Oil Drillers Doing More With More

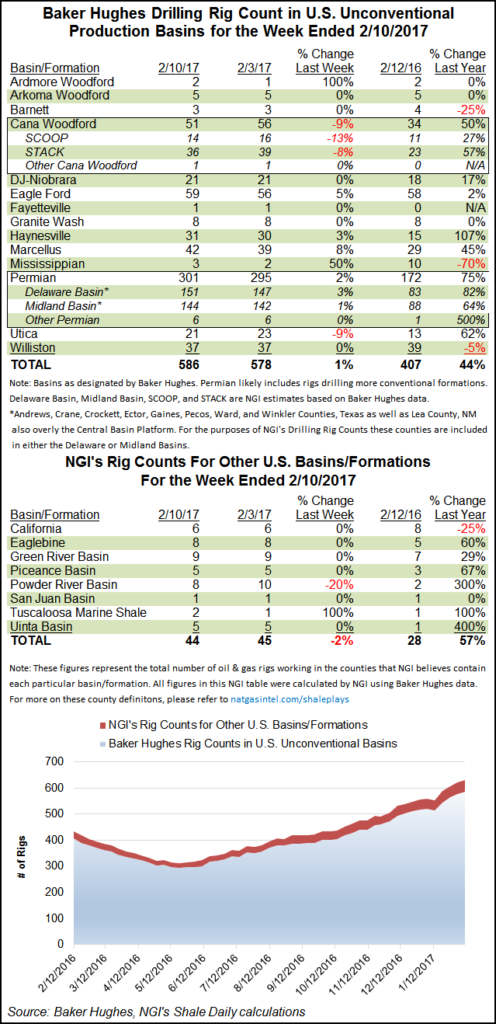

Texas and the Permian Basin again led the gainers among states and plays in the latest Baker Hughes Inc. (BHI) rig count. Twelve rigs (mostly oil) returned to U.S. land-based service, and they’ll be more productive than their predecessors, oil analysts at Societe Generale said in a note Tuesday.

“Rig counts are increasing at an accelerating pace, and given the technological advances of the past three years, this should translate into significant supply,” Societe Generale said. “Decline rates for U.S. shale wells are still steep, but typical production profiles have shifted upwards considerably. Going forward, higher initial [oil] production levels and production profiles (due to high-grading of well locations, technology improvements, and efficiency gains) mean stronger aggregate supply.

“…[E]ach additional rig now translates into more output than ever before.”

Eight oil rigs and four natural gas rigs returned during the week, BHI said on Friday. Eleven horizontal rigs came back, accompanied by one vertical unit.

One U.S. rig returned to inland waters, and one left the offshore, making for a net U.S. gain of 12 rigs overall. Nine rigs returned to action in Canada (10 oil minus one gas), putting the North American increase at 21 units. The week ended with 717 U.S. land rigs running (741 in the U.S. overall), and 352 rigs running in Canada. The overall North America count was 1,093. These totals are well above year-ago activity levels.

Texas added seven rigs, and the Permian Basin added six. The Marcellus and Eagle Ford each gained three, but the Cana Woodford lost five.

While the focus of most drillers has been oil, the natural gas rig count has been climbing, too. Still, Lower 48 U.S. natural gas production averaged just 70.2 Bcf/d during January, marking the lowest monthly production level recorded since June 2014, according to IHS Markit.

January production represented the second consecutive monthly decline for U.S. natural gas production, and a 1% (0.8 Bcf/d) decrease below December 2016 average production levels. Compared to January 2016, Lower 48 gas production is off 3.4% (2.5 Bcf/d), according to the firm’s data.

Natural gas production declines are not uniform across regions, though, IHS Markit said. While Northeast production has grown, on average, over the past four months and is at an all-time high, production is off in Texas, the firm said.

Texas production only averaged 16.5 Bcf/d of total Lower 48 natural gas production in January, its lowest output since December 2009, according to IHS Markit. “Just one year ago, in January 2016, Texas production was above 18.0 Bcf/d, but waning production in East Texas and in the Eagle Ford in South Texas has had a severe impact on total gas supply for the U.S.” West Texas Permian natural gas production has benefited from increased oil drilling, though, IHS Markit said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |