Brrrrr, It’s Cold; Eastern Cash Natgas Soars, Futures Post Gains

Next-day natural gas trading on Wednesday was a deeply divided affair, with gas bound for East Coast and New England destinations sharply higher, often by multiple dollars, and producing zones and Midwest market zones down about a nickel.

After the smoke cleared, though, the NGI National Spot Gas Average was a stout 65 cents higher at $4.51. Futures managed a modest recovery from Monday and Tuesday’s selling. January rose 6.6 cents to $3.540, and February gained 8.3 cents to $3.558. January crude oil plunged $1.94 to $51.04/bbl as the Federal Reserve raised its key short term interest rate and signaled other increases to follow.

Natural gas markets, however, had their hands full dealing with the weather.

“The Midwest and East Coast are preparing themselves for a serious cold shot this weekend as the polar vortex meanders south and drops sub-freezing arctic air across the continental U.S.,” said Energy GPS, a Portland OR-based risk management and consulting firm. “Temperatures are forecasted to decline the remainder of the week with the coldest weather expected to hit Friday. High temperatures are not expected to break 20 degrees in Boston for Friday while New York city sees a high of only 25 degrees.

“As is typically the case, the freezing temperatures will drive a significant increase in residential/commercial demand, pushing up gas consumption and cash prices across the Northeast.”

A “key relationship” Energy GPS is watching closely “is the Transco Z6 NY/ AGT spread. Since the beginning of the AIM expansion project on the Algonquin pipeline, the market has speculated that the increased capacity will drive the AGT basis below Transco Z6 for January and February.”

That would represent a “drastic paradigm shift, as Algonquin is typically the premium gas basis in the winter,” Energy GPS said. “However, the cold temperatures earlier this month drove strong AGT prices in the cash market while Transco Z6 showed very little volatility. As a result, expectations were tempered slightly and the January AGT contract quickly moved above Transco Z6 NY.”

Gas on Transco Zone 6 NY showed Wednesday’s greatest volatility, rising $14.89 to $19.35, and Algonquin Citygate deliveries posted some stout gains, adding $2.55 to $12.47.

Other Eastern points followed suit. Gas on Iroquois Waddington jumped $6.88 to $12.75, and packages on Tenn Zone 6 200L were quoted $2.93 higher at $12.38. Deliveries to Tetco M-3 gained $4.96 to $8.71.

The forecast cold prompted Transco to issue system wide operational flow orders (OFO) for Zones 4, 5, and 6. The company posted on its website “notice of limited flexibility to manage imbalances and recommended shippers maintain a concurrent balance of receipts and deliveries. In order to ensure system integrity, maintain safe operations, manage imbalances, and handle within-the-day volatility, Transco is issuing an Imbalance OFO.”

Some traders were prescient.

“We baseloaded a lot of gas, so we didn’t do any additional buying for this week,” said a Michigan marketer. “I for one am not enthused about this real cold weather, but we’ll have to take readings on Monday to see how much gas our customers used.”

Other market centers eased. Gas at the Chicago Citygate was flat at $3.78, and deliveries to the Henry Hub shed 8 cents to $3.52. Gas on Panhandle Eastern fell a nickel to $3.44, and parcels at the PG&E Citygate changed hands 6 cents lower at $3.65.

Tuesday overnight longer term weather models inched colder, with a less likely outlook of a late-month warmup.

“Net national changes were small to the upside as we shifted a bit stronger with the Midcontinent cold outbreak for late one- to five-day and early six- to 10-day range from Chicago to Texas,” said Commodity Weather Group President Matt Rogers in a Wednesday morning note to clients. “We have lows Sunday-Monday in Chicago getting down to 12-13 below zero, which is closer to record levels for these December dates. Texas aims for the coldest weather so far this season with lows getting close to the teens in Dallas.

“The six- to 10-day looks warmer thanks to forecast progression…as we move away from the third big cold outbreak. The models are really struggling with the incoming late month warm-up as both the European and American guidance are not as strong with it in the 11- to 15-day compared to [Tuesday] morning.”

Tim Evans of Citi Futures Perspective said there was “room for the downward price correction to continue, with the market still trading above its five-year average level at a time when storage is still above a corresponding five-year average inventory level, and we note that a 50% retracement of the November-December rally in January futures would target $3.25.

“At the same time, however, we note that the temperature forecast remains cool enough to draw down storage at something more than the five-year average rate.”

What once was a plump surplus to five-year averages looks to be gone by the end of the month.

Evans is forecasting a 124 Bcf draw for Thursday’s Energy Information Administration storage report, and he said his outlook calls for the five-year storage surplus currently at 254 Bcf to become a 12 Bcf deficit by Dec. 30.

“This swing from surplus to deficit would confirm that the market is becoming physically tighter on a seasonably adjusted basis, a fundamental support for prices over the intermediate term,” Evans said. “While this normally translates into rising prices, we can also think of it as reducing the downside price risk. Prices might still decline in the short run with this firming support; they would just fall less than they might have with an expanding storage surplus.”

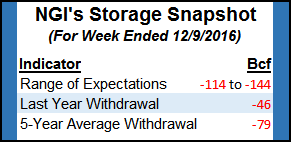

Other estimates of Thursday’s storage withdrawal are in sync with a triple-digit pull. Last year 46 Bcf was withdrawn, and the five-year pace stands at a 79 Bcf. Raymond James calculated a 117 Bcf decline, and Stephen Smith Energy is expecting a 134 Bcf pull. A Reuters poll of 21 traders and analysts revealed a withdrawal estimated at 128 Bcf with a range of -114 Bcf to -144 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |