Markets | NGI All News Access | NGI Data

Northeast Weekly Gains Trump Broader Losses, But NatGas Futures Swoon

Weekly natural gas prices for the week ended Dec. 17 followed the cue of futures from the previous week and closed higher, but the market was sharply divided, with triple digit gains in the Northeast offsetting broader declines in Midwest Market Zones and Producing Zones.

TheNGI Weekly Spot Gas Average rose 17 cents to $3.92. Of the actively traded points, Transco Zone 6 NY posted the greatest gain, adding $3.92 to $7.85, and the biggest loser was Tennessee Zone 4 Marcellus with a loss of 27 cents to $2.89.

Regionally, nearly all sections of the country were in the red, with the exception of the Northeast showing a rise of $1.95 to $6.77 and the Southeast adding 25 cents to $4.02.

South Texas shed the most, dropping 17 cents to $3.41, South Louisiana fell 16 cents to $3.46, and East Texas was lower by 15 cents to $3.43.

Both California and Appalachia were lower by 8 cents to $3.62 and $3.24, respectively, and the Midwest fell 7 cents to $3.71.

The Rockies eased 4 cents to $3.54 and the Midcontinent was off 2 cents to $3.59.

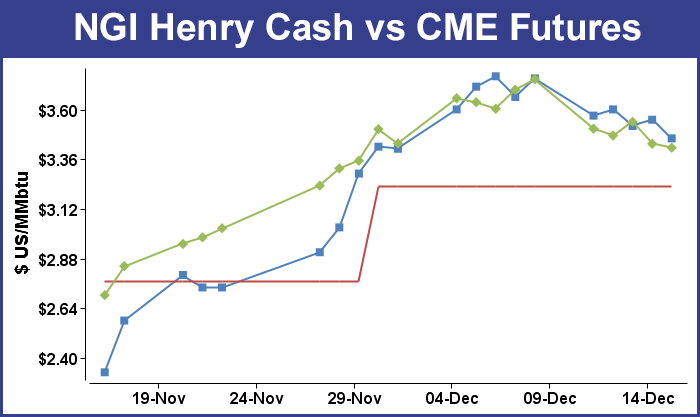

January futures plunged 33.1 cents to $3.415.

Futures bulls got a momentary treat Thursday when the Energy Information Administration (EIA) disclosed storage withdrawals much higher than anyone estimated. Although prices advanced initially, at the end of the day January had fallen 10.6 cents to $3.434 and February was off 8.8 cents to $3.470.

Once the EIA storage number rattled across trading desks, futures traded higher. EIA reported a 147-Bcf storage withdrawal in its 10:30 a.m. EST release, whereas traders were expecting a pull of about 19 Bcf less. January futures reached a high of $3.589 immediately after the figures were released and by 10:45 a.m. January was trading at $3.552, up 1.2 cents from Wednesday’s settlement.

The figure was well beyond expectations. A Reuters survey showed an average 128-Bcf withdrawal with a range of 114 Bcf to 144 Bcf.

“We were hearing a number of 123 to a 124 draw, so this is something of a surprise,” said a New York floor trader. “I’m putting support at $3.50 and resistance at $3.75. It looks like people are looking at the weather reports and not the storage.”

“The 147 Bcf draw for last week was above the range of expectations and also above the 79-Bcf five-year average for the date, a clearly bullish report that implies greater sensitivity to cold temperatures than anticipated, a possibly ongoing factor,” said Tim Evans of Citi Futures Perspective.

“This drawdown was 17 Bcf below our estimate of 130 Bcf and outside the range of most other analyst estimates as well,” said Harrison, NY-based Bespoke Weather Services. “Bearish weather trends should temper any rally today, though.”

Steve Blair, vice president at Rafferty Technical Research in New York, said he was “very surprised by the market’s reaction. You get a storage number that is almost 20 Bcf above expectations you would expect the market to rally right off the number. The only thing I can think of is that people are focused on weather forecasts to get warmer between now and the end of the month.

“We are putting technical support at $3.38 and then $3.30. We are closer to the major support right now, and I have a feeling that off today’s action unless something changes weather-wise we’ll probably see some more downside [Friday].”

Inventories now stand at 3,806 Bcf and are 50 Bcf less than last year and 186 Bcf more than the five-year average. In the East Region 34 Bcf was withdrawn and the Midwest Region saw inventories decrease by 41 Bcf. Stocks in the Mountain Region fell 12 Bcf, and the Pacific Region was down 11 Bcf. The South Central Region shed 49 Bcf.

In Friday’s trading natural gas cash for weekend and Monday delivery on average took a pretty hard fall, but the devil was in the details and swooning eastern prices were able to overpower strong Midwest quotes as Chicago’s high Sunday was not expected to reach double digits.

The NGI National Spot Gas Average fell 27 cents to $3.66 and rising weekend temperatures combined with a soft power market were able to prompt multi-dollar declines along the East Coast. Futures had a hard time as well with January down as much as 9 cents on the day before a late rally closed the gap and limited January to a loss of 1.9 cents to $3.415. February was off 2.1 cents to $3.449.

A 14-degree rise in weekend temperatures, combined with weak power markets, was all it took to pull the plug on quotes for physical natural gas over the weekend at eastern points. AccuWeather.com predicted New York City’s Friday high of 28 degrees would jump to 42 Saturday before sliding to 33 by Monday. The normal high in New York is 42. Philadelphia’s high of 28 on Friday was anticipated to make it to 40 on Saturday before dropping to 35 Monday, 9 degrees below normal.

Gas bound for New York City on Transco Zone 6 tumbled $3.30 to $4.26 and gas on Texas Eastern M-3, Delivery shed 62 cents to $3.41.

Deliveries to the Algonquin Citygate imploded $3.23 to $6.54, and gas on Iroquois, Waddington was quoted $3.96 lower at $4.95. Parcels on Tenn Zone 6 200L fell $3.92 to $6.16.

A weak power market also kept prices on the defensive. Intercontinental Exchange reported that on-peak Monday power at the ISO New England’s Massachusetts Hub fell $31.85 to $70.00/MWh and power at the PJM West terminal skidded $8.43 to $47.99/MWh.

It was a vastly different weather picture in the Midwest, where a new blast of arctic air will settle over the Midwest on Sunday, following snow and ice into Saturday night. AccuWeather.com forecast that Friday’s high in Chicago of 24 would rise to 30 by Saturday before plummeting to 7 on Sunday.

Prices rose on pipes capable of delivering into the Chicago market, with gas at the Chicago Citygate up 28 cents to $3.93. Gas at Cheyenne added 31 cents to $3.75, and packages on Kern rose 25 cents to $3.72. Gas on Panhandle Eastern changed hands 22 cents higher at $3.67.

AccuWeather.com meteorologists contended that “Fans who brave the bone-chilling cold at the Chicago Bears game on Sunday, Dec. 18, may endure the coldest football game in Chicago’s history. The Chicago Bears will take on their division rival Green Bay Packers at 1:00 p.m. EST on Sunday, and the lowest recorded kick-off temperature at Soldier Field was on Dec. 22, 2008, when the Bears squared off against the Packers, with the air temperature at 2 degrees Fahrenheit.

“There will be 10- to 15-mph winds, producing [wind chill] temperatures around 20 below zero,” said meteorologist Dave Samuhel.

“The Bears game this weekend will leave its mark in the record books of coldest NFL games but will fall short of reaching the coldest football game ever played. Known as “The Ice Bowl,” the Dallas Cowboys faced the Green Bay Packers at Lambeau Field on Dec. 31, 1967, with a temperature of minus 13 and a wind chill of minus 48.”

Futures traders were looking at somewhat longer-term weather forecasts and were stewing on a market that looked just a week ago to be one with solid bullish overtones to one which had become a case of “buy the rumor, sell the fact.”

WSI Corp. in its Friday morning report to clients said, “The 11-15 day period forecast is also generally warmer than the previous forecast. CONUS GWHDDs are down 5.3 for days 11-14 and are now only forecast to be 138.1 for the whole period. These are 11.5 below average.

“Day to day details will be key and could cause the forecast to waver in either direction. However, -PNA [Pacific North America pattern] supports warmer risks over the southern U.S. along with a colder risk over the Southwest and north-central U.S.”

The recent market tumble clearly has the bulls with their backs against the wall, and both fundamentalists and technicians see further weakness ahead. Jim Ritterbusch of Ritterbusch and Associates sees the weather forecasts as “suggesting above-normal patterns across the eastern half of the U.S. that will sharply reduce withdrawals from storage beyond next week’s EIA report. [Thursday’s] release offered a supply draw that was about 20 Bcf larger than average industry expectations.

“The market’s sharp selloff in the face of such a bullish report underscores a heavy pricing environment that has been accompanied by significant chart damage. From here, we see additional weakening that will carry January futures to about the $3.25 level, especially if weekend temperature updates suggest milder trends into the New Year.”

Elliott Wave adherents had calculated critical support at $3.486, and with Thursday’s weak close the bulls have some work to do. “Thursday gave a failed attempt to rebound and a weak close. It is once again rally or else time for the bulls,” said Walter Zimmermann, vice president at United ICAP, in closing comments Thursday.

“But what about the cold snap? Natty did just rebound from $2.546 to $3.777, so a great deal of cold is likely already discounted in current price levels. To have any hope of saving a bull outcome, natty needs to quickly get back above $3.720. A ‘cold weather is coming rally’ can be fun as long as one takes profits before it actually gets cold. Otherwise the risk is a ‘buy the rumor, sell the news’ dump.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |