Markets | LNG | NGI All News Access

U.S. LNG Projects Could Gain if Market Tightens After 2020, Barclays Says

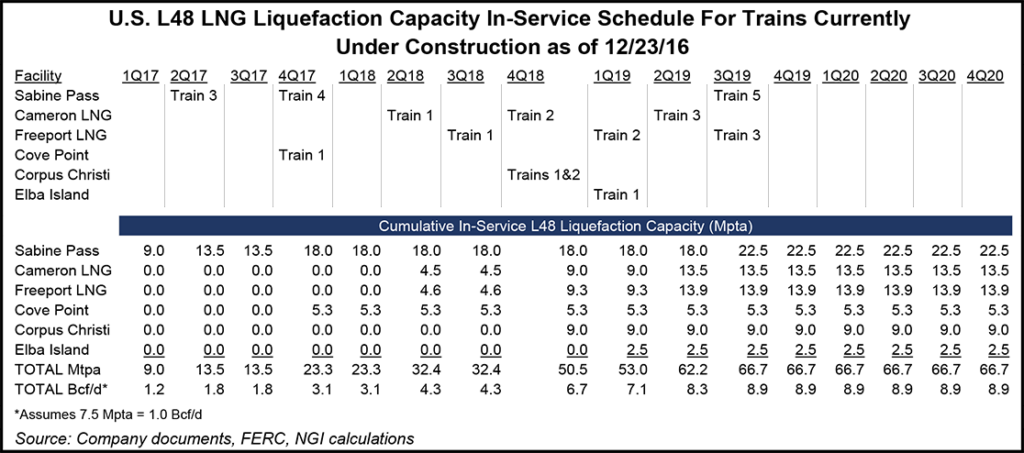

During a week when some Lower 48 liquefied natural gas (LNG) export projects saw advances, analysts at Barclays Commodities Research wrote that there’s reason for the backers of U.S. LNG exports to be hopeful as the global market tightens.

If LNG buyers and sellers delay coming to agreement on contract terms to support new liquefaction development, Lower 48 projects could benefit from a tighter market caused by a consequent delay in final investment decision (FID) on new projects, Barclays said.

“With 55 million metric tons/year of Henry Hub-linked LNG [capacity] currently under construction in the U.S., the marketing environment for other U.S. projects has become more difficult,” analysts said. “Major Asian buyers have signaled that, at least for now, they have reached their tolerance levels for both U.S. price and geographic LNG exposure.

“But if the hiatus in FIDs lasts through 2017, more buyers may sign up for volumes from the U.S., specifically from expansion trains at currently under-construction projects.”

Projects in the United States could offer the fastest time to completion for buyers sensing that the LNG market after 2020 will be tighter than previously thought. For instance, the analysts said, construction of the first two trains at Cheniere Energy Inc.’s Sabine Pass terminal was completed more quickly than recent projects in Australia.

U.S. LNG liquefaction projects, compared to others around the world, have natural gas supply at the ready, thanks largely to shale plays. Other projects can face delays, not only at the liquefaction end but also upstream at the natural gas supply end, Barclays said.

While buyers and sellers haggle over whether LNG pricing in future contracts should be oil-indexed or hub-linked, Henry Hub could take the lead. “Although buyers may be concerned about being overexposed to the benchmark, a prolonged impasse over pricing for other global projects could make Henry Hub the best option in a tightening market…” Barclays said. “With the recent rally in oil prices, thanks to promised OPEC production cuts, the bullish momentum in oil prices may be enough to push buyers back to hub-based gas prices.”

U.S. liquefaction projects gaining traction recently include Golden Pass LNG (final Federal Energy Regulatory Commission approval); Plaquemines LNG (FID); and Elba Island LNG (non-free trade agreement export authorization).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |