Markets | NGI All News Access | NGI Data

Weekly NatGas Trading Tackled For A Loss, But Industry Optimistic Going Forward

The natural gas market went looking for any incursion of cold air it could find for the week ended Feb. 3 and came up empty handed. It seemed as though trading during the week ended up being a never-ending succession of weather models turning more moderate and prompting lower pricing.

Less than a dozen points followed by NGI in the Northeast managed to turn a gain, and the NGI National Weekly Spot Gas Average fell 20 cents to $3.01.

The week’s greatest gainers popped up in the Northeast, with the Algonquin Citygate adding 94 cents to $4.90 and Tennessee Zone 6 200 L up by 74 cents to $4.78. The week’s biggest loser was Northwest Sumas, with a drop of 42 cents to $2.87.

Regionally, California and the Rocky Mountains found themselves at the bottom of the leader board with declines of 36 cents and 35 cents to $3.08 and $2.82, respectively. The Northeast was the only positive region and posted a gain of 16 cents to $3.71.

[ Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

The remainder of the country was stuck with drops from 18 cents to 21 cents.

South Louisiana shed 21 cents to $2.97, and South Texas, East Texas, the Midwest and Midcontinent all fell 20 cents to $2.95, 2.95, $3.02, and $2.89, respectively.

The Southeast fell 19 cents to $3.05 and Appalachia touched down with a loss of 18 cents to $2.83.

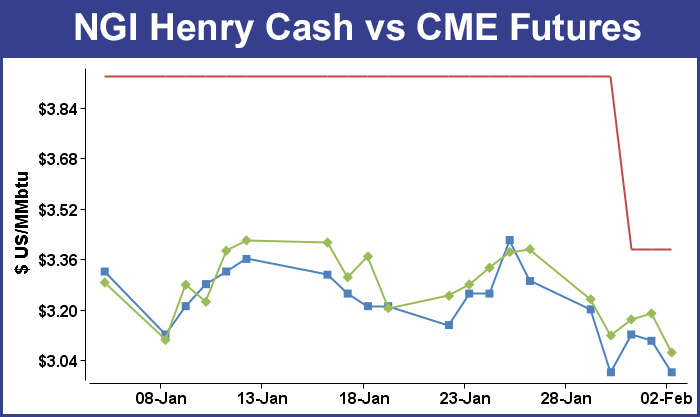

March futures retreated 32.8 cents to $3.063.

Thursday saw the NGI National Spot Gas Average fall 2 cents to $3.06, and the EIA reported a storage withdrawal of 87 Bcf, nearly in line with market expectations, and prices were slow to respond. At the close, March had risen 1.9 cents to $3.187, and April was up 3.1 cents to $3.245.

March futures were trading about 4 cents lower prior to the EIA report, but after the statistics were released, March rose to $3.154. By 10:45 a.m., March was trading at $3.162, down six-tenths from Wednesday’s settlement.

“The natural gas market largely saw this report coming,” said Tim Evans of Citi Futures Perspective. Citi analysts still “view this as confirmation that storage fell far less than the five-year average in the week ended Jan. 27, leaving the market with an additional cushion to help cover the balance of the winter heating season.”

“The market seems to have priced in this number, though it could add a little support coming on the more bullish range of expectations,” said Harrison NY-based Bespoke Weather Services. “While maybe not enough to rally significantly, it has added support at the $3.10 level with prices unchanged in the five minutes following the print.”

Last year 169 Bcf were withdrawn and the five-year pace stands at 166 Bcf.

Inventories now stand at 2,711 Bcf and are 266 Bcf less than last year and 59 Bcf greater than the five-year average. In the East Region, 27 Bcf was withdrawn and the Midwest Region also saw inventories fall by 27 Bcf. Stocks in the Mountain Region fell 9 Bcf, and the Pacific Region was down 14 Bcf. The South Central Region dropped 10 Bcf.

In Friday’s trading physical natural gas traded for the weekend and Monday joined hands with the futures screen and in something akin to a lover’s leap, jumped off a cliff.

Physical gas faced strong headwinds in the form of weekend and Monday temperatures as much as 20 degrees above normal in some metropolitan areas, and futures succumbed to a vulnerable technical situation and were pummeled by what appeared to be institutional selling ahead of the day’s open. The NGI National Spot Gas Average skidded 14 cents to $2.92 and no point tracked by NGI posted a gain. The futures fared little better. At the close March had fallen 12.4 cents to $3.063 and April was down by 12.9 cents to $3.116. March crude oil rose 29 cents to $53.83/bbl.

Forecasters called for a warming trend throughout the nation’s midsection into Monday. Wunderground.com predicted the Friday high in Chicago of 29 would reach 33 Saturday and 44 by Monday, 12 degrees above normal. Dallas’ 55 max on Friday was seen easing to 52 Saturday, but surging to 78 by Monday, 23 degrees above normal. Boston’s 32 high on Friday was expected to inch up to 33 Saturday and reach 36 by Monday, 1 degree below normal.

Points across the country tumbled. Gas on Texas Eastern M-3, Delivery fell 38 cents to $2.86 and gas headed for New York City on Transco Zone 6 shed 40 cents to $3.26.

Gas at the Chicago Citygate slipped 12 cents to $2.94 and packages at the Henry Hub changed hands a dime lower at $3.00. Deliveries to Panhandle Eastern were down 11 cents to $2.74, and Opal slipped a dime to $2.75. On the West Coast gas at Malin gave up 7 cents to $2.81 and gas priced at the SoCal Border Avg. skidded 9 cents to $2.84.

According to forecasters, conditions are expected to become more winter-like next week. “Rain and snow will begin in the West Monday,” said The Weather Channel meteorologist Brian Donegan.

“Snow, sleet and freezing rain will develop from the upper Midwest through the interior Northeast Monday night into Tuesday. Accumulating snow is possible along or near the Interstate 95 Northeast corridor north of New York City, including Boston.

“The potential for snow and ice returns to the Midwest and Northeast early next week, as winter remains locked in across the northern tier of the nation. A low-pressure system will move ashore in the Pacific Northwest Monday, bringing more snow to the winter-fatigued region. The storm system will impact the Midwest and Northeast Tuesday into Wednesday,” said Donegan.

Funds and managed accounts appeared to be entering the market on the short side inspired by weak fundamentals and technicals.

Overnight longer term weather models again forecast more moderate conditions and a lessening of heating load. “[Friday’s] 6-10 day period forecast is generally warmer than yesterday’s forecast over the eastern two thirds of the US,” said WSI Corp. in its morning report to clients. “The West is a bit cooler,” and continental U.S. gas-weighted heating degree days were “down 6.4 to 122.1 for the period. These are 25.1 below average.”

WSI said the forecast “has risks in either direction depending on the exact speed or progression of the pattern. There is a slight colder risk during the front half of the period, but a faster progression,” similar to the European model, that “offers a warmer risk over the East and Northeast by the end of the period.”

Analysts see a worsening fundamental and technical environment. The moderating weather outlooks are “forcing the market to discount some continued downsized storage withdrawals” as seen in Thursday’s Energy Information Administration storage release, said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning note to clients.

“While the current surplus against five-year averages is modest at only 59 Bcf, the likelihood that this overhang will be increasing appreciably going forward has re emboldened the money managers who appear to be re-entering the short side of the market in force. Increasing bearish opinions are also being supported [Friday] by technical deterioration that has seen March futures drop below last month’s well defined support at the $3.11 level. From here, we look for this area to provide resistance.

“But, at the same time, we are recognizing the volatility of the daily updates to the one-to-two week temperature forecasts and, as a result, we are going to stay with our trading plan that suggests stop protection on existing long March positions below the $3.10 level on a close only basis. Should we get pushed off of the long side, additional downside price possibilities into the $2.80-2.90 zone would be implied. Should such a price decline be realized next week, we will look to reinstate 2017 bull spread positions.”

Market technicians at United ICAP calculated that if March futures can’t break above $3.25, then sub $3 prints are just around the corner.

“If you can’t get above there [$3.25] it’s at least $2.98 to $2.94 as our downside target,” said Brian LaRose, market technician, in a Thursday webcast. “If we can’t stop there, it’s $2.59. If we can stay below $3.25 then I think we head to $2.94 in very short order. “It’s very clear where our lines in the sand are. $3.25 to the upside and $3.10 to the downside.

“As long as we stay below $3.25, the bears own the technicals and we are likely headed at least to the $2.94 area.”

Pessimism may be the order of the day on physical and futures trading desks, but it’s an entirely different story in boardrooms across the oil and gas patch where budgets and capital expenditure plans are formulated. Increased drilling in basins such as the Permian highlight a trend that looks to be in place through 2017.

The U.S. drilling rig count jumped 17 week/week on Friday to 729, with 16 rigs raised in the onshore, all oil-directed, and one lifted in the Gulf of Mexico (GOM), Baker Hughes Inc. said.

As of Friday, 705 rigs were running in the U.S. onshore, 162 more than a year ago, according to Baker Hughes. Two rigs also are working inland waters, up from zero a year earlier. The GOM rig count overall had fallen to 21 Friday from 26 last year. Another 145 natural gas rigs were working, flat week/week, but 41 more than in the year-ago period.

According to energy analysts that cover the North American sector, exploration and production (E&P) capital outlays are expected to increase substantially this year, based on early earnings reports by oilfield services companies and some E&Ps. Most U.S. onshore activity continues to be directed to the Permian, which should not only lead the U.S. recovery but arguably the world, said Sanford C. Bernstein & Co. analyst Colin Davies. The massive basin that straddles West Texas and southern New Mexico is poised for a “significant uptick in well completion activity,” evidenced by results in the fourth quarter for oilfield services companies and their forecasts for 2017.

More optimism reigned Friday as the Labor Department reported the U.S. generated 227,000 new jobs in January, the largest gain in four months. Economists had been expecting a rise of 197,000 in new nonfarm jobs. The unemployment rate rose a tick to 4.8%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |