Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Steady Ahead of Storage Data; March Adds Couple Pennies

Most physical points moved only a little in Wednesday natural gas trading for next-day delivery as weather forecasts in the East showed falling temperatures and the Midwest was expected to see sharply rising temperatures. The NGI National Spot Gas Average added 4 cents to $2.83, and most of the day’s price movement was confined to eastern points.

Futures traders were spared the indignity of additional moderation in longer-term temperature outlooks, and prices came in higher on the open and managed to stay in positive territory for the duration of the day’s trading.

The March contract added 2.0 cents to $2.925, and April gained 3.2 cents to $3.037. March crude oil fell 9 cents to $53.11/bbl.

Eastern points tacked on double-digit gains as temperatures were expected to take a healthy drop Thursday. AccuWeather.com forecast that New York City’s 46 degrees high on Wednesday would drop to 37 Thursday and recover to 40 by Friday, 1 degree above normal. Chicago on the other hand was expected to see its 35 high on Wednesday reach 43 Thursday and 56 by Friday, 20 degrees above normal.

Gas bound for New York City on Transco Zone 6 added 23 cents to $3.11, and packages on Texas Eastern M-3, Delivery rose 11 cents to $2.85.

Gas at the Algonquin Citygate gained 32 cents to $4.02, and deliveries to Iroquois, Waddington rose 14 cents to $3.37. Gas on Tennessee Zone 6 200 L added 8 cents to $4.02.

Energy pricing and in particular, the coal-natural gas dynamic, is facing some unusual, but presumably temporary misalignments in the Northeast. The largest coal-fired generation plant in New England is shutting down.

“Brayton Point Power Station is the largest coal plant in New England and consists of three units combing for 1,200 MW of coal generation plus a fourth, 475 MW, oil-fired unit,” said EnergyGPS, a Portland, OR-based energy consulting firm in a report. “In late 2013 the facility owners announced that the coal unit would be retired in early 2017, which meant the end of coal generation in Massachusetts. The planned retirement has remained on schedule and is currently expected to shut its doors sometime this March.

“As Brayton Point approaches its scheduled retirement, it is incentivized to burn all of its coal stockpile before the plant is closed down. As a result, the plant operator has run the unit nonstop through the first two weeks of February, despite a complete lack of price signal,” EnergyGPS said.

“We see that thermal generation and heat rates are flat for February compared to January; this implies that gas generation has remained on the margin and the 300 MWa increase in coal generation is running as base load. Any amount of baseload coal is unusual for New England, and we certainly wouldn’t expect it to increase month/month. Brayton Point is entering the market as a price taker and will continue to do so until they run out coal and shut down the unit.”

Other market points showed modest changes. Gas at the Chicago Citygate fell a penny to $2.84, and deliveries to the Henry Hub added 6 cents to $2.92. Gas at the NGPL Midcontinent Pool rose a penny to $2.68, and gas on Kern Receipt added 4 cents to $2.70. Gas priced at the PG&E Citygate added a penny to $3.30.

Futures prices firmed as traders were spared another onslaught of temperature forecasts calling for moderating temperatures.

Although near-term outlooks continue to moderate, longer-dated forecasts were mostly unchanged.

“Forecast changes were generally minor here as the broad warm anomalies seen in the preceding periods start to wane,” said MDA Weather Services in its Wednesday morning 11- to 15-day outlook. “Despite this, this period should continue to feature above normal coverage across the South, around the Great Lakes and in the East, while below normal temperatures are focused in the West.

“The breakdown of the warm-dominated pattern leading into this period is supported” by the Madden Julian Oscillation, which is tracking across the Indian Ocean, “with the biggest risk in this regard relating to the timing in which variability increases in response to the signal. Overall confidence is steady at moderate levels.”

Tuesday’s forecast change has prompted a reassessment of near-term supply-demand balances, which motivated one trader to take a short position.

“Tuesday’s weather update reduced the likely rate of storage withdrawals, particularly for the week ending Feb. 24,” said Tim Evans of Citi Futures Perspective in a note to clients. Evans calculated a pull of 124 Bcf for Thursday’s storage report and said by March 3 the year-on-five-year surplus should jump back up to 244 Bcf “confirming that the market is becoming better supplied on a seasonally adjusted basis even as the time remaining in the storage withdrawal season grows shorter.”

That building supply in the face of waning time left on the withdrawal season prompted Evans to take a short futures position. Evans is currently short the March contract from $3.16, with a protective buy stop lowered to $3.11 to reduce exposure on the trade. His objective is $2.85.

Others aren’t buying into the lower price scenario.

“I think we have come down too far, too fast,” said Harry’s RE Trust principal Alan Harry. “I think there is still some cold winter, not much, but some. The biggest thing I am looking at is the supply that is coming into the market is not as high as it should have been. Because of that, it says to me that there is still going to be pressure on the supply-demand part of natural gas, and I see us heading back up come June.”

Harry is a scale-in buyer at current levels.

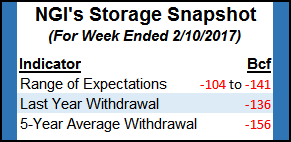

Traders are looking for an increase in the long-term storage surplus, currently at 45 Bcf, when the Energy Information Administration on Thursday releases inventory data for the week ended Feb. 10.

Last year 136 Bcf was withdrawn, and the five-year pace is for a 156 Bcf pull. IAF Advisors calculated a withdrawal of 122 Bcf. A Reuters poll of 20 traders and analysts showed an average 124 Bcf pull, with a range of -104 Bcf to -137 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |