Markets | NGI All News Access | NGI Data

Tightening Market Has NatGas Bulls On Run Following Storage Data

Natural gas futures traded sharply higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what traders were expecting.

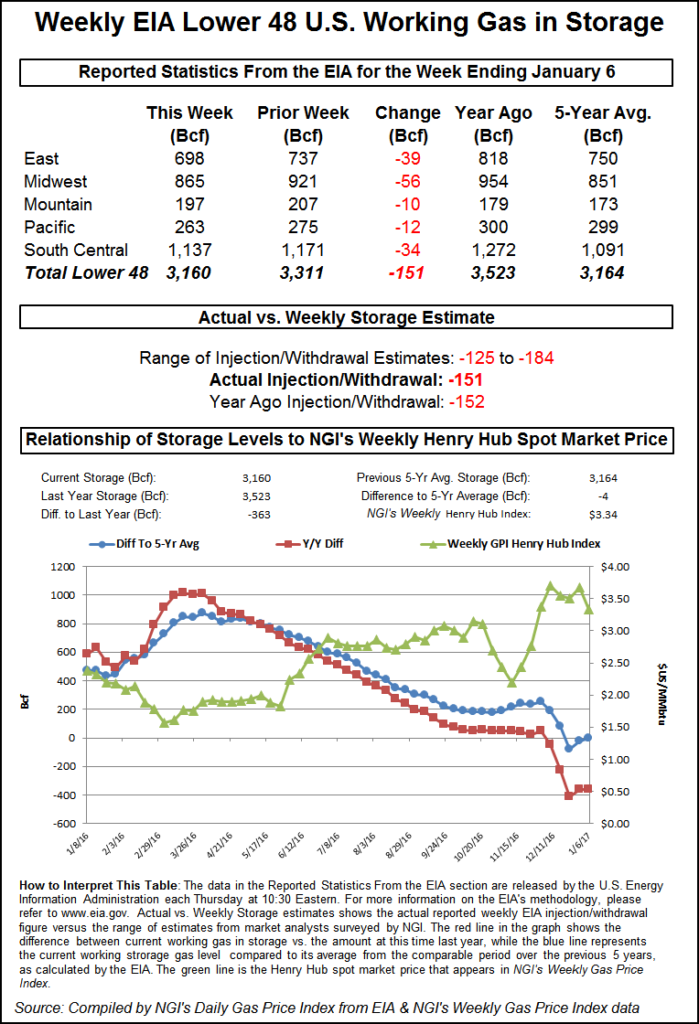

EIA reported a 151 Bcf storage withdrawal in its 10:30 a.m. EST release, whereas traders were expecting a pull of about 7 Bcf less. February futures reached a high of $3.450 immediately after the figures were released and by 10:45 a.m. February was trading at $3.417, up 19.3 cents from Wednesday’s settlement.

“You had all those shorts that panicked out and pushed the market higher,” said a New York floor trader. “We are looking for it to hold $3.41.”

“Following a very bearish print last week [-49 Bcf] prices have quickly spiked this morning, as we expected a number over 150 Bcf to do,” said Harrison NY-based Bespoke Weather Services, “and we see $3.50 as likely to be hit before the week is over as we see significant week-over-week tightening.”

Inventories now stand at 3,160 Bcf and are 363 Bcf less than last year and 4 Bcf less than the five-year average. In the East Region 39 Bcf was withdrawn and the Midwest Region saw inventories decrease by 56 Bcf. Stocks in the Mountain Region fell 10 Bcf, and the Pacific Region was down 12 Bcf. The South Central Region dropped 34 Bcf.

Salt Cavern storage was unchanged at 343 Bcf, and non-salt storage was lower by 34 Bcf to 794 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |