Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Part Company; March Gains 2 Cents After Storage Data

Traders of physical natural gas for Friday delivery scurried to get their deals done Thursday ahead of the release of Energy Information Administration (EIA) storage figures, and prices inched lower. Prices in the Mid-Atlantic, however, managed gains as near-term weather forecasts called for cooler temperatures going into the weekend. The NGI National Spot Gas Average fell 2 cents to $3.06.

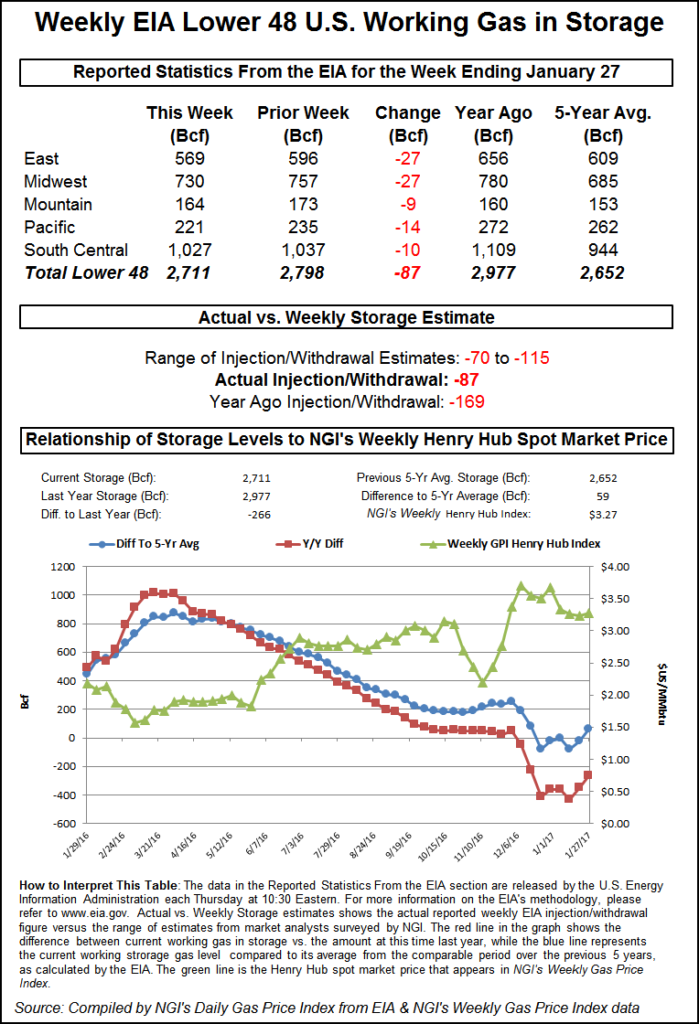

The EIA reported a storage withdrawal of 87 Bcf, nearly in line with market expectations, and prices were slow to respond. At the close, March had risen 1.9 cents to $3.187, and April was up 3.1 cents to $3.245. March crude oil slipped 34 cents to $53.54/bbl.

March futures were trading about 4 cents lower prior to the EIA report, but after the statistics were released, March rose to $3.154. By 10:45 a.m., March was trading at $3.162, down six-tenths from Wednesday’s settlement.

“The natural gas market largely saw this report coming,” said Tim Evans of Citi Futures Perspective. Citi analysts still “view this as confirmation that storage fell far less than the five-year average in the week ended Jan. 27, leaving the market with an additional cushion to help cover the balance of the winter heating season.”

“The market seems to have priced in this number, though it could add a little support coming on the more bullish range of expectations,” said Harrison NY-based Bespoke Weather Services. “While maybe not enough to rally significantly, it has added support at the $3.10 level with prices unchanged in the five minutes following the print.”

Last year 169 Bcf were withdrawn and the five-year pace stands at 166 Bcf.

Inventories now stand at 2,711 Bcf and are 266 Bcf less than last year and 59 Bcf greater than the five-year average. In the East Region, 27 Bcf was withdrawn and the Midwest Region also saw inventories fall by 27 Bcf. Stocks in the Mountain Region fell 9 Bcf, and the Pacific Region was down 14 Bcf. The South Central Region dropped 10 Bcf.

Traders are looking for technical weakness and an opportunity to sell the market. On Jan. 9 and 10, spot futures established a near-term low of $3.10-3.11. Prices subsequently rose, but on Tuesday and Wednesday they revisited the support level and firmly established a technical double bottom. Should that double bottom be broken traders are ready to sell.

“The cold weather did not appear so the market has been breaking down,” said a New York floor trader. “If the market can get to $3.22 to $3.25, it could go, and maybe a little short-term buying will surface, but if it doesn’t get out and get short.”

Citi’s Evans recommended entering a short position in the March futures, should prices break support at $3.11. He recommended a protective stop at $3.26 to limit risk on the trade. The objective is $2.85.

Weather models continued to flip-flop, and Wednesday overnight model runs took back most of expected cooling.

“The largest losses are in Week 3, [and] this reversal is creating downward price pressure in trading early” on Wednesday, said EBW AnalyticsGroup President Andy Weissman. He was looking for a pull of 85-88 Bcf in the EIA figures.

“There is a significant risk though that the withdrawal will disappoint,” he said. “Near-term, the market could receive at least some support from cold weather currently spreading across the U.S. and from another shot of cold air expected late next week. Both episodes, however, are expected to be brief, followed by much warmer air. Our most likely Week 4 forecast is also strongly bearish, suggesting that downward price pressure could continue later this month.”

Forecasts of heating load continued to fall short of the mark. The National Weather Service (NWS) for the week ended Friday (Feb. 4) predicted that New England would see 269 heating degree days (HDD), or 12 fewer than normal, and the Mid-Atlantic is expected to endure 253 HDDs, or eight less than its seasonal tally. The greater Midwest from Ohio to Wisconsin is anticipated to shiver under 269 HDDs, 20 less than its seasonal norm.

In physical activity, forecasts of falling temperatures in the Mid-Atlantic helped boost prices. AccuWeather.com said New York City’s 45 degrees high on Thursday would drop to 34 Friday and Saturday, 5 degrees below normal. Philadelphia’s Thursday high of 47 was seen falling to 35 Friday and 34 Saturday, 7 degrees below normal.

Gas bound for New York City on Transco Zone 6 rose 26 cents to $3.66, and packages priced at Texas Eastern M-3, Delivery added 13 cents to $3.24.

Prices in New England were hit with double-digit declines as next-day power prices and loads proved unsupportive. Intercontinental Exchange reported on peak Friday power at the ISO New England’s Massachusetts Hub fell $1.87 to $43.26/MWh. ISO New England forecast peak power load Thursday of 17,350 MW was seen easing to 17.250 MW Friday and 16,550 MW Saturday.

Gas at the Algonquin Citygate fell 26 cents to $5.13, and deliveries to Iroquois, Waddington shed 12 cents to $3.74. Deliveries to Tenn Zone 6 200L were quoted 29 cents lower at $4.97.

Major market hubs were weaker. Gas at the Chicago Citygate fell 2 cents to $3.06, and gas at the Henry Hub shed 2 cents as well to $3.10. Gas at the NGPL Midcontinent Pool fell 5 cents to $2.86, and deliveries to Opal changed hands 8 cents lower at $2.85. Gas at the PG&E Citygate fell 7 cents to $3.43.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |