Markets | NGI All News Access | NGI Data

Bulls Have Upper Hand Following 200 Bcf-Plus EIA Storage Withdrawal Report

Natural gas futures traded higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what traders were expecting.

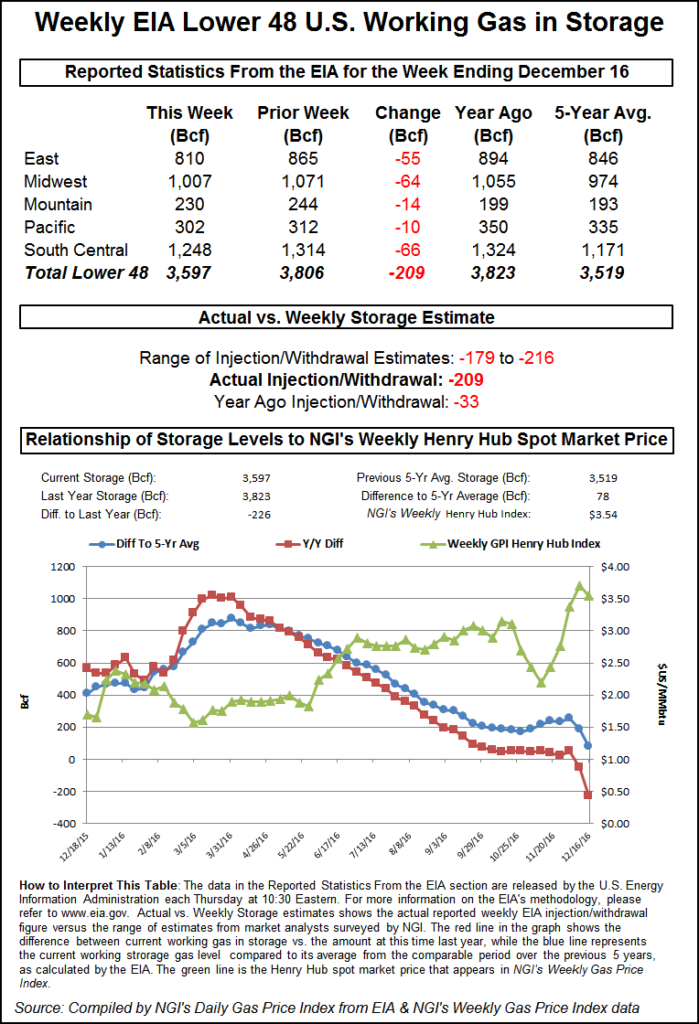

EIA reported a 209 Bcf storage withdrawal in its 10:30 a..m. EST release, whereas traders were expecting a pull of about 8 Bcf less. January futures reached a high of $3.626 immediately after the figures were released, and by 10:45 a.m. January was trading at $3.560, up 1.8 cents from Wednesday’s settlement.

“It looked like the market moved high enough to give some traders a chance to take money off the table ahead of the long weekend,” said a New York floor trader

“This drawdown was 9 Bcf below our estimate of -200 Bcf and on the lower side of most analyst estimates as well,” said Harrison, NY-based Bespoke Weather Services. “However, the recent market rally has seemed to have priced in an even more bullish miss in today’s number, and the number falling generally within expectations has helped prices fall back a bit today as weather remains neutral. Still, this market remains tight with some upside risk left.”

Citi Futures Perspective analyst Tim Evans called the report “bullish,” adding that it was likely the result of stronger-than-anticipated heating demand. “The data implies a somewhat tighter balance in the market for the reports to follow as well,” he said.

The 209 Bcf draw dwarfed last year’s 33 Bcf pull for the week, as well as the 101 Bcf five-year average draw for the week.

Inventories now stand at 3,597 Bcf and are 226 Bcf less than last year, but still 78 Bcf more than the five-year average. In the East Region 55 Bcf was withdrawn and the Midwest Region saw inventories decrease by 64 Bcf. Stocks in the Mountain Region fell 14 Bcf, and the Pacific Region was down 10 Bcf. The South Central Region declined 66 Bcf.

Salt cavern storage was down 25 Bcf at 363 Bcf, while the non-salt cavern figure was down 43 Bcf at 884 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |