E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Economist: Texas Oil/NatGas Slump Might Have Seen Turning Point in November

The contraction in the Texas upstream oil and gas economy passed the two-year mark in November, according to the Texas Petro Index (TPI), a barometer of industry health in the Lone Star State.

November saw the 24th consecutive monthly decline in the index, which fell to 148.1 from 149.1 in October. The TPI was down by 26.4% from its November 2015 level of 201.2. The index peaked at 313.5 in November 2014 and had lost 52.7% of its value through last November, according to Karr Ingham, the economist who developed and maintains the TPI.

Last November could end up being the downturn’s low point, Ingham said. Stronger crude prices have spurred an uptick in drilling and permitting activity, and industry employment has stabilized.

“Of course, no one knows where prices are headed from here,” Ingham said. “But momentum continued building during November for higher levels of exploration and production activity and higher prices in 2017 for both crude oil and natural gas.”

Importantly, Ingham calculated the November TPI based on Texas oil and gas industry conditions that existed before an agreement to curtail 1.2 million b/d of production by OPEC and other key non-OPEC oil producers pushed oil prices above $50/bbl in late December.

“The market has clearly accepted that agreement at face value, but whether participating countries will hold to lower volumes has yet to be determined,” Ingham said. “But in any case, the agreement will not permanently remove 1.2 million b/d of oil from the global marketplace. Ultimately, a significant portion of that volume will be produced elsewhere — Texas and the U.S. most notably — and there is every possibility that prices will be held in check as a result.

“Whatever happens to prices, however, parties to the agreement to curtail output in effect have ceded market share to competing producers in Texas and the U.S., and they’ll take it, gladly.”

During November, Texas crude oil production totaled slightly more than 93.7 million bbl, 8.3% less than in November 2015. With oil prices in November averaging $42.06/bbl, the value of Texas-produced crude oil came to about $3.94 billion, 1.7% less than a year ago.

Estimated Texas natural gas output surpassed 649.4 Bcf, a year-over-year decline of about 8.5%. With natural gas prices in November averaging $2.38/Mcf, the value of Texas-produced gas increased about 7.3% to nearly $1.55 billion.

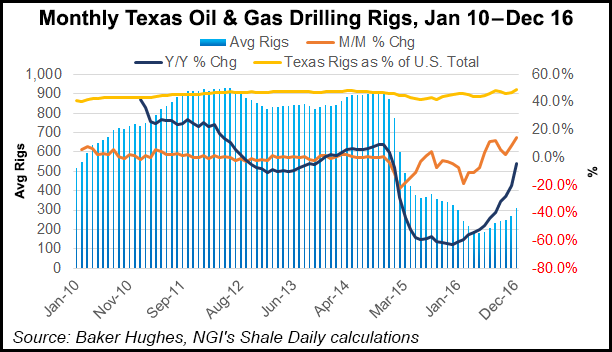

The Baker Hughes Inc. count of active drilling rigs in Texas averaged 271, 20.1% fewer units than in November 2015 when an average of 339 rigs were working. Drilling activity in Texas peaked in September 2008 at a monthly average of 946 rigs before falling to a trough of 329 in June 2009. In the most recent economic expansion, which began in December 2009, the statewide average monthly rig count peaked at 932 in May and June 2012.

The number of original drilling permits issued last November was 673, about 2% less than the 687 permits issued in November 2015.

An estimated 205,675 Texans remained on upstream oil and gas industry payrolls, based on revised quarterly data from the Texas Workforce Commission, about 12.1% fewer than in November 2015 and about 32.8% fewer than the estimated high of about 306,020 in December 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |