E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

SM Energy Midland Basin ‘RockStar’ Well IP Rates Chart High

The Permian Basin remains red hot as SM Energy Co. on Tuesday released results of eight new Midland Basin wells in Howard County, TX, where the company will be focusing a substantial amount of its drilling effort this year.

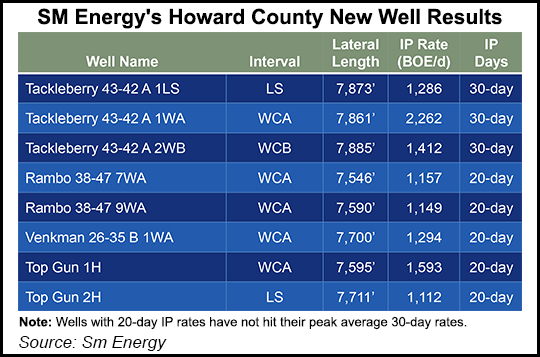

All eight wells in the Permian sub-basin (see chart) are exceeding pre-completion estimates for productivity, including three Wolfcamp A wells along the southeastern flank of the company’s RockStar acreage (recently acquired in separate deals with Rock Oil and QStar), Denver-based SM Energy said Tuesday.

“These eight wells include five wells drilled into the Wolfcamp A, two in the Lower Spraberry and one well in the Wolfcamp B, indicating the multi-pay potential of our acreage position,” said CEO Jay Ottoson. “Results from the three wells drilled and completed on the southeast edge of our acreage position are an important confirmation of our geologic model in that area.”

The Tackleberry 43-42 A 1WA, a 7,860-foot lateral Wolfcamp A completion, produced a peak average 30-day initial production rate of 2,262 boe/d, which is among the highest 30-day rates per lateral foot recorded in the Midland Basin, according to SM Energy.

“During 2017, we expect that our capital program will focus on drilling and completing wells like those we are announcing today, resulting in accelerated high-margin production growth on our retained assets. In addition, we will be working to improve completion techniques and further delineate our Midland Basin position to ensure that our future development plans are optimized,” Ottoson said.

Also Tuesday, SM Energy said its 55.3 million boe full-year 2016 production was in line with expectations, including fourth quarter production of 13.4 million boe. Production for the fourth quarter and full year was 30% oil. Midland Basin production increased by nearly four times, exit rate 2015 to exit rate 2016, SM Energy said, as it focused development spending in this core area.

The fourth quarter average realized commodity price of $25.86/boe (pre-hedge) was up 11% sequentially and up 29% year over year. Fourth quarter of 2016 production was in line with guidance, adjusted for the completion of a number of transactions that closed during the quarter, including the Rock Oil and QStar acquisitions and the completed sale of assets in the Williston Basin.

This year, SM Energy is focusing on its Midland Basin oil assets and natural gas/natural gas liquids assets on its operated Eagle Ford acreage. The previously announced sale of third-party operated Eagle Ford assets is expected to close during the first quarter. The sale of SM Energy’s remaining Williston Basin assets is expected to occur around the middle of this year.

“The company starts 2017 with production from core assets (excluding the Williston Basin and third-party operated Eagle Ford assets) of approximately 100,000 boe/d, which will serve as the basis for growth and development plans going forward,” SM Energy said.

An earnings conference call is scheduled for Feb. 23.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |