NatGas Traders Skeptical As Futures Surge Post-EIA Data

Natural gas futures worked higher Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was slightly less than what traders were expecting.

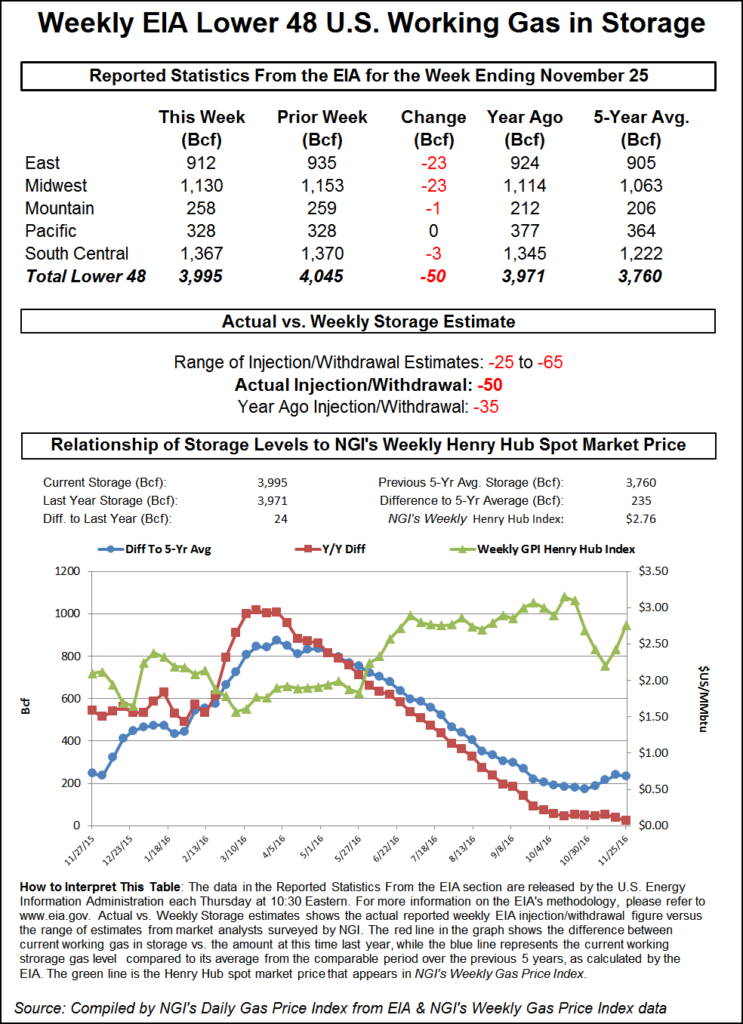

The EIA reported a 50-Bcf storage withdrawal for the week ending Nov. 25 in its 10:30 a.m. EST release, whereas traders had been expecting a pull about 3 Bcf greater. January futures reached a high of $3.479 immediately after the figures were released and by 10:45 a.m. January was trading at $3.470, up 11.8 cents from Wednesday’s settlement.

Traders see the market move off the number as somewhat ephemeral. “I think it’s going to do a little pull back from this number,” said a New York floor trader. “It didn’t really tap the $3.48 area, so I think it’s going to pull back to the $3.41 to $3.43 area, and there is the possibility to slip back to the upper $3.30s.

“Traders are trying to hold the market up, but at this time it doesn’t look like a strong hold,” he added.

“The net implied flow this week was -50 Bcf, still slightly [greater] than the five-year average of -44 Bcf as stockpiles began to rapidly fall back towards the five-year historical range,” said Harrison, NY-based Bespoke Weather Services. “Next week’s number will likely be a bit more loose, though even this week saw a small amount of loosening as an additional 54 TDDs only drew 48 Bcf more out of storage. We may struggle to break above $3.50 resistance.”

Inventories now stand at 3,995 Bcf and are 24 Bcf greater than last year and 235 Bcf more than the five-year average. In the East Region 23 Bcf were withdrawn and the Midwest Region saw inventories decrease by 23 Bcf as well. Stocks in the Mountain Region fell 1 Bcf, and the Pacific Region was unchanged. The South Central Region shed 3 Bcf.

Salt cavern storage was up 4 Bcf at 400 Bcf, while the non-salt cavern figure was down 7 Bcf at 967 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |