Markets | NGI All News Access | NGI Data

NatGas Cash Gains; Hedging Urged as Futures Notch Two-Year High

Physical natural gas for next-day delivery made it four straight days of advances by the end of trading Thursday as weather forecasts called for a return to seasonally normal readings by the end of the week and below-normal levels by the weekend.

The NGI National Spot Gas Average gained 14 cents to $3.27, and hefty gains of close to 50 cents in the Northeast were more than able to offset more modest gains in Texas of about a nickel.

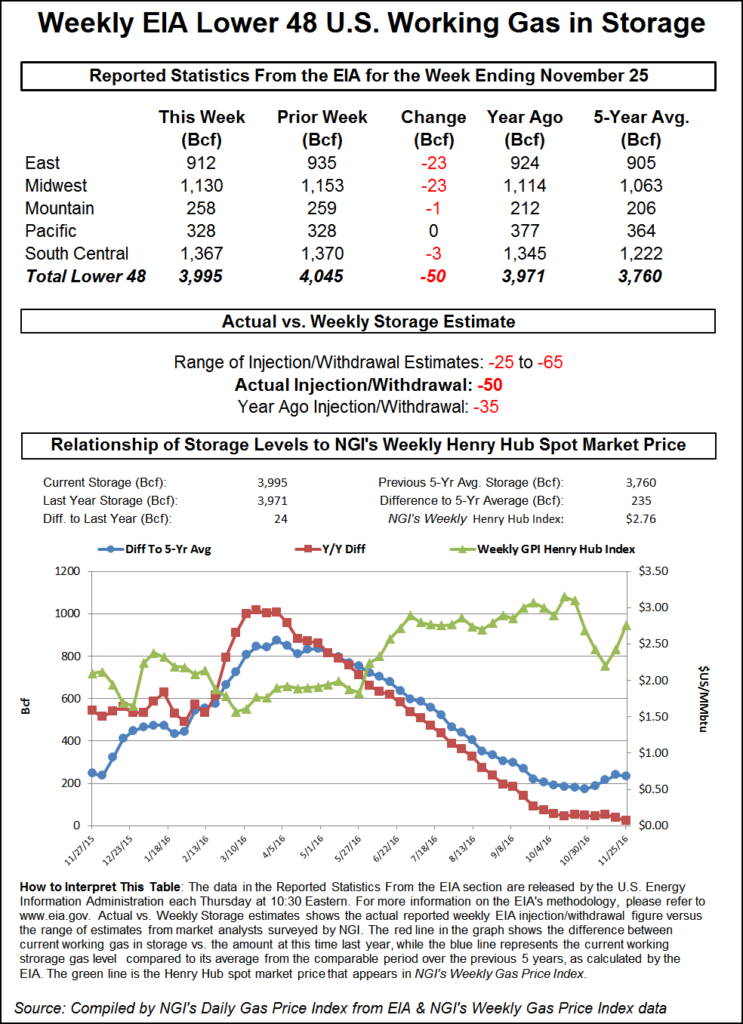

The Energy Information Administration (EIA) reported the second storage withdrawal of the young heating season, and futures bulls welcome it with open arms. The withdrawal of 50 Bcf fell only about 3 Bcf shy of expectations.

January finished the session with a 15.3-cent advance to $3.505, the highest spot price since December 2014, and February added 15.0 cents to $3.509. January crude oil was able to build on its $4-plus gain of Wednesday and added $1.62 more Thursday to end at $51.06/bbl.

Even though the EIA-reported withdrawal was slightly less than what traders were expecting, it was above seasonal averages — all the bulls needed to carry the market higher.

January futures reached a high of $3.479 immediately after the figures were released, and by 10:45 a.m., January was trading at $3.470, up 11.8 cents from Wednesday’s settlement.

Traders saw the market move off the number as somewhat ephemeral.

“I think it’s going to do a little pull back from this number,” said a New York floor trader. “It didn’t really tap the $3.48 area, so I think it’s going to pull back to the $3.41 to $3.43 area, and there is the possibility to slip back to the upper $3.30s.

“Traders are trying to hold the market up, but at this time it doesn’t look like a strong hold,” he said.

“The net implied flow this week was -50 Bcf, still slightly [more] than the five-year average of -44 Bcf as stockpiles began to rapidly fall back towards the five-year historical range,” said Harrison, NY-based Bespoke Weather Services. “Next week’s number will likely be a bit more loose, though even this week saw a small amount of loosening as an additional 54 temperature degree days (TDD) only drew 48 Bcf more out of storage. We may struggle to break above $3.50 resistance.”

Understatement, anyone?

“The 50 Bcf net withdrawal from U.S. storage for last week was a bit less than some expected, given the 49-53 Bcf range among the newswire survey estimates,” said Tim Evans of Citi Futures Perspective. “This is not a major miss, however, and was still more than the 43-Bcf five-year average, so we wouldn’t anticipate much of a bearish price reaction.”

Others see a market ripe for a correction. “I think it is very overbought here,” said McNamara Options Director of Trading Alan Harry. “We may have a high of $3.70, but I think it’s going to wedge [congest] in here, and I think we are going to come off. I would look for the market to trade below $3.38, and that would be my signal to go short.

“There are so many longs in the market that it would have to entice some large players to take a short position. It’s probably going to take a fund on the opposite side to be the short. If I were a producer I would be hedging all I could.”

Inventories now stand at 3,995 Bcf and are 24 Bcf above last year and 235 Bcf more than the five-year average. In the East Region, 23 Bcf was withdrawn, and the Midwest Region saw inventories decrease by 23 Bcf as well. Stocks in the Mountain Region fell 1 Bcf, and the Pacific Region was unchanged. The South Central Region shed 3 Bcf.

Weather models offer a variety of patterns.

“The forecast sees a mix of changes in this period, with warmer adjustments preceding a slower moving cold front from the eastern Midwest on day seven to the East Coast on day eight,” said MDA Weather Services in its Thursday morning six- to 10-day outlook. “In the wake of this front, however, a much colder air mass presses into the Rockies and Plains, and these areas are additionally colder in [the] outlook.

“At the peak, temperatures are forecast to fall to much below normal levels in Texas, along the southern tier and in the Midwest, with belows pressing to the East Coast in the latter stages as well. The East is near normal overall, as aboves precede the colder air mass.”

MDA said risks to the forecast include the West being colder than the European Ensemble, “which lingers belows there into late period. Models disagree with the intensity of cold late in the Eastern Half, posing mixed risks.”

In physical market activity, forecasts of normal- to below-normal temperatures were enough to bring buyers to the table. Forecaster Wunderground.com predicted the Thursday high of 55 degrees in New York City would recede to 49 Friday and to 45 by Saturday, 3 degrees below normal. Chicago’s Thursday max of 41 was seen easing to 40 Friday and 38 by Saturday, 2 degrees off its seasonal norm. Dallas hit 60 Thursday and by Friday was forecast to see 65 before dropping to 50 on Saturday, 10 degrees below normal.

Gas at the Algonquin Citygate added a hefty 70 cents to $3.64, and gas on Iroquois, Waddington rose 14 cents to $3.69. Deliveries to Tenn Zone 6 200L gained 64 cents to $3.89.

Major market centers firmed. Gas at the Chicago Citygate was quoted a dime higher at $3.39, and deliveries to the Henry Hub came in 13 cents higher at $3.42. Gas on Panhandle Eastern added 10 cents to $3.22, and gas priced at the PG&E Citygate changed hands 9 cents higher at $3.69.

Next-day power prices provided a firm undertone to traders having to buy gas for incremental power generation. Intercontinental Exchange said on-peak power at the ISO New England’s Massachusetts Hub rose $2.79 to $33.93/MWh and power at the PJM West terminal was up $1.95 to $33.02/MWh.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |