.

For December, North Dakota “lost ground” in gas flaring as it increased from 11% in November to 14%, which is still within the state limits that phase in reductions through 2020.

End of the 4Q2016 breakeven statistics for the state were relatively unchanged from the previous quarter, according to the DMR statistics showing that on average it is still economic to drill in the Bakken at $18/bbl prices. In the four core counties (Dunn, McKenzie, Mountrail and Williams) breakeven prices ranged from $16/bbl to $25/bbl.

“Lower prices for wells and fracking are still in the mix,” Helms said. “Well performance has improved a little bit and oil prices today are the same place they were three months ago” when they averaged $42.50/bbl.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |