Markets | NGI All News Access | NGI Data

NatGas Cash Outpaces Lagging Futures; January Sheds 3 Cents

Physical natural gas for Thursday delivery posted strong gains in Wednesday’s trading, boosted by early initial strength in screen prices, flow limitations at eastern population centers and healthy gains in power pricing.

Pricing at Rocky Mountain and California points lagged, but the NGI National Spot Gas Average jumped 13 cents to $3.80. Futures opened about a dime higher and managed to trade at a new high of $3.748, but throughout the day, prices eroded and by the end of the session had slipped into the red.

At the close, January was $3.603, down 3.2 cents, and February settled at $3.589, off 3.7 cents. January crude oil gave up a stout $1.16 as it slipped below $50 and settled at $49.77/bbl.

As the coldest temperatures of season begin to settle in, “several pipelines are issuing operational warnings,” said industry consultant Genscape Inc. A force majeure on Tennessee’s 200 Line is now in its fourth day, and volumes have been restricted by about 30% to the high population areas of New England.

Initial indications were that irregularities were discovered during pigging operations, and “they’ve got to fix something if it needs fixing,” said an industry veteran familiar with the situation. “They’ve got to lower the pressure, dig a hole and get the welders out there. This is the worst time to have something like this happen, and hopefully all this gets done in a day or two before the cold weather hits.”

Next-day prices at New England points bounded higher as supplies tightened. Gas at the Algonquin Citygate rose $1.38 to $6.00, and deliveries to Iroquois, Waddington rose 23 cents to $4.45. Gas on Tennessee Zone 6 200 L jumped $2.04 to $7.15.

Packages on Texas Eastern M-3, Delivery rose 40 cents to $3.85, and gas headed for New York City added a hefty 50 cents to $4.13.

Gains at other market points were more subdued. Deliveries to the Chicago Citygate rose 9 cents to $3.85, and gas at the Henry Hub was quoted a nickel higher at $3.76. Deliveries to El Paso Permian added a penny to $3.59, and gas at the PG&E Citygate changed hands at $3.79, down a nickel.

Next-day gas at California points was mixed. Not having access to the Aliso Canyon gas storage facility could have significant ramifications to Southern California (SoCal) Gas customers.

“This is the first time in nearly 40 years that this cavern is unavailable for the winter withdrawal season,” said Energy GPS in a report. “During the summer, episodes of high demand were caused by electric generators meeting the cooling demand on the power grid, [and] SoCal Gas was able to avoid any use of Aliso this summer through planning and coordination with the power generators.

“Winter load is a different story. Demand is driven by residential and commercial customers that need the gas for space heating. This load is a lot larger than the electric load and not nearly as elastic.

Making matters worse for Californians is that gas production in the state continues to decline. California marketed production averaged 572 MMcf/d in September, down from nearly 700 MMcf/d in January 2014.

Gas at Malin rose a penny to $3.64, and deliveries to the SoCal Citygate added 3 cents to $3.84. Gas priced at the SoCal Border Avg. fell 7 cents to $3.74, and packages on El Paso S. Mainline/N. Baja dropped 6 cents to $3.74.

Tuesday overnight weather models showed a more powerful Arctic air mass than previously thought.

“The big story overnight is the strengthening of next week’s Arctic out-break on the various models,” said Commodity Weather Group President Matt Rogers in a Wednesday morning report to clients. “This air mass continues to look more powerful, with the main impact area for severe early season cold from Calgary to Chicago where most modeling now has strong below for the period average (15 or more degrees colder than normal).

“There might be a risk that the models are overdoing the cold in spots by over-factoring snow-cover impacts, but the overall situation looks like the strongest cold outbreak in December in several years. There is also a real concern that the models are not sending enough cold air into the Deep South. When air masses get this big, they can surprise the models on their southern reach.”

Some are likening the blast of cold arctic air to the polar vortex of three years ago. The “upper-level atmosphere configuration [is] very similar in scale and magnitude as infamous January 2014 #PolarVortex”, tweeted meteorologist Ryan Maue of WeatherBell Analytics.

“The bitter cold air is expected to first arrive in the northern Rockies and northern Plains on Sunday. It should reach Chicago on Tuesday and the northeast United States by Wednesday or Thursday,” according to aWashington Post report.

Given Tuesday’s and Wednesday’s weak finishes, market technicians are mulling a market retreat, at least in the short term.

“On one hand, the bulls were able to bust through the January high at 3.675 intraday,” said United ICAP market technician Brian LaRose Tuesday. “On the other hand, they could not prevent natgas from falling back below $3.675 before the close. As a result, we now have a shooting star top on the daily candlestick chart and bearish divergence” on the intraday Relative Strength Indicator. “Given the situation, we would not be surprised to see some consolidation, even a pullback from here.”

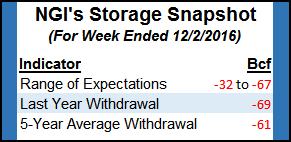

Thursday’s Energy Information Administration storage report is likely to be the last time storage surpluses increase relative to last year and the five-year averages. Last year 69 Bcf was withdrawn, and the five-year average stands at a 61 Bcf pull.

Kyle Cooper of IAF Advisors is forecasting a 33 Bcf withdrawal, and Citi Futures Perspective expects a 49 Bcf decline. A Reuters survey of 18 traders and analysts showed an average 43 Bcf withdrawal with a range of -32 Bcf to -67 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |