EIA Sees Lower 48 NatGas, Oil Output Rising Through 2018

The U.S. Energy Information Administration (EIA) expects Lower 48 natural gas and crude oil production to trend higher this year than in 2016, in tandem with rising commodity prices.

In the latest edition of the Short-Term Energy Outlook (STEO) issued on Tuesday, government forecasters said U.S. crude oil production should increase to an average of 9.0 million b/d in 2017, 0.2 million b/d higher than previously forecast, with 2018 output averaging 9.3 million b/d. Lower 48 onshore crude oil production is seen averaging 6.8 million b/d in 2017, up slightly from the 2016 level. In its initial 2018 forecast, Lower 48 oil production is seen increasing by almost 0.2 million b/d.

“In previous forecasts, EIA had expected Lower 48 onshore production to generally decline through the end of 2017,” the STEO noted. “The change in the current forecast reflects crude oil prices that have been higher than forecast in recent months, allowing producers to increase active rigs at a faster pace than expected.

“Additionally, it reflects the incorporation into EIA’s models of continuous productivity improvements and lower breakeven costs. However, the forecast remains very sensitive to actual wellhead prices and rapidly changing drilling economics that vary across regions and operators.”

Declines in Lower 48 onshore crude oil production “have largely ended, and production will be relatively flat in the first quarter of 2017 compared with the previous quarter, averaging 6.7 million b/d,” according to the STEO. “Lower 48 crude oil production is then expected to increase at an average month/month rate of 20,000 b/d from April 2017 through March 2018 before leveling at just under 7.0 million b/d from April 2018 through December 2018. The growth in Lower 48 onshore crude oil production primarily reflects increased oil production in the Permian Basin in Texas and New Mexico.”

Dry gas production, which fell last year for the first time since 2005, is forecast to increase by 2% this year, rising by 1.4 Bcf/d. For 2018, EIA now sees gas output increasing 3.8%, or 2.8 Bcf/d.

An increase in gas production “reflects a forecast of higher Henry Hub natural gas spot prices as well as pipeline buildout, particularly in the Marcellus and Utica natural gas producing regions,” the STEO said.

Henry Hub spot prices, which averaged $2.51/MMBtu in 2016, are forecast to climb through 2017 and average more than $1.00 higher year/year. The new forecast, the first to include a call for 2018 prices, sees next year’s gas prices averaging $3.73.

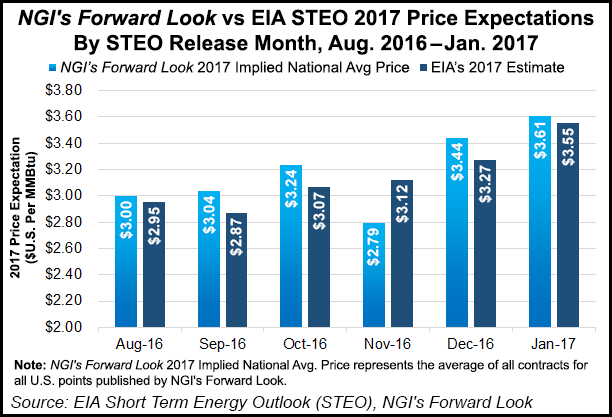

In the December STEO, EIA had said spot prices would average $3.27/MMBtu in 2017, a forecast that was 15 cents higher than predicted in November.

The West Texas Intermediate (WTI) crude oil price, which averaged $43.33/bbl in 2016, is seen averaging $52.00/bbl in 2017 — $1.84 higher than EIA had previously forecast. The initial forecast for 2018 calls for WTI to average $55.18/bbl.

“The current price outlook is expected to support onshore drilling and well completions, which are expected to be complemented by continued increases in rig and well productivity along with falling drilling and completion costs.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |