Eagle Ford Shale | E&P | NGI All News Access

Chesapeake Raising Onshore Rig Count to 17 as Activity Rises in Oklahoma, PRB, Eagle Ford

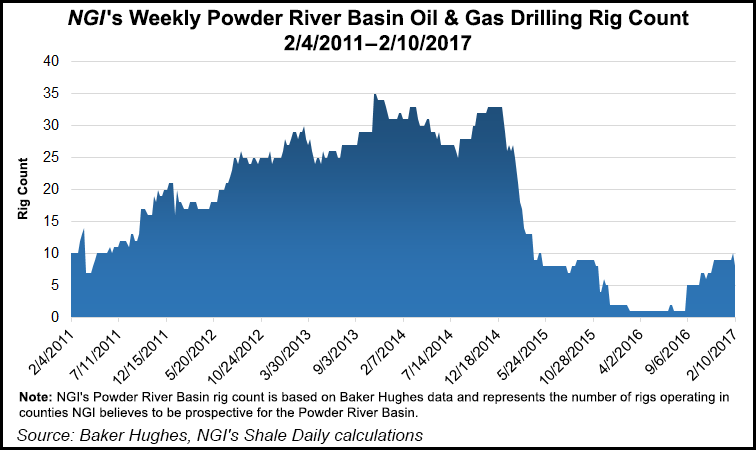

Chesapeake Energy Corp. is planning to operate 17 drilling rigs across the U.S. onshore this year, up seven from 2016, as it mounts a return to the Powder River Basin (PRB) and boosts activity in the Midcontinent and Eagle Ford Shale, the Oklahoma City-based independent said Tuesday.

Long a natural gas-focused operator, Chesapeake is turning up the volume in the onshore oil plays, forecasting oil output will be 10% higher year/year. Gas volumes should remain relatively flat, adjusted for sales, with volumes returning to growth again from year-end 2017 to year-end 2018, CEO Doug Lawler said in a guidance update.

This year’s capital program “is driven by improved capital efficiencies and profitability from our significant portfolio of high rate of return drilling opportunities,” Lawler said. “We will maintain our financial and operational flexibility with a relentless focus on driving differential performance.”

Ahead of its quarterly and year-end results scheduled for Feb. 23, Chesapeake said total capital expenditures for 2017 have been increased to $1.9-2.5 billion from 2016 spending of $1.65-1.75 billion. Production is expected to average 194-205 million boe, or 532,000-562,000 boe/d, which adjusted for asset sales would be a decline year/year of 3% to growth of 2%. Projected total output includes an estimated 33-35 million boe of crude oil, 18-20 million boe of natural gas liquids and 860-900 Bcf of natural gas.

Plans are to spud 400 gross operated wells from 213 in 2016, while turning 450 to sales from 428.

“We have a number of operational results we are looking forward to in 2017, including our return to the Powder River Basin and our first results from the Turner formation in the 2017 second quarter, along with additional results from the Sussex and Niobrara and a Mowry test later in the year,” Lawler said. “In total, we plan to place approximately 30 wells on production in the PRB in 2017.

“In the Midcontinent area, we plan to place approximately 100 wells on production during 2017, with roughly 60 of those wells planned from the Oswego formation. The Midcontinent is expected to provide oil growth in 2017 through development drilling in the Oswego and our exploitation of the Wedge play,” first announced last October.

And in South Texas, plans are to operate six rigs and place 165 wells on production in South Texas. Several tests are planned in the Eagle Ford, including more than 10 “extra-long lateral wells reaching approximately 15,000 feet,” Lawler said. As well, Chesapeake plans to test wells in the Upper Eagle Ford and Austin Chalk formations.

“Our increased activity in the Eagle Ford, Oklahoma and the PRB is expected to result in oil growth of approximately 10% from year-end 2016 to year-end 2017, with continued growth in our oil volumes projected to be over 20% by year-end 2018.”

Chesapeake, the No. 2 U.S. natural gas producer, is progressing development in Louisiana’s Haynesville Shale. Recent wells placed on production reached about 30-45 MMcf/d.

“Our plans for 2017 in the Haynesville include utilizing three rigs and placing approximately 35 wells on production,” Lawler said.

In the gassy Northeast Appalachia, “our activities in the Marcellus Shale in Pennsylvania and the Utica Shale in Ohio will be more focused on completing inventory wells compared to drilling and completing new wells. We also plan to begin applying more aggressive fracture stimulation procedures to wells in both the Marcellus and our dry gas Utica areas during the year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |