Precision Marking Up Fleet Prices as North American Drilling Activity Increases

Natural gas drilling activity has escalated in Canada’s Deep Basin, U.S. oil-directed operations are improving, and customers are demanding high-tech rig technology, prompting Precision Drilling Corp. to mark up prices across its fleet.

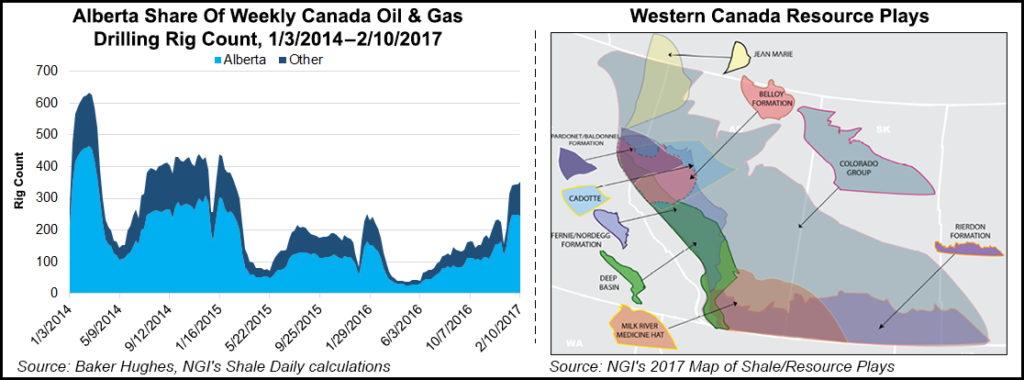

The Calgary-based land drilling contractor, considered the most active player in the Western Canada Sedimentary Basin, also operates in all major resource plays in the United States, as well as overseas.

Measured by drilling rig utilization days, Precision’s U.S. activity actually fell 13% sequentially in 4Q2016, while Canadian activity increased 12%. International demand was off 10%.

However, demand for the super-spec rigs has allowed Precision to begin marking up prices across the fleet. During the third quarter pricing rose “on a select number of rigs,” and in the fourth quarter, mark ups began on most of its spot market rigs, CEO Kevin Neveu said.

Precision now “is in the process of implementing price increases across all of the active spot market rigs in our fleet.”

Oilfield services operators that include No. 1 Schlumberger Ltd. and No. 2 Halliburton Co. already have indicated they will increase prices this year.

An “improving customer sentiment we reported in the third quarter gained momentum through the end of the year, as stabilized commodity prices and improving industry cash flows continued to drive demand for our services,” Neveu said. “Today, Precision has 138 rigs drilling or moving, with 48 in the U.S. and 90 in Canada.”

Activity levels “are underpinned by strengthening customer demand for our pad-walking Super Series rigs.”

During a fourth quarter conference call, also on Thursday, management at Patterson-UTI Energy Inc. said it also is seeing a big demand for super-spec rigs.

Since activity levels troughed in 2Q2016, Precision has activated more than 100 rigs, with “essentially no increase in fixed costs or reactivation charges,” Neveu said. The ability to hold costs has validated a stated 2016 priority, “to be positioned for a rebound.”

In Canada, “there has been strength in natural gas and gas liquids drilling activity related to Deep Basin drilling in northwestern Alberta and northeastern British Columbia, while the trend toward oil-directed drilling in the U.S. continues.”

Last year, 48% of the Canadian industry’s active rigs and 80% of the U.S. industry’s active rigs “were drilling for oil targets, compared with 45% for Canada and 77% for the U.S. at the same time last year.”

Most customers are requesting to top-tier rig lines, which Precision markets as its “Super Triples,” which automate several drilling processes, “demanning” directional drilling.

Precision recently completed “five autonomous jobs across North America,” Neveu said. “In the coming months, we will deploy this technology to more rigs.”

The agreement in late 2016 by the Organization of the Petroleum Exporting Countries (OPEC) and allies to reduce output through at least May also came at an opportune time, the CEO said. The OPEC production quotas “should lead to improved market-balancing fundamentals. We expect this stabilized and improving oil price will lead to increased spending for resource development programs, which will be positive for Precision’s activity levels and service pricing.”

Although the market upturn bodes well, “pricing remains below the level necessary to achieve appropriate returns on our capital base…”

As of Wednesday (Feb. 8), Precision’s term rig contracts for 2017 averaged 49 — 20 in Canada, 21 in the United States and eight internationally — versus a year ago when it had on average 30 rigs under contract for 2017.

“In Canada, term contracted rigs normally generate 250 utilization days per year because of the seasonal nature of well site access,” management said. “In most regions in the U.S. and internationally, term contracts normally generate 365 utilization days per year.”

During the final three months of 2016, the average U.S. active rig count was 39, down six year/year but up 10 sequentially. In Canada, the average active rig count in 4Q2016 was 51, an increase of six year/year and up 20 from 3Q2016.

Precision expects to see more industry consolidation. In December it improved its share of the Canadian rig services market after agreeing to swap some oilfield service assets with Calgary-based Essential Energy Services Ltd. The deal expanded Precision’s rig operations and added 150 people to the Canadian workforce, while Essential took over its coil tubing and pumping services.

Precision, which reports in Canadian dollars, recorded a net loss of $30.6 million (minus 10 cents/share) in 4Q2016, versus a year-ago loss of $270.9 million (minus 93 cents). Revenue fell almost 18% year/year to $283.9 million from $344.9 million. Revenue from the contract drilling services fell 17%, while completion/production services revenue was off 26%.

Net losses for 2016 totaled $156 million (minus 53 cents/share), down from a 2015 loss of $363 million (minus $1.24). Revenue declined from 2015 by 39% to $951 million.

Precision expects to spend $108 million for capital projects this year, including $4 million for expansions, $52 million for sustaining and infrastructure expenditures, and $52 million to upgrade existing rigs.

NGI’s Shale Daily will be covering many North American-focused oil and gas operator results in the coming weeks. A calendar listingis available on the website.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |