Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S.-to-Mexico NatGas Pipeline Capacity to Nearly Double

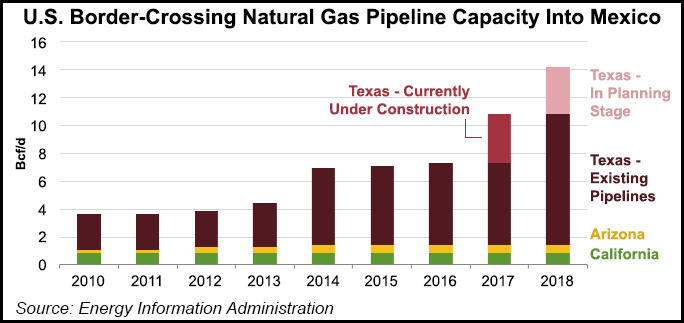

U.S. pipeline capacity for natural gas exports to Mexico has not only rapidly expanded in recent years, but it is expected to nearly double over the next three, according to the Energy Information Administration (EIA).

The cross-border pipeline expansion has been driven by Mexico’s use of natural gas for power generation, declining domestic production and the lower cost of U.S. pipeline gas compared with liquefied natural gas (LNG) imports, EIA said in a “Today in Energy” brief on Thursday. United States-to-Mexico pipeline capacity is 7.3 Bcf/d and primarily serves the northeast and central parts of the country.

To get a better picture of the developing natural gas market in Mexico, including operational and in-process projects, as well as where the U.S./Mexico import and export points are, check out NGI’s 2017 Map of Emerging Mexico Natural Gas Pipeline Infrastructure.

Over the next three years, pipeline projects such as Oneok Partners LP’s Roadrunner Phase II, Energy Transfer Partners LP’s Comanche Trail and Trans-Pecos, and Nueva Era — backed in part by Howard Energy Partners — would add 3.5 Bcf/d to current capacity. Those projects would supply new gas-fired power plants in the Mexican states of Chihuahua, Nuevo Leon, Sonora and Sinaloa. By 2018, Kinder Morgan Inc.’s Mier-Monterrey and Spectra Energy Corp.’s Nueces-Brownsville projects are expected to add another 3.3 Bcf/d of exports to Northeast and Central Mexico.

U.S. pipeline exports have doubled since 2009 and are expected to keep growing this year, EIA said earlier this week. The United States exported 4.2 Bcf/d of natural gas through pipelines to Mexico in August. Through the first eight months of this year, the EIA said Mexican pipeline exports averaged 3.6 Bcf/d, or 85% higher than the five-year average from 2011-2015.

A separate analysis of EIA data by Ponderosa Advisors LLC shows that Mexican exports accounted for 4% of U.S. gas demand last year. That’s compared to the 10-year average of 2% from 2006-2015.

The cross-border pipeline expansion has been matched by growth in Mexico’s domestic pipeline network. The country is expanding capacity to accommodate higher imports from the United States under a five-year plan launched last year by its energy ministry, Secretaria de Energia.

U.S. pipeline exports have gradually displaced Mexico’s LNG imports. The EIA said that after the 2.1 Bcf/d Los Ramones Phase I pipeline was completed in 2014, nearly all LNG imports at the Altamira terminal in Central Mexico have been displaced with gas from the Eagle Ford Shale. LNG imports at Altamira were 50% lower through October of this year than they were in 2015.

The completion of the 1.4 Bcf/d Los Ramones Phase II, which is being developed in part by Petroleos Mexicanos, is also expected to displace LNG imports at the Manzanillo terminal in Central Mexico, including Mexico City.

Mexico’s evolving natural gas market was the topic of discussion during a webinar hosted by NGI in November. NGI also recently released a special report, “Inside Cenagas,” detailing the growth of the country’s natural gas infrastructure.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |