E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Book Your West Texas Room Now For Permian Boom

Across the West Texas plains, analysts at Wunderlich Securities Inc. say they “can see a boom coming.” After recently visiting producers in Houston and Midland, TX, and hanging out at the Texas-New Mexico border, Wunderlich analysts Irene Haas and Jason Wangler feel confident enough to call another Permian boom.

“We ended up returning to the Permian just as the region is entering another boom cycle,” Wunderlich said in a note Friday. “Rig count has rebounded this year, while the hotel rates have not returned to boom time levels, we expect to have to pay up soon.”

Prices have been run up in the Midland sub-basin, Wunderlich noted, adding that the Delaware has become a new favorite. It has a thicker column of stacked pays as well as more competitive drilling and completion costs, the analysts said.

“In [the] Midland Basin, most projects are entering development mode,” they said. “In [the] Delaware Basin, producers are still delineating new zones, optimizing completion designs, looking for efficiency gains, and running well-spacing pilots in anticipation of full development.”

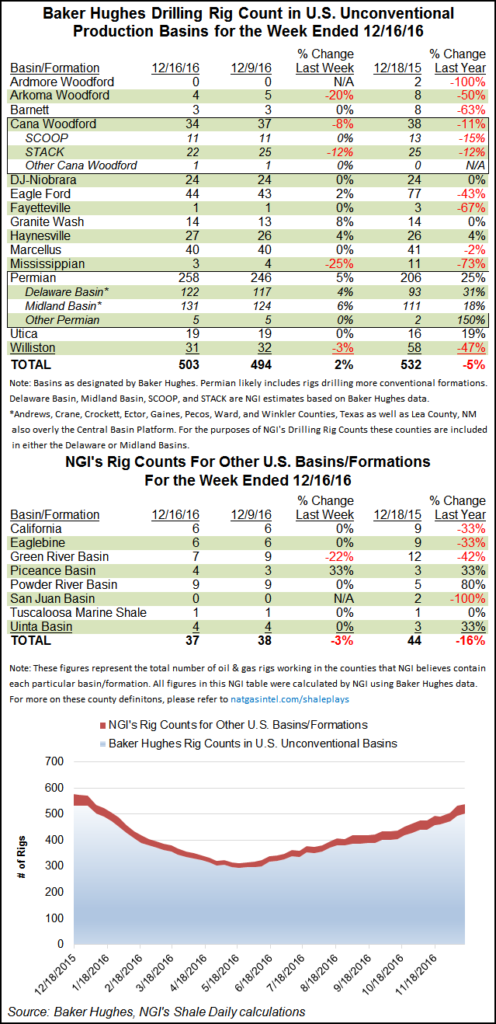

Drillers agree on the Permian. One-dozen rigs returned to the West Texas-New Mexico play during the week ending Friday, according to Baker Hughes Inc. (BHI). There were 258 rigs running in the Permian, up from 206 one year ago. Other major basins lost rigs during the week or saw only modest gains.

Overall, 13 U.S. land-based rigs returned to play (12 oil and one natural gas). Thirteen also was the net gain for the United States overall as there were no changes offshore. Three directional rigs returned along with nine horizontals and one vertical unit.

Canada added four rigs to end at 234 running, up from 162 a year ago. Overall, the North American count by BHI increased by 17 to end at 871 rigs running — which is exactly where it was a year ago.

If you’re Permian-bound, by the way, a room at the DoubleTree in Midland could be had for about $100 on Friday, according to hotels.com.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |