February NatGas Forwards Enjoy Quiet Week Before Friday’s Nosedive

In a winter marked by extreme natural gas price volatility due to equally extreme gyrations in temperatures, the third week of January proved to be a rather quiet one as February prices fell by 5 cents or so at most market hubs between Jan. 13 and 19, according to NGI’s Forward Look.

Nymex futures set the tone for the week, with prompt-month futures swinging by double-digits on only one day during this period, even as the largest storage withdrawal of the season was reported. The Nymex February futures contract ultimately fell 5 cents from Jan. 13 to settle Jan. 19 at $3.368.

NGI did not publish prices on Jan. 16 in observance of the Martin Luther King Jr. holiday.

Thursday’s report from the U.S. Energy Information Administration (EIA) showed a 243 Bcf withdrawal for the week ending Jan. 13, higher than most market estimates and the largest draw of the season to date. The next largest pull so far this winter — 237 Bcf — was reported for the week ending Dec. 23. At 2,917 Bcf, inventories were 431 Bcf less than last year at this time and 77 Bcf below the five-year average of 2,994 Bcf.

“The February natural gas contract bounced off support around the $3.30 level following a bullish miss in EIA data. From there, prices attempted to break above $3.35 resistance, but struggled to hold above that level,” Bespoke Weather Services said.

Although underlying fundamentals are tight, bearish weather risks are likely capping any upside to prices, the Harrison, NY-based weather forecaster said. In fact, a brief pullback toward $3.25 is possible as medium-term cold risks are not as impressive as long-range bearish risks, it said.

Forecasters at NatGasWeather agreed that a lack of sustained cold this winter has limited momentum in the natural gas market. “Yesterday’s impressive draw on supplies again showed just how tight the structural dynamics are when cold enough temperatures arrive. The problem this winter has been this has only happened in spurts, where just when deficits are increasing, milder temperatures return to kill any sort of bullish momentum,” they said.

And longer-term outlooks don’t offer much convincing proof that February will trend any differently. In fact, there are huge differences in the weather data on how arctic air over Canada affects the U.S. in early February. While NatGasWeather expects stronger natural gas demand regardless, arctic outbreaks need to show proof they will arrive into the U.S. in order for prices to experience a sustained rally. “There’s potential for it, but the data is far from convincing,” the forecaster said.

A polar blast is likely to threaten the northeastern U.S. the first few days of February, but it is currently favored to miss just to the north as it tracks across southeastern Canada and then out over the North Atlantic Ocean, the weather forecaster said.

A second polar blast upstream will also have opportunity to affect the United States, and the latest Global Forecast System data gives this second shot a better chance of pushing into the north-central U.S. than the Canadian model keeps the polar cold pool farther north, it said.

Data and analytics company Genscape’s supply-demand forecast shows Lower 48 total demand averaging 78.2 Bcf/d between Jan. 20 and Jan. 26, topping out Jan. 26 at 88.5 Bcf/d. Beyond that, early indications are for demand to crest at 92 Bcf/d by Jan. 27 and remain well above 90 Bcf/d into mid-February, it said.

“Essentially, the markets are likely to be cautious in believing frigid cold temperatures will arrive over the northern or eastern U.S., even though the data suggests it could still happen as the arctic cold pool lurks just across the Canadian border,” NatGasWeather said.

Indeed, it appears that Friday’s weather reports weren’t enough to keep gas prices afloat. The Nymex February contract plunged to a $3.20 low in the last 30 minutes of trading.

“It’s not looking good for bulls. We may have had a strong storage draw, but we’re still only 77 Bcf away from the five-year average, close enough that we could swing back to it on a little bit of warm weather,” said NGI’s Nate Harrison, markets analyst.

Harrison pointed to the National Oceanic Atmospheric Administration’s one-month outlook, which favors colder-than-normal weather over just a small part of the country. “The area of colder-than-normal temps encompasses a tiny part of the country that probably has more cows than it does people,” Harrison said, adding that major population centers in California and Texas are looking rather balmy.

And while technical market indicators continue to point to an oversold market, a bounce could take time to come to fruition, especially in the face of bearish weather.

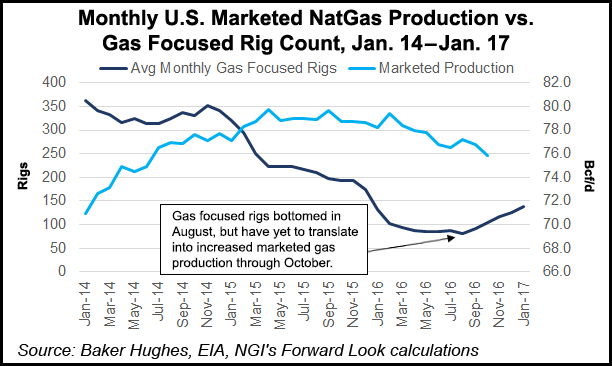

Production also is expected to cover, albeit at a slower pace than many in the market initially thought. NGI’s Patrick Rau, director of strategy and research, said overall natural gas production declines should slow soon and will likely start growing again in short order.

“It takes roughly six to nine months for new drilling to start having an impact on production. Gas-focused rigs in the U.S. bottomed at 81 on Aug. 26, 2016, which was only five months ago, so the lagged impact hasn’t really taken full effect yet. The gas rig count is currently 142, so that new well production should start getting layered in over the next few quarters,” Rau said.

Meanwhile, Baker Hughes reported Friday that the total U.S. rig count (oil & gas) climbed by 35 during the week, the fourth-largest weekly increase since 2008 and the highest increase on a quarter-over-quarter percent basis during that time.

Oil and gas services giant Schlumberger also offered up optimism when it said North American producers are likely to increase their investments in 2017. “E&P spending surveys currently indicate that 2017 North American E&P investments will increase by around 30%, led by the Permian Basin, which should lead to both higher activity and a long overdue price recovery in service industry pricing,” Houston-based Schlumberger said.

Looking closer at the markets, the Nymex futures curve took somewhat of a breather during the week as the mild weather was expected to continue until late next week. The Nymex February futures contract fell just 5 cents between Jan. 13 and 19 to reach $3.37, while March was down 4 cents to $3.36 and the summer (April to October) strip slipped by less than a penny to $3.427.

On a national level, February forward prices averaged 12.5 cents lower between Jan. 13 and 19, and March forward prices averaged 6 cents lower; the summer 2017 forward package came in flat to the previous week.

Substantial declines in and around New England helped drive near-month packages lower on a national level as demand there was expected to plummet after Friday. Genscape showed demand falling to 2.82 Bcf/d by Jan. 23 after reaching a projected high of 3.40 Bcf/d on Jan. 20. Demand was expected to remain soft until later in the week, when it was expected to rocket up toward 3.50 Bcf/d on both Jan. 26 and 27.

At the Algonquin Gas Transmission (AGT) Citygates, February forwards plunged 86 cents from Jan. 13 to 19 to reach $7.57, according to Forward Look. AGT CG March dropped 19 cents during that time to hit $5.40, while the summer 2017 package edged up 2 cents to $2.975.

At Tennessee zone 6 200 Leg, February forwards tumbled 85 cents from Jan. 13 to 19 to reach $7.81, while March dropped 21 cents to $5.51 and the summer 2017 package picked up 2 cents to reach $2.99, Forward Look data shows.

Points along the Iroquois pipeline were down about 75 cents on average for February and down 27 cents on average for March. The summer 2017 strip was up 2 cents on average, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 |