NatGas Markets Find Lots of Volatility Under the Tree This Christmas

If anyone in the natural gas market thought the week leading up to Christmas was going to be a quiet one, they were wrong. Nymex January futures set the tone for a volatile week, plunging more than 10 cents early on, but then spiking nearly 30 cents the very next day. The Nymex January futures contract ultimately gained 12.5 cents between Dec. 16 and 21 to settle at $3.54 amid prospects for returning cold for the beginning of January and a solid 200+ draw from storage.

While milder-than-normal conditions are forecast to blanket most of the U.S. during the next week — and folks in Texas are once again planning to wear shorts for Christmas — a weather system that has trended cooler is expected to move across the country Dec. 29-31, bringing rain, snow and a modest increase in natural gas demand, according to forecaster NatGasWeather.

Still, the weather forecaster said the first week of January is a more important period to watch as weather data remains mixed on whether a cold blast over Canada will push into the U.S. around Jan. 1-3. “To highlight the large differences between the weather models, the latest GFS operational run whiffed on spilling subfreezing temperatures into the U.S., while the Canadian operational solution pushed it aggressively across,” NatGasWeather said.

Who wins this battle is very important because if the southern U.S. upper ridge gives up ground, subfreezing temperatures are likely to spill into the northern U.S. The data has been inconclusive on who wins this battle all week, but in his view, colder patterns gained back a little momentum, especially for after Jan. 4, the forecaster said.

“The weather models have been unusually inconsistent the past several days, thus it’s important to mention there remains a camp of data that suggests the southern U.S. ridge will be quite strong and hold back cold Canadian air through the first week of January, which if it were to win out, would be considered quite bearish,” NatGasWeather said.

Commodity Weather Group (CWG) forecasters agreed that weather models appear to be all over the place as a weak La Niña to a negative neutral background state create the perfect opportunity for a fairly volatile winter situation when both warm and cold periods have shorter lifespans than what is typical.

“This challenges forecast models and forecasters as the standard deviation is higher. About two-thirds of these types of winters tend to have longer cold than warm periods,” CWG said.

In addition to weather, it appears that Wednesday’s dramatic 28-cent rally in the Nymex prompt month was likely tied to market players squaring away their positions ahead of Thursday’s storage report. A 200+ draw was widely expected, and the U.S. Energy Information Administration did not disappoint as it reported a 209 Bcf draw for the week ending Dec. 16.

The pull was considered to be a slightly bullish miss, although estimates ranged as high as 215 Bcf. At 3,597 Bcf, stocks fell 226 Bcf below year-ago levels but remained 78 Bcf above the five-year average of 3,519 Bcf.

Folks are looking to next week’s storage report to see inventories finally fall below the five-year average and whether any related price movements will set the tone for the remainder of the winter season. It should be noted that the last time storage inventories were below the five-year average was in May 2015.

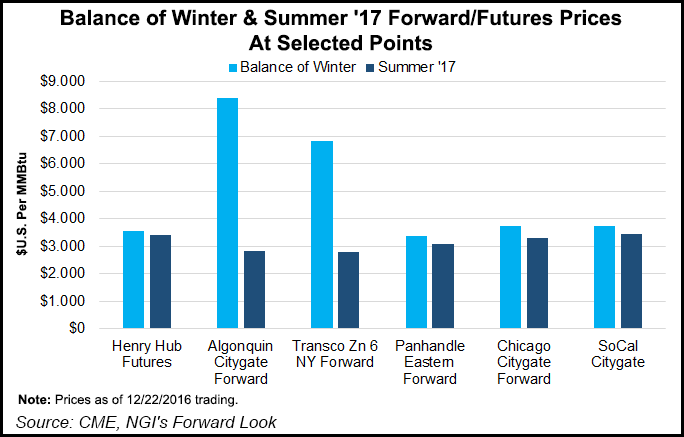

“It seems like the market has been underpricing this winter. For a while, the balance of winter was priced below the summer ’17 strip,” said NGI’s Nate Harrison, natural gas analyst.

With 3,597 Bcf in storage, the market is looking much better than it was during the famous Polar Vortex winter of 2013-2014, where storage inventories for the week ending Dec. 20, 2013, were at 3,017 Bcf. “But that winter serves as a good example of what unexpected weather can do to storage. That said, 3.5 Tcf is probably more than fine, and the Hub might bump up a little bit (but not much) on us crossing below the five-year average,” Harrison said.

Analysts at Societe Generale are optimistic that the recent strong withdrawal pace will continue to highlight just how quickly fundamentals can tighten under a normal to cold weather scenario. The December withdrawal pace is currently trending over 25 Bcf/d, which is stronger than any December in its balances.

“Winter has barely started, lots of days to go, and so far the season has trended tighter than our initial base-case expectation. The storage deficit, now established, will continue to ramp through the end of the year, and anything other than a mild weather scenario for January through March, storage looks positioned to finish the winter season under 1.45 Tcf,” Societe Generale said.

SocGen’s expectation is underpinned by a 72.5 Bcf/d production trend, which has not yet been established as supply averaged just 71 Bcf/d for the week ending Dec. 16. “Production is not getting the end-of-year bump that we expected, still lagging below our target 72.5 Bcf/d level for winter 16-17,” SocGen said.

“We still believe there is a bounce due in production, but our confidence is waning as the end of the year approaches and the bump fails to materialise. Additional infrastructure out of the Northeast was expected to drive that bump, delays of those projects plague the region, but perhaps there is also not as much waiting in the wings as the market thinks?” the investment bank said.

The soft supply outlook and supportive picture on the demand side of the ledger could spell out even more volatility to come over the next few months, even in the case of a normal winter scenario.

The first half of December has seen its fair share of volatility. Since Nov. 30, the Nymex January futures price has gone from $3.35 to as high as $3.75 and then back down to $3.50/MMBtu over the last couple of days.

“The entire Cal ”17 portion of the curve has seen some upward migration with the front-month-focused support, and has been consistently moving within range of our $3.48/MMBtu call,” SocGen said. “We reiterate that 1Q 2017 looks primed for an upside volatility session. How long the price support holds through 2017 will have a lot to do with the evolution of production by mid-year. We would rather be long than short contracts for 1H 2017.”

The Nymex January contract stood at $3.54 on Dec. 22 after essentially stalling out in that day’s trading session, but traders were once again hitting the gas pedal early Friday as the prompt month was up nearly 10 cents at $3.635 by midday.

The ongoing strength could be a glimpse of what is to come as Friday also marked the start of bidweek. Henry Hub December bidweek prices averaged $3.23, on par with where the Nymex December futures contract expired and a 31-cent discount to the January futures contract as of Dec. 22.

“We believe this weekend and next have the potential to be a couple of the most dangerous weekends of the year to hold positions, where the results could be feast or famine depending on weather trends. Also of interest, Jan ’17 futures go off the board Wednesday, so that’s likely to aid volatility as well,” NatGasWeather said.

Looking further out the futures curve, the Nymex February futures contract was at $3.57 after climbing 12 cents between Dec. 16 and 21, and the balance of winter (February-March) was at $3.55 after picking up 10 cents. Gains beyond the current winter strip were limited to no less than a nickel.

Interestingly, prices in portions of the Northeast continued to put up increases that were much stronger than the rest of the country. In New England, Algonquin Gas Transmission (AGT) citygates January forward prices jumped $1.10 between Dec. 16 and 21 to reach $8.91, while February rose 99 cents to $8.92 and the balance of winter edged up 79 cents to $7.44, according to Forward Look.

The gains at AGT come even as Spectra’s AIM project, which was built to help alleviate some of the price spikes in the region, went into partial service in early November. The pipeline on Dec. 16 requested FERC permission to place into service the remaining facilities for the AIM project. Specifically, the request was for the final 2.9 miles of pipeline that was being upgraded through Rockland and Westchester Counties in New York, as well as all of its corresponding facilities.

This final piece will allow Algonquin to bring online the remaining 97 MMcf/d of capacity that has been missing from the total 342 MMcf/d AIM project capacity. Algonquin has asked that the commission authorize this request by Jan. 4.

Meanwhile, Tennessee zone 6-200 leg January forward prices rose 74 cents between Dec. 16 and 21 to reach $8.87, while February forward prices picked up 78 cents to hit $8.96 and the balance of winter rose 66 cents to $7.50, Forward Lookdata shows.

At the other end of the spectrum, points along the Iroquois pipeline eased quite a bit as prices in the cash market tumbled. Iroquois Waddington January forwards were down 44 cents between Dec. 16 and 21 to reach $6.55, while February forwards were down 30 cents to $6.70 and the balance of winter was down 23 cents to $5.28, according to Forward Look.

Iroquois zone 2 posted similar declines as cash prices at the two points plunged by some 80 cents and 65 cents, respectively, during that period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |